2022

Benefits &

Perks Guide

At Southwest,

we recognize your

passion for life.

So, we’re here to provide benefits and perks that

help you and your family live healthy and well. From

comprehensive medical coverage and a generous

retirement savings plan to travel privileges and

everything in between—we’ve got you covered.

Let’s take a look.

Health

Contacts

2

BenefitsPlus Program

Regular Plan Program

Other Benefits

2

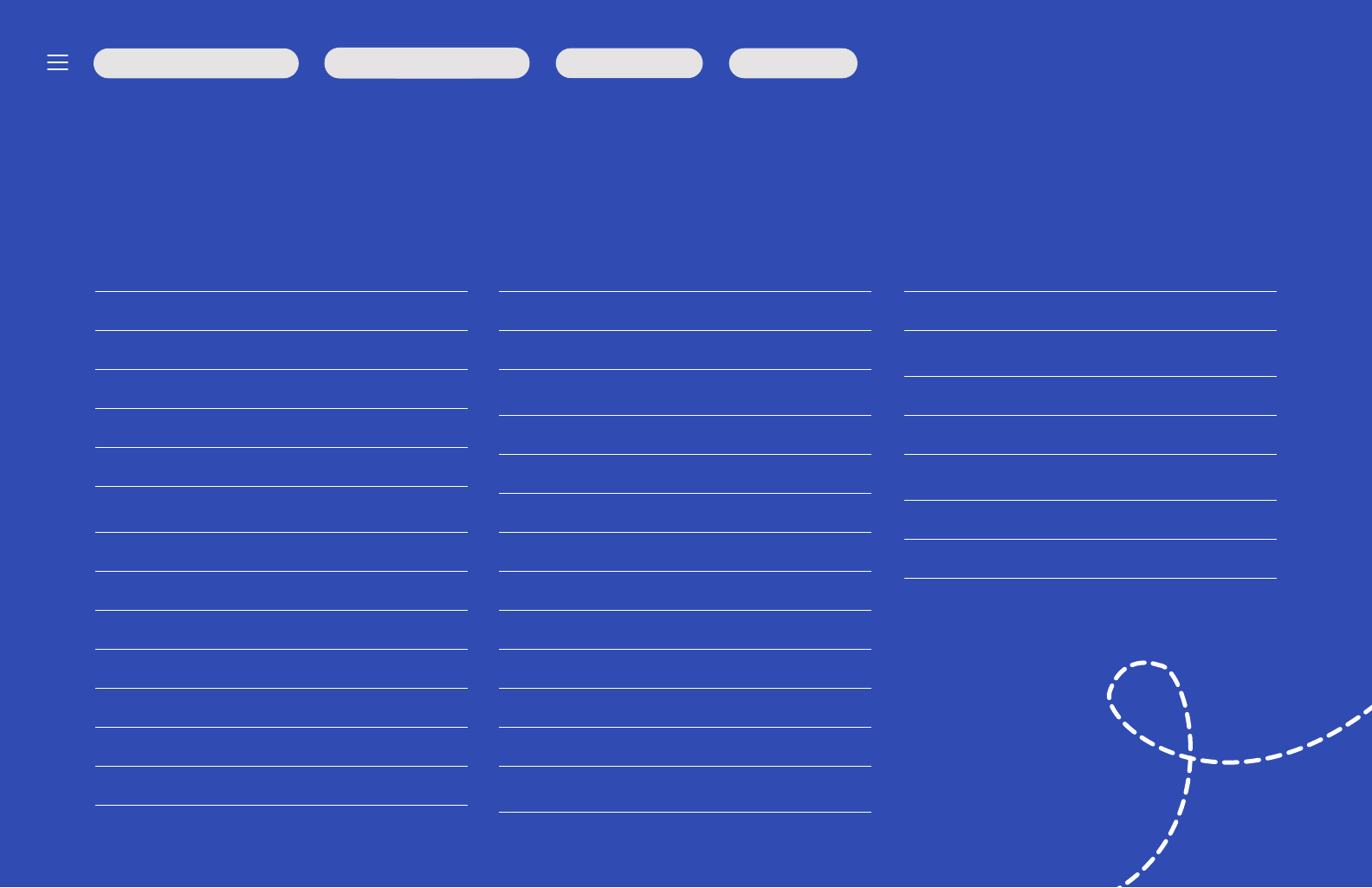

Table of contents

This guide only provides highlights. Additional exclusions and limitations may apply. Details are in the Summary Plan

Description on SWALife >Life & Career >Employee Services >Health Benefits (WorkPerks) >Access Health Benefits

(WorkPerks) >Reference Center >Legal Documents.

Rev 02/2022

Know who you can cover 4

Health and welfare benefits 5

BenefitsPlus Program 6

Medical 7

Hawaii, SFO, SJU and employees 10

Hawaii—HMSA Hawaii PPO

and Kaiser HMO

11

SFO—Kaiser HMO 13

SJU—Triple S Plan 15

Support for your health 17

Tax savings accounts 19

Dental 21

Vision 23

Additional benefits 25

Short-Term Disability 26

Long-Term Disability 27

Accidental Death And

Dismemberment (AD&D)

28

Life insurance coverage 29

Regular Plan Program 31

Medical 32

Support for your health 35

Dental 36

Vision 38

Short-Term Disability 40

Long-Term Disability 41

Life insurance coverage 42

Accidental Death and

Dismemberment (AD&D)

44

Other benefits 45

Retirement and

investment benefits

46

Time O 50

Travel privileges 51

Clear Skies Employee

Assistance Program (EAP)

55

Other perks 56

Contacts 58

Health

Contacts

3

BenefitsPlus Program

Regular Plan Program

Other Benefits

3

Know who you

can cover

You may enroll your eligible family members in many of

Southwest’s benefits.

To add your family member(s), go to SWALife >Life & Career >Employee Services >Health Benefits

(WorkPerks) >Access Health Benefits (WorkPerks). You must provide required documentation to

add new dependents. Find all the details and a list of the necessary documentation in the Health &

Welfare Summary Plan Description (SPD) on the home page of WorkPerks. If you provide any false

information, Southwest may deny or terminate your benefits, and take disciplinary action up to

and including termination of employment.

Eligible family members include:

•

Spouse as defined by federal tax law

•

Natural child, stepchild, legally adopted child, child placed for adoption, or child for whom you

have a legal obligation (up to the end of the month in which the child turns age 26)

•

For the BenefitsPlus Program only: Committed partner, as defined in the Health & Welfare

Summary Plan Description.

You may only add or remove a family member outside of the New Hire or annual enrollment period

if you have a qualifying life event (e.g., the birth of a child, marriage, or divorce). You must report

life events within 30 days of when they happen. You can do this by accessing SWALife >Life &

Career >Employee Services >Health Benefits (WorkPerks) >Access Health Benefits (WorkPerks)

>Change My Benefits.

Health

Contacts

4

BenefitsPlus Program

Regular Plan Program

Other Benefits

4

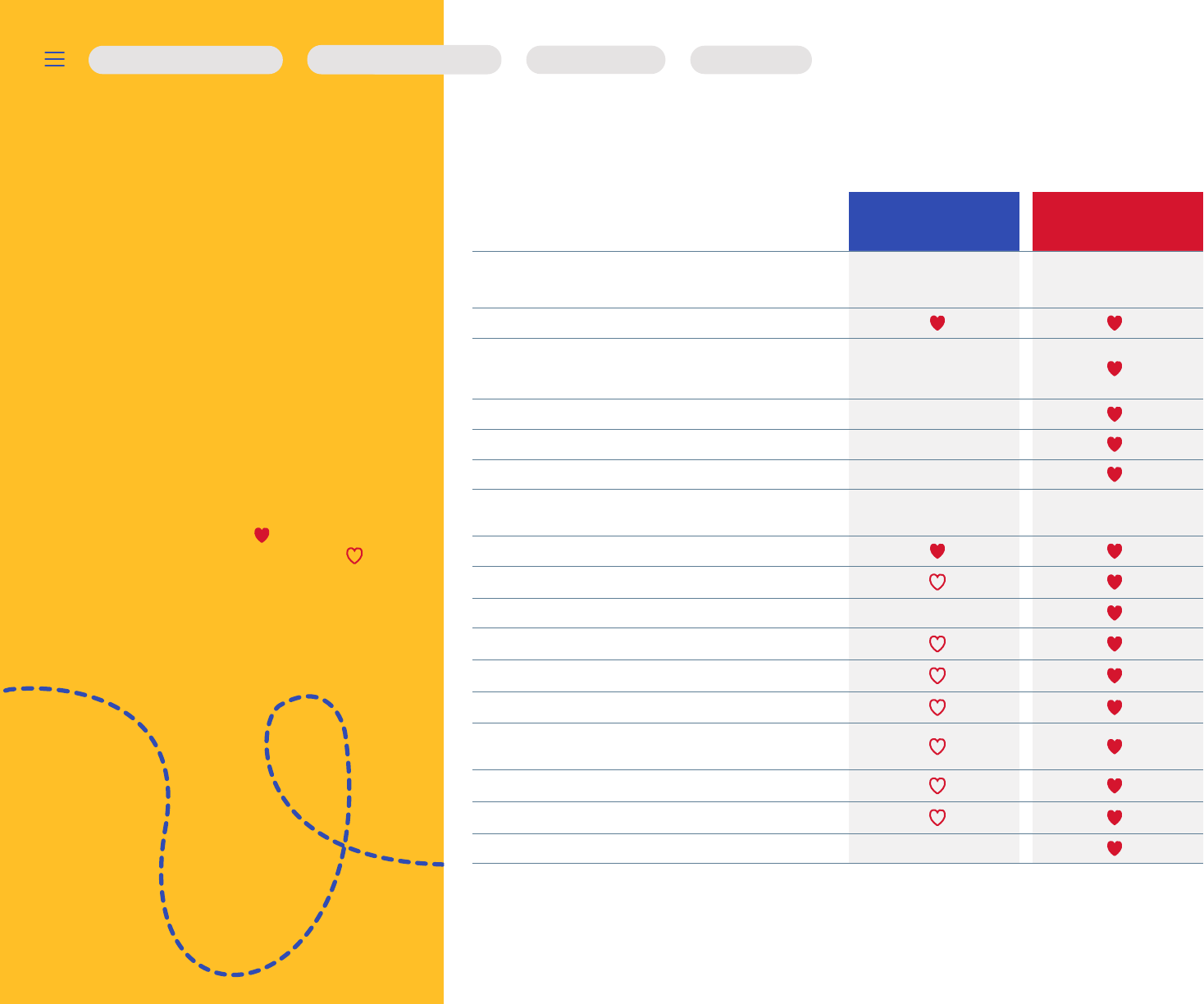

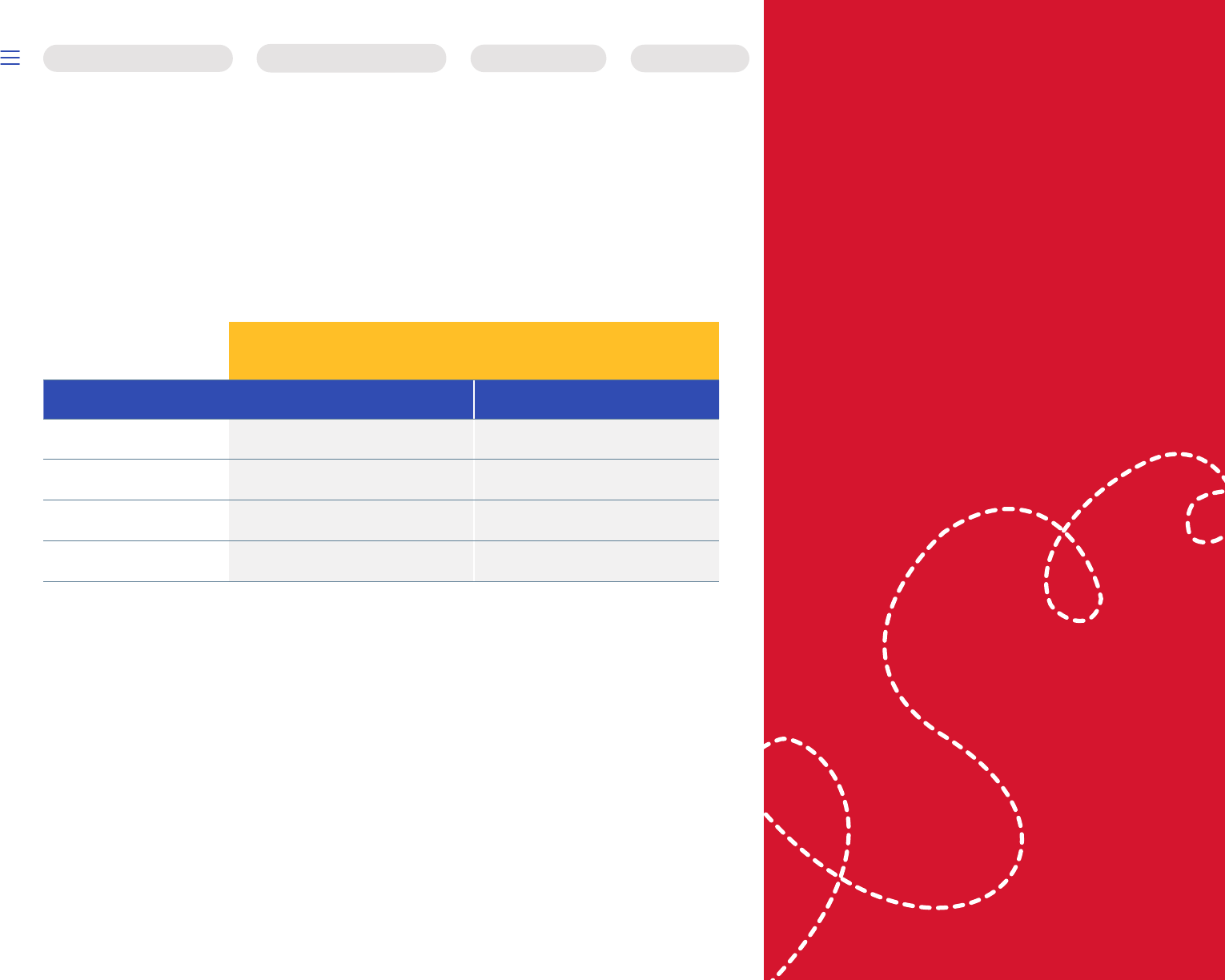

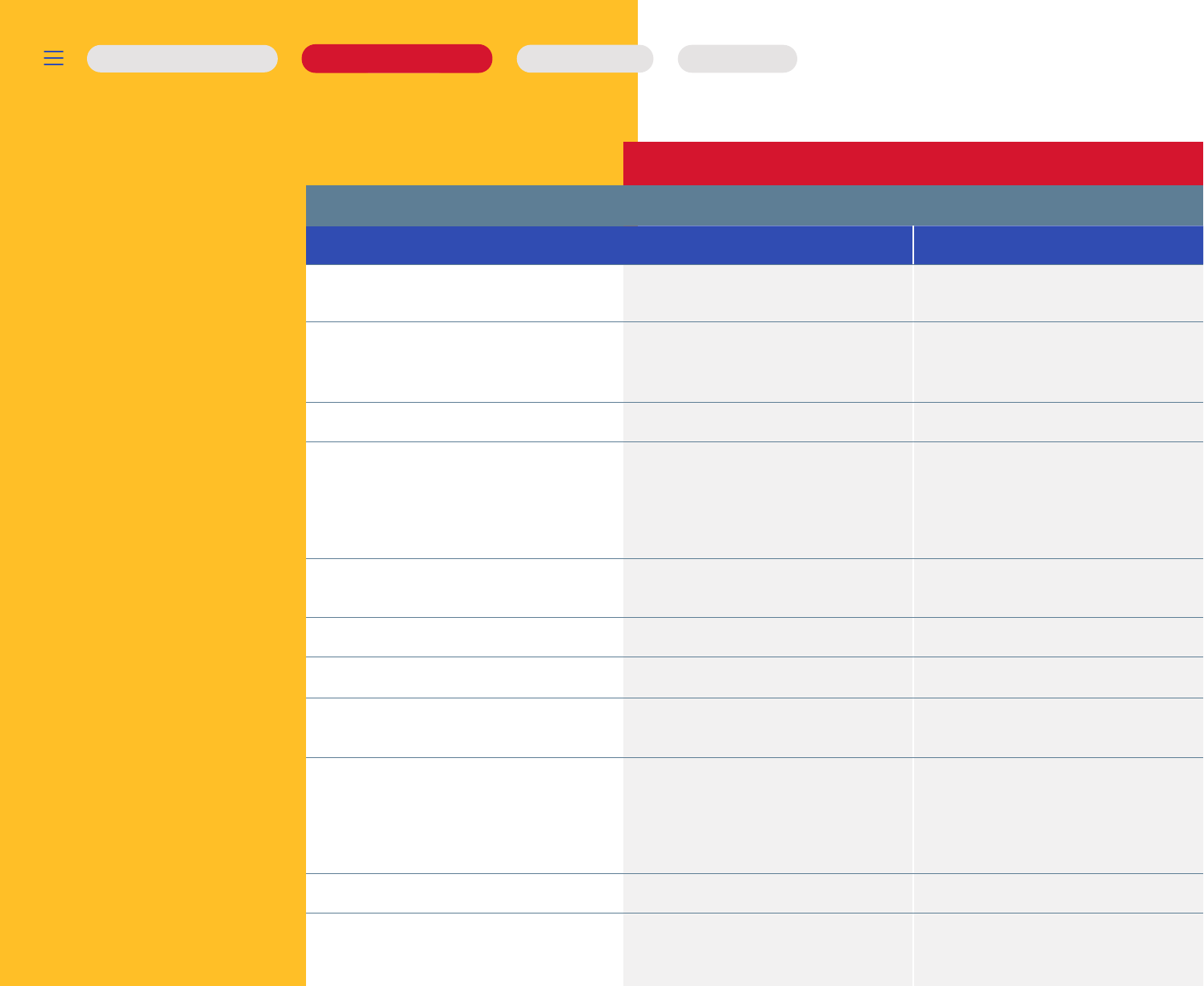

Health and

welfare

benefits

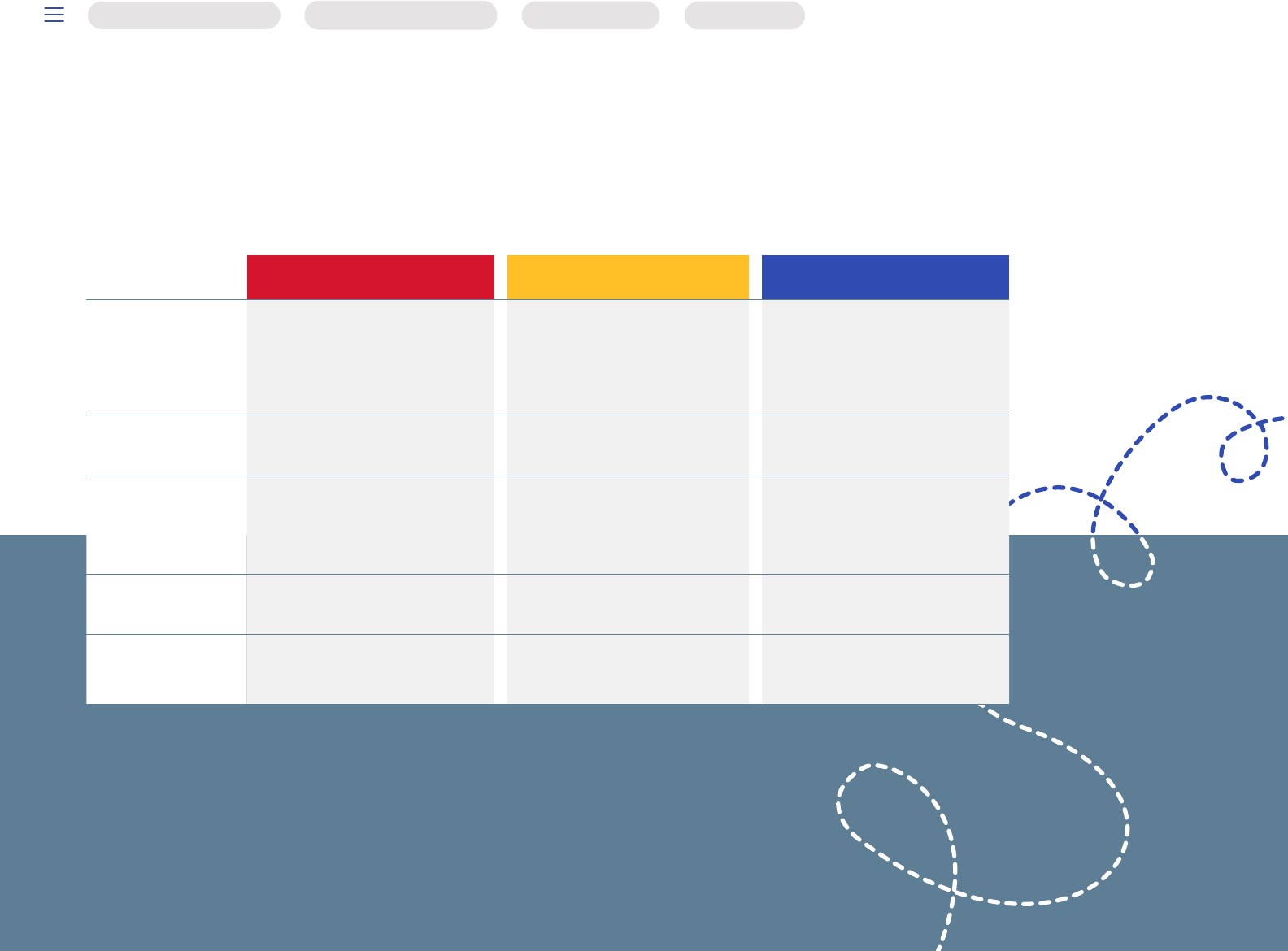

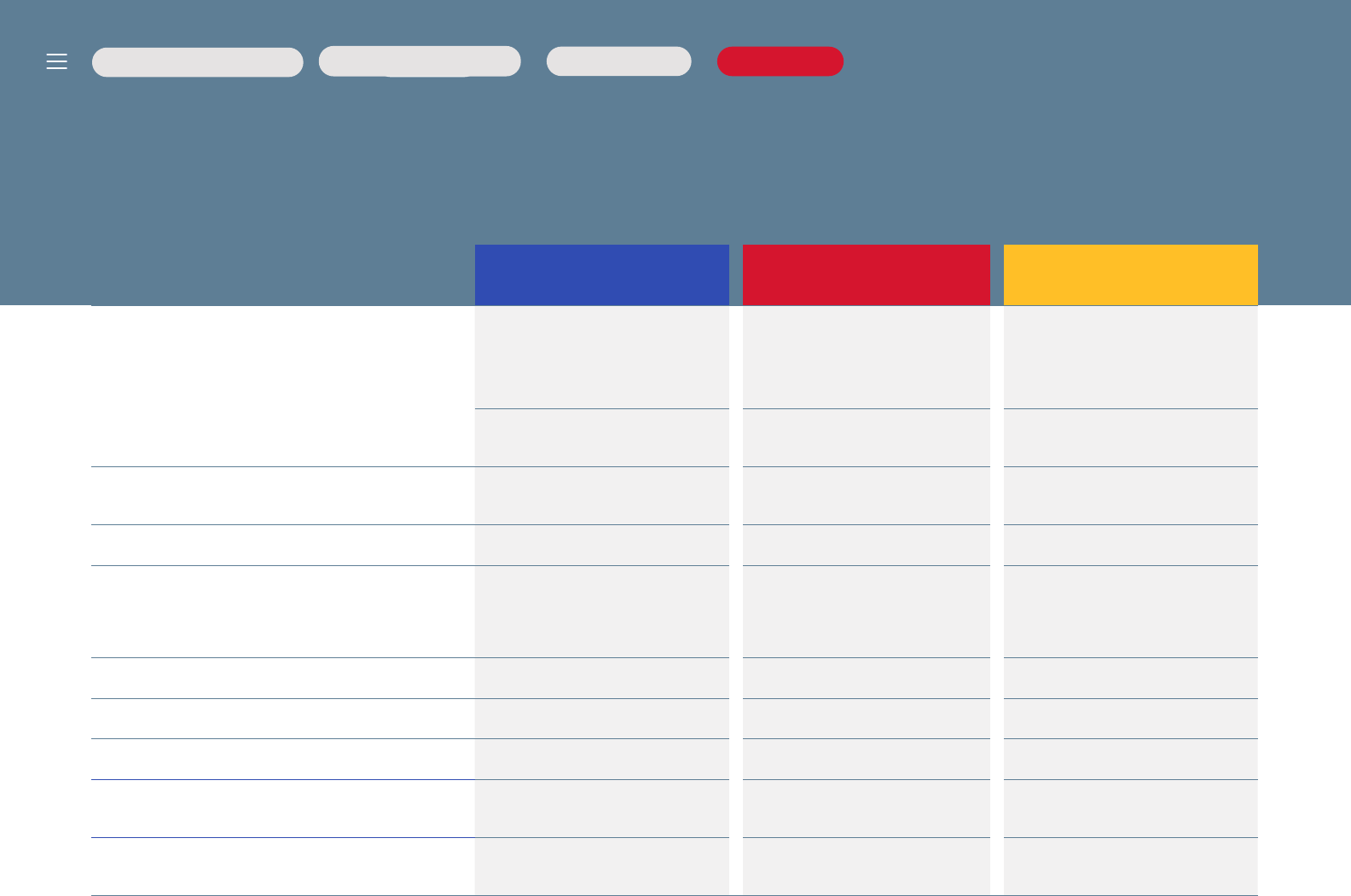

You can choose from two benefit

programs—the Regular Plan Program

or the BenefitsPlus Program.

Both oer medical and other coverages, but

the level of benefits diers. The BenefitsPlus

Program is more comprehensive, while the

Regular Plan Program oers some of the same

benefits, but not all. Here’s a quick look at

how they compare. The means the benefit

is oered as part of the program. The

means benefits vary significantly by eligibility,

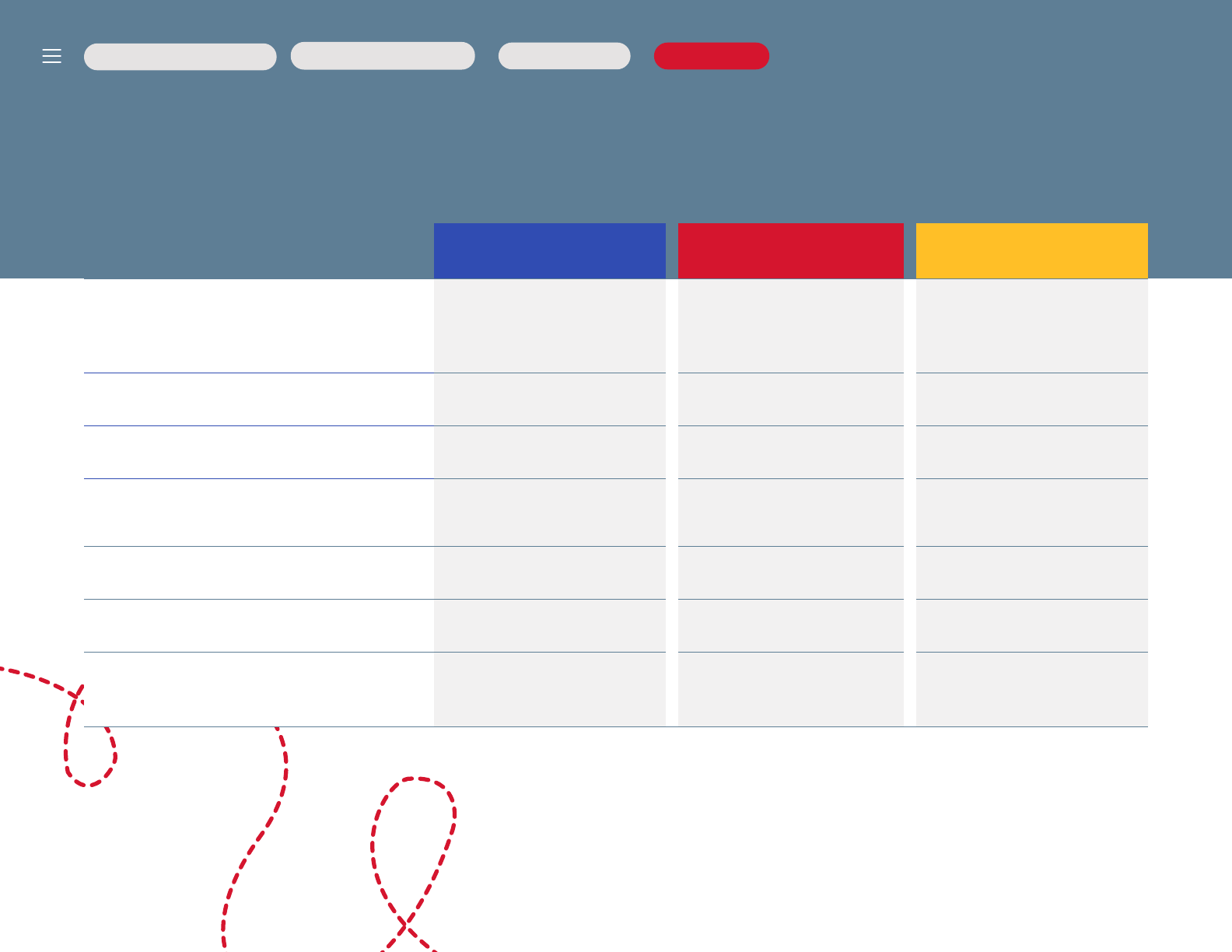

coverage, and salary.

Regular Plan

Program

1

BenefitsPlus

Program

Medical & prescription coverage

Regular Medical Plan Choice Plus Plan, Choice

Plan C, Health Savings Plan,

Waive medical coverage

Low paycheck deductions

Preventive care coverage

Preventive drugs, annual physicals, newborn care, flu shots

and immunizations, and other preventive care

No coverage

Teladoc (telemedicine)

Supplemental Hospital and Critical Illness Plans

Waive medical (you receive $50 per month)

Company contribution to Health Savings

Account (HSA)

Health Savings Plan Only

$200–$375

Dental coverage

Vision coverage

Company-Paid Long-Term Disability

Optional Long-Term Disability

Company-Paid Basic Life Insurance

Optional Life Insurance

Optional Spouse/Committed Partner Life

Insurance

Optional Child Life Insurance

Accidental Death & Dismemberment Insurance

Auto, home, and pet insurance

1

The Regular Plan Program is not currently available to Employees working or living in Hawaii or working at SFO.

Health

Contacts

5

BenefitsPlus Program

Regular Plan Program

Other Benefits

5

Medical

If you choose the BenefitsPlus Program, you have three medical plan options.

Each plan is administered by Cigna or Aetna, depending on where you live. You can find out who your administrator is by going to myswamedical.com and

entering the ZIP code of your permanent residence (as it’s listed on SWALife >Life & Career >Employee Services >About Me >Launch About Me). All of the plans

cover the same services, like doctor visits, hospital stays, and lab work, and also cover 100% of in-network preventive care. The dierence is in how much is deducted

from your paycheck and how much you pay for care when you need it. The Health Savings Plan is the only plan that comes with a tax-advantaged

Health Savings Account (HSA) with money from Southwest. Here’s a look at what you’ll pay when you need care.

Choice Plus Plan Choice Plan C Health Savings Plan

In-Network Out-of-Network

1

In-Network Out-of-Network

1

In-Network Out-of-Network

1

Preventive care 0% 50% 0% 50% 0% 40%

Annual deductible

Individual

$500 $1,800 $1,000 $2,400 $1,500 $1,500

Family

$1,250 $4,500 $2,500 $6,000 $3,000

2

$3,000

2

Coinsurance 20% 50% 20% 50% 20% 40%

Copays

Teladoc

$5

Not applicable;

see deductible

and coinsurance

Not applicable;

see deductible

and coinsurance

Convenience care clinic

$15

Oce visit

$25

Specialist

$40

Urgent care

$40

Emergency room

$250

Annual

out-of-pocket

maximum

Individual

$4,300 $16,125 $4,800 $18,000 $6,000 $8,250

Family

3

$8,600 $32,250 $9,600 $36,000 $12,000 $16,500

1

Out-of-network benefits are paid based on eligible charges. You are responsible for any amount that exceeds eligible charges,

even after you meet your out-of-pocket maximum.

2

In the Health Savings Plan, the family deductible must be met before any family member begins receiving benefits; one family

member or multiple family members may meet this limit.

3

If you enroll in Family coverage in the Health Savings Plan, there is an individual in-network out-of-pocket maximum of $7,350.

This maximum is the most that would have to be paid out-of-pocket for any covered individual in the family.

Words

to know

Preventive care

The amount you pay for specified

preventive care services, such as an annual

physical, well baby visits, and recommended

preventive screenings.

Annual deductible

The amount you pay before Southwest

starts sharing costs with you.

Coinsurance

The percentage you pay after

meeting your deductible.

Copays

The flat dollar amount you pay

for certain services.

Annual out-of-pocket maximum

The most you pay for medical services in

a plan year, including your deductible,

copays, and coinsurance; Health Savings

Plan includes prescriptions.

Health

Contacts

7

BenefitsPlus Program

Regular Plan Program

Other Benefits

7

Prescription drugs

All the medical plans include prescription drug coverage administered by

CVS Caremark.

However, each plan works a little dierently. Here’s what you’ll pay for prescription drugs

based on the medical plan you choose.

Choice Plus Plan Choice Plan C Health Savings Plan

30-day

retail

90-day

retail

90-day

mail order

30-day

retail

90-day

retail

90-day

mail order

30-day

retail

90-day

retail

90-day

mail order

Annual deductible

Individual

$50 $150

Included in medical deductible

Family

$100 $300

Included in medical deductible

Coinsurance or copay

Generic

$10 $30 $25

10%

($10 min/

$35 max)

7%

($35 min/

$98 max)

7%

($25 min/

$88 max)

20% 20% 20%

Preferred brand

25%

($25 min/

$50 max)

25%

($60 min/

$150 max)

20%

($45 min/

$125 max)

25%

($25 min/

$100 max)

20%

($63 min/

$250 max)

20%

($48 min/

$220 max)

20% 20% 20%

Non-preferred brand

45%

($40 min/

$150 max)

45%

($75 min/

$400 max)

45%

($60 min/

$375 max)

45%

($50 min/

$175 max)

45%

($135 min/

$400 max)

45%

($125 min/

$375 max)

20% 20% 20%

Specialty drug (30-day only)

25%

($20 min/

$150 max)

Not

applicable

Not

applicable

25%

($20 min/

$150 max)

Not

applicable

Not

applicable

20%

Not

applicable

Not

applicable

Specified preventive drug

Not applicable Not applicable

20%

1

Diabetic testing supplies

(i.e. testing strips)

0% 0% 0%

1

Annual out-of-pocket

maximum

Individual

$2,050 $1,550

Included in medical deductible

Family

$4,100 $3,100

Included in medical deductible

1

Deductible waived for certain preventive medications and testing supplies.

What you

need to know

• There is no prescription drug

coverage if you fill at an excluded

pharmacy, like Walgreens. To find a

pharmacy, visit caremark.com and

use the Pharmacy Locator tool.

• If you take a maintenance

medication, you may purchase a

90-day supply at a CVS retail

pharmacy or through CVS mail

order. Or, if you wish to use another

of the 58,000+ pharmacies in

the network, you can fill a 30-

day supply. If you choose to refill

every month, it will probably cost a

little more for the smaller volume

prescription. Go to caremark.com

or call (800) 378-0755 for

more details.

• Some medications require prior

authorization before the plan will

pay for these drugs. To initiate a

prior authorization, you or your

doctor can call (800) 378-0755.

• The plans do not cover certain

items including over-the-counter

medications or their equivalents,

drug products used for cosmetic

purposes, vitamins and minerals

(except prenatals), experimental

drug products and any drug

used experimentally, and foreign

medications or drugs not

approved by the U.S. Food and

Drug Administration.

• Get the app! Download the CVS

Caremark app to refill or request

new prescriptions, track your

orders, view your prescription

history, and more.

Health

Contacts

8

BenefitsPlus Program

Regular Plan Program

Other Benefits

8

Monthly cost for

medical coverage

Your cost for coverage under any of the medical plans is deducted from your paycheck

on a before-tax basis. This lowers your taxable income, saving you money.

Choice Plus Plan Choice Plan C Health Savings Plan

Full-time Part-time Full-time Part-time Full-time Part-time

Employee Only $87.00 $87.00 $69.00 $69.00 $17.00 $17.00

Employee + Spouse/

Committed Partner

$280.00 $407.29 $174.00 $367.70 $34.00 $305.30

Employee + Children $230.00 $310.61 $147.00 $277.53 $25.00 $219.76

Employee + Family $417.00 $630.90 $260.00 $576.28 $43.00 $506.83

No Medical

If you elect No Medical, $50 will be added to your paycheck monthly.

Finding an in-network provider

If Cigna is your administrator, you can find in-network providers here.

If Aetna is your administrator, you can find in-network providers here.

ID cards

Keep an eye out for medical ID cards that will be sent to your permanent residence

(as it’s listed on SWALife >Life & Career >Employee Services >About Me).

Health

Contacts

9

BenefitsPlus Program

Regular Plan Program

Other Benefits

9

Hawaii, SFO, and SJU Employees

If you work or live in Hawaii, work at SFO, or work at SJU, you have some dierent options when it comes

to your benefits. Take a look and go to SWALife >Life & Career >Employee Services >Health Benefits

(WorkPerks) >Access Health Benefits (WorkPerks) >Reference Center >Health Benefits to get all the details.

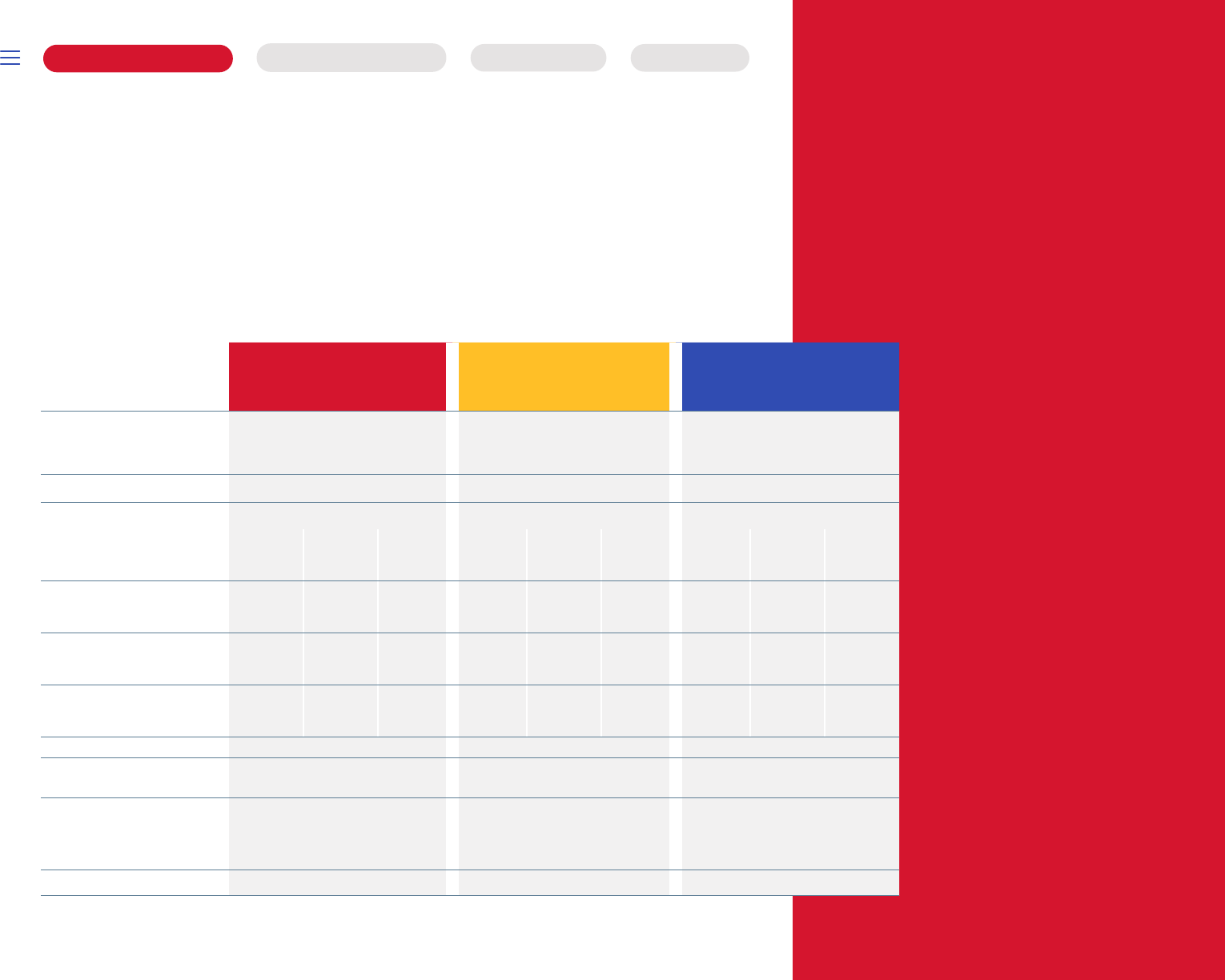

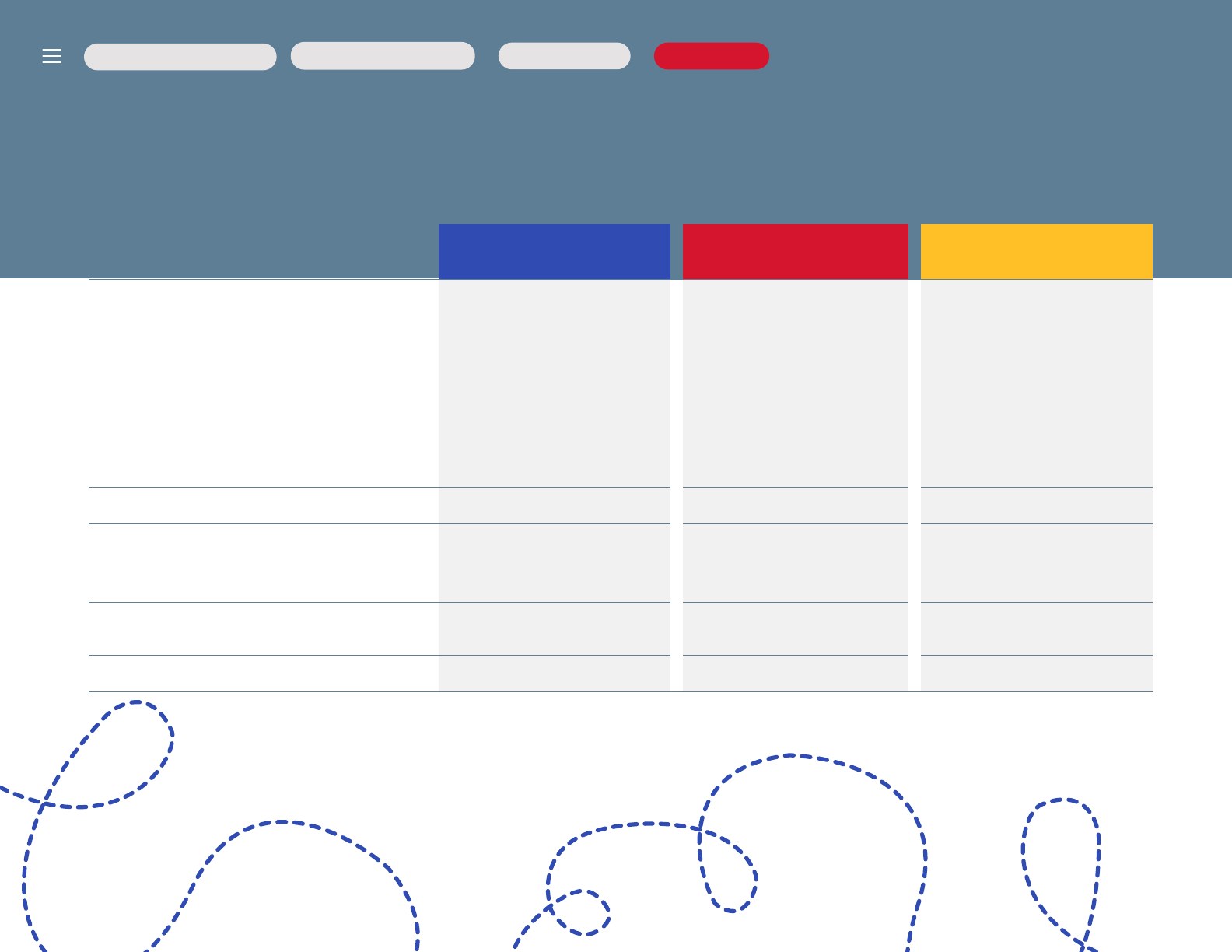

SJU SFO Hawaii

Medical plan

options

BenefitsPlus Program:

Triple S

Regular Program:

Regular Plan

BenefitsPlus Program:

Kaiser HMO (default)

BenefitsPlus Program:

HMSO PPO (default)

Kaiser HMO

Prescription drug

coverage

Included in medical plan Included in medical plan Included in medical plan

Dental plan

options

Optional

Basic

Optional

Basic

DeltacareMO

Optional

Basic

DeltacareMO

Vision plan

options

EyeMed Vision EyeMed Vision EyeMed Vision

Health accounts N/A

Dependent Care FSA

Health Care FSA

Dependent Care FSA

Health Care FSA

Health

Contacts

10

BenefitsPlus Program

Regular Plan Program

Other Benefits

10

Hawaii—HMSA Hawaii PPO

and Kaiser HMO

If you live or work in Hawaii, you can choose either the HMSA Hawaii PPO or the Kaiser HMO.

HMSA Hawaii PPO

(in-network only)

Kaiser HMO

(in-network only)

Preventive care 0% 0%

Annual deductible

Individual

$0 $0

Family

$0 $0

Coinsurance/copays

Oce visit

$14 $20

Specialist

$14 $20

Urgent care

$14 $20

Emergency room

20% $100

Annual out-of-pocket

Individual

$2,500 $2,500

Family

$7,500 $7,500

Here’s what you pay when you need care. Here’s what you pay for prescription drugs.

HMSA Hawaii PPO

(in-network only)

Kaiser HMO

(in-network only)

31-day

supply

90-day

mail order

31-day

supply

90-day

mail order

Generic $7 $11 $15 $30

Preferred brand $30 $65 $50 $100

Non-preferred brand $75 $200 $50 $100

Specialty $200

N/A

$200

N/A

Out-of-pocket

maximum

(Individual and Family)

Combined

with medical

Combined

with medical

Health

Contacts

11

BenefitsPlus Program

Regular Plan Program

Other Benefits

11

Hawaii—HMSA Hawaii

PPO and Kaiser HMO

Monthly cost

for coverage

Your cost for medical coverage is deducted from your paycheck

on a before-tax basis. This lowers your taxable income, saving

you money. Here’s what you’ll pay each month based on who

you cover.

HMSA Hawaii PPO Kaiser HMO

Full-time Part-time Full-time Part-time

Employee Only $32.00 $16.00 $26.00 $13.00

Employee +

Spouse/Committed

Partner

$255.00 $342.15 $202.00 $283.48

Employee + Children $211.00 $243.52 $174.00 $229.38

Employee + Family $355.00 $569.68 $311.00 $553.94

No Medical

If you elect No Medical, $50 will be

added to your paycheck monthly.

Health

Contacts

12

BenefitsPlus Program

Regular Plan Program

Other Benefits

12

SFO—Kaiser HMO

If you enroll in the Kaiser HMO, here’s what you pay when you need care.

Kaiser HMO

Annual deductible

Individual

$750

Family

$1,500

Hospital inpatient

(services

rendered in the hospital and maternity)

20% coinsurance after plan deductible

Primary care, urgent care,

and specialty

$30/visit (deductible does not apply)

Well child, preventive care

visits, and routine prenatal

$0

Outpatient surgery 20%

coinsurance after plan deductible

Therapies (PT, OT, ST) $30 after plan deductible

X-rays and lab tests $10 per encounter after plan deductible

Advanced imaging (CT, MRI, PET)

20% coinsurance up to a max of $150

after plan deductible

Ambulance and emergency room

$150 per trip after plan deductible

Annual out-of-pocket

Individual

$3,000

Family

$6,000

Maximum individual benefit

Unlimited

Kaiser HMO

Mental Health

Inpatient psychiatric care

20% coinsurance after plan deductible

Outpatient individual therapy visits

$30

Outpatient group therapy visits

$15

Substance use services

Inpatient detoxification

20% coinsurance after plan deductible

Outpatient individual therapy visits

$30

Outpatient group therapy visits

$5

Health

Contacts

13

BenefitsPlus Program

Regular Plan Program

Other Benefits

13

SFO—Kaiser HMO

Prescription drugs

Here’s what you’ll pay for prescription drugs.

Kaiser HMO

(outpatient prescription drugs)

Retail (up to 30-day supply) Mail order (up to 100-day supply)

Generic brand $10 $20

Preferred brand $35 $70

Non-preferred brand $35 $70

Specialty $35 $70

SFO—Kaiser HMO

Monthly

cost for

coverage

All rates, regardless of level of coverage

or part-time/full time status, are $0.

Health

Contacts

14

BenefitsPlus Program

Regular Plan Program

Other Benefits

14

SJU—Triple S Plan

If you enroll in the Triple S Plan, preventive care is covered 100%. Here’s what you pay when you need other care.

Triple S

Coinsurance/copays

Generalist

$10

Specialist

$15

Sub-specialist

$15

X-rays, laboratories, and

diagnostic tests

20%

Emergency room

Sickness

$80

Accident

$25

Major medical

Individual

$100/20%

Family

$300 per family/20%

Annual out-of-pocket

Individual

$6,350 (combined with pharmacy)

Family

$12,700 (combined with pharmacy)

Health

Contacts

15

BenefitsPlus Program

Regular Plan Program

Other Benefits

15

SJU-Triple S Plan

Prescription drugs

Here’s what you’ll pay for prescription drugs.

Triple S Plan

30-day retail 90-day mail order

Annual deductible

Individual

$50 $50

Family

$100 $100

Generic brand $10 $30

Preferred brand $20 $45

Non-preferred brand $30 $60

Specialty drug

(Specialty products will be

dispensed only through the

ABARCA Network)

25% ($200 max)

N/A

Annual out-of-pocket

Individual

$6,350 (combined with medical) $6,350 (combined with medical)

Family

$12,700 (combined with medical) $12,700 (combined with medical)

SJU-Triple S Plan

Monthly

cost for

coverage

Your cost for medical coverage is

deducted from your paycheck on

an after-tax basis.

This lowers your taxable income, saving you

money. Here’s what you’ll pay each month

based on who you cover.

Triple S Plan

Full-time Part-time

Employee Only $54.34 $54.34

Employee + Spouse/

Committed Partner

$108.70 $184.48

Employee + Children $108.70 $184.48

Employee + Family $135.86 $249.52

No medical

If you elect No Medical,

$50 will be added to your

paycheck monthly.

Health

Contacts

16

BenefitsPlus Program

Regular Plan Program

Other Benefits

16

Support for your health

In addition to the medical coverage you can elect each year, Southwest oers

benefits that help you get the care you need and stay healthy year round.

Alight Healthcare

Concierge Service

Alight can help make sure you’re getting high-quality healthcare at the

best price. They provide pricing estimates on healthcare services, provider

recommendations, and can even help reconcile your healthcare bills.

Be sure to reach out before you schedule any treatment or procedure.

Health Savings Plan members

You’re automatically enrolled in Alight for free!

Choice Plus Plan or Choice Plan C members

You can elect Alight for only $4 per month.

Get started

Contact Alight at (855) 769-4383 or email answers@compassphs.com.

Teladoc

Get the care you need, when you need it! Teladoc is an aordable, convenient

way to get medical help 24/7. Their board-certified physicians can diagnose,

recommend treatment, and prescribe medication for many common medical

issues, such as:

• Cold and flu symptoms

• Bronchitis

• Allergies

• Ear infections

Health Savings Plan and Choice Plan C members

Pay $30 per session until you meet your deductible. Once you meet your

deductible, you pay 20% (which is $6).

Choice Plus Plan members

Pay $5 per session.

Get started

There’s no need to enroll in Teladoc. If you enroll in a BenefitsPlus Program

medical plan, this benefit is automatic! Just call (888) 368-8799 or download

the Teladoc app for quick access to a doctor by phone or video when you

need care.

• Pink eye

• Urinary tract infections

• Respiratory infections

• Sinus problems

Talk to a nurse

Evie Newton, our Dedicated Nurse, is available Monday-Friday from

8 a.m. to 5 p.m. CT at (214) 792-7986 or evie.newton@wnco.com.

Evie’s goal is to provide preventive and general health education to

you and your family members. She provides consultation to assess

and refer you to the appropriate resources as needed. Additional

information about Evie and other physical health resources may be

found on SWALife >Employee Services.

Health

Contacts

17

BenefitsPlus Program

Regular Plan Program

Other Benefits

17

Support for your health (continued)

Quit for Life

Quit for Life is a tobacco cessation program

provided to all Employees and spouses/

committed partners who are enrolled in a

BenefitsPlus Program. The program includes

a Quit Coach to help you make a plan and

stick to it, and eight weeks of nicotine patches

or gum at no additional cost.

Each enrollee receives abundant support

along the way via phone, video, chat, or text.

Real-time digital access to program incentives

and trackers.

Get started

Contact Quit for Life at (866) 784-8454 or

visit quitnow.net.

Livongo

Livongo is available at no cost to Employees and

their covered dependents that meet the program’s

criteria and are enrolled in the BenefitsPlus

Program (Choice Plus Plan, Choice Plan C, and

Health Savings Plan) or Regular Plan Program. All

other medical plans are not eligible to participate.

Livongo provides you with tools, insights, and

expert support to help you reach your health

goals. There are two main areas where Livongo

can support:

• Healthy living and diabetes prevention

• Diabetes management

With Livongo all participants will have

access to:

• Technology: Track and manage health on the go by

automatically logging data in a private dashboard and

easy-to-use app.

• Personalized insights: Get real-time tips and

personalized feedback to help learn and improve.

• Expert coaching: Talk to a Livongo health coach for

advice on nutrition, weight loss, and more whenever

extra support is needed.

Depending on the selected program,

you will also have access to the following

additional benefits at no cost:

Healthy living and diabetes prevention includes:

• smart scale,

• unlimited coaching, and

• guidance on healthy habits

Diabetes management includes:

• unlimited test strips,

• a connected blood glucose meter, and

• personalized insights

Programs include trends and support on

participant’s secure Livongo account and mobile

app but do not include a tablet or phone.

Get started

Contact Livongo at (800) 945-4355 or visit

go.livongo.com/SWA/now, registration code

is SWA.

Health

Contacts

18

BenefitsPlus Program

Regular Plan Program

Other Benefits

18

Tax savings accounts

Southwest oers three types of accounts that let you save money tax-free: the Dependent Care Flexible

Spending Account (FSA), the Healthcare FSA, and the Health Savings Account (HSA).

Here’s how these accounts work.

Dependent Care FSA Healthcare FSA HSA

How does it work?

FSAs are designed to help you budget money to pay for certain eligible healthcare and

dependent care expenses during the year.

The money you set aside in an FSA is not subject to payroll taxes, which could help you save

money. MyChoice, a Businessolver product, administers the FSAs.

The HSA allows you to set aside

before-tax money to pay for eligible

healthcare expenses for yourself

and your dependents.

If you prefer, you can invest the money and

use it for future healthcare expenses.

Who’s eligible to

contribute?

Employees enrolled in the BenefitsPlus

Program.

Employees enrolled in the BenefitsPlus

Program who are NOT enrolled in the Health

Savings Plan.

Employees enrolled in the Health Savings

Plan who meet the federal tax law

eligibility rules for having an HSA.

How much can I

contribute per year?

Minimum: $120

Maximum: $5,000

$2,500 if you are married and file separate

federal tax returns.

You can only use funds that are currently in

your account.

Minimum: $120

Maximum: $2,750

Your total annual elected amount is available

for use on Jan. 1.

Up to $3,650

for employee-only coverage

Up to $7,300

for family coverage

These limits apply to your contributions

and any Company-paid contributions.

If you are at least 55 years old during the

year, you can contribute an extra $1,000.

You can only use funds that are currently in

your account.

Note: Tax savings accounts are not available if you work at SJU.

Health

Contacts

19

BenefitsPlus Program

Regular Plan Program

Other Benefits

19

See more.

Tax savings accounts (continued)

Dependent Care FSA Healthcare FSA HSA

How much does

the Company

contribute?

$0 $0 Employee only: $200

Employee + spouse/committed partner:

$300

Employee + children:

$300

Employee + family: $375

(You must be enrolled in the Health Saving Plan as of

Jan. 1, 2022, and complete the eligibility questions during

enrollment and give Southwest permission in the WorkPerks

tool by Sept. 30, 2022, to open your account.)

What can the money

be used for?

1

Keep in mind, money

used for non-eligible

expenses is taxable and

subject to a tax penalty

Eligible expenses, including:

• Licensed nursery schools

• Licensed daycare centers for children and

disabled adults

Go to irs.gov for a full list of eligible expenses.

Eligible medical, dental, and vision out-of-

pocket expenses, including:

• Deductibles

• Copayments

• Coinsurance

• Some over-the-counter medications

• Other eligible healthcare expenses

Go to irs.gov for a full list of eligible expenses.

Eligible expenses, including:

• Medical

• Prescription drug

• Dental

• Vision

Go to irs.gov for a full list of eligible expenses.

How do I access the

money?

Manually file claims for eligible expenses

by going to SWALife >Life & Career >Employee

Services >Health Benefits (WorkPerks)

>Access Health Benefits (WorkPerks).

(There is no debit card associated with this account.)

You’ll receive a debit card to use for all

eligible expenses. Or you can file a claim for

reimbursement.

Once your account is open, you’ll receive

a debit card from Empower HSA to use for

eligible expenses.

Can I roll over

unused money?

No.

You can use the money for claims incurred

until Dec. 31, 2022, and you must submit all

claims for reimbursement by Mar. 31, 2023.

Any remaining balance is forfeited.

No.

You can use the money for claims incurred

until Dec. 31, 2022, and you must submit all

claims for reimbursement by Mar. 31, 2023.

Any remaining balance is forfeited.

Yes.

You can roll your entire unused balance over

from year to year.

Can I take my

money with me if I

leave the Company

or retire?

No.

Unused dollars are forfeited.

No.

Unused dollars are forfeited.

Yes.

Your HSA, including Company contributions,

belongs to you.

1

Committed Partner healthcare expenses are not usually eligible for the Healthcare FSA or the HSA.

Note: Tax savings accounts are not available if you work at SJU.

Health

Contacts

20

BenefitsPlus Program

Regular Plan Program

Other Benefits

20

Dental

You have three plan

options for dental

coverage—Optional,

Basic, and

the DHMO. Delta

Dental administers all

plans, and you’ll save

money on services if

you stay in-network.

Here’s a look at how the

plans compare.

Optional Basic DeltaCare DHMO

1

Annual deductible You pay $50 per person You pay $50 per person

Not applicable

What the plan pays

Annual maximum

benefit

$2,000

per person $1,500 per person

Not applicable

Preventive treatment

(e.g., cleanings, oral exams,

X-rays two times a year)

No deductible, and costs do

not apply to your deductible or

annual maximum benefit

100% 100%

Exams: $0

Cleanings: $5

Bitewing X-rays: $0

Panoramic X-rays: $0

Dental sealants

No deductible

100%

One application per tooth

every five years for the first and

second molars up to age 15

Not covered

$15

Limited to permanent

molars up to age 15

Basic treatment

(e.g., tooth extractions,

root canals)

After deductible

80% 75%

Fillings: $8–$95

Simple tooth extraction: $10

Root canals:

$125–$365

Major treatment

(e.g., crowns, bridges, dentures)

After deductible

80% 60%

Crowns: $185–$395

Bridges: $295–$395

Complete dentures: $365

Orthodontia

Braces for all ages

80% up to a lifetime maximum

benefit of $2,000 per person

60% up to a lifetime maximum

benefit of $1,500 per person

Interceptive: $1,150

Limited: $1,350

Comprehensive: $1,900

Comprehensive adult: $2,100

Special services

(e.g., impacted wisdom teeth)

No deductible and does

not apply to your annual

maximum benefit

80% 80%

Varies by state. Contact your

dentist for an estimate.

Night guards

No deductible and does

not apply to your annual

maximum benefit

Covered up to $200,

replaceable every 5 years

Not covered

Night guard: $105

Limited to 1 every 3 years

1

The DeltaCare plan does not have

coinsurance, deductibles, and

maximums. Benefits refer to specific

dental codes.

Note: Amount only includes covered

charges. Refer to Dental Program

(Section 7) of the Summary Plan

Description for a list of covered charges.

Health

Contacts

21

BenefitsPlus Program

Regular Plan Program

Other Benefits

21

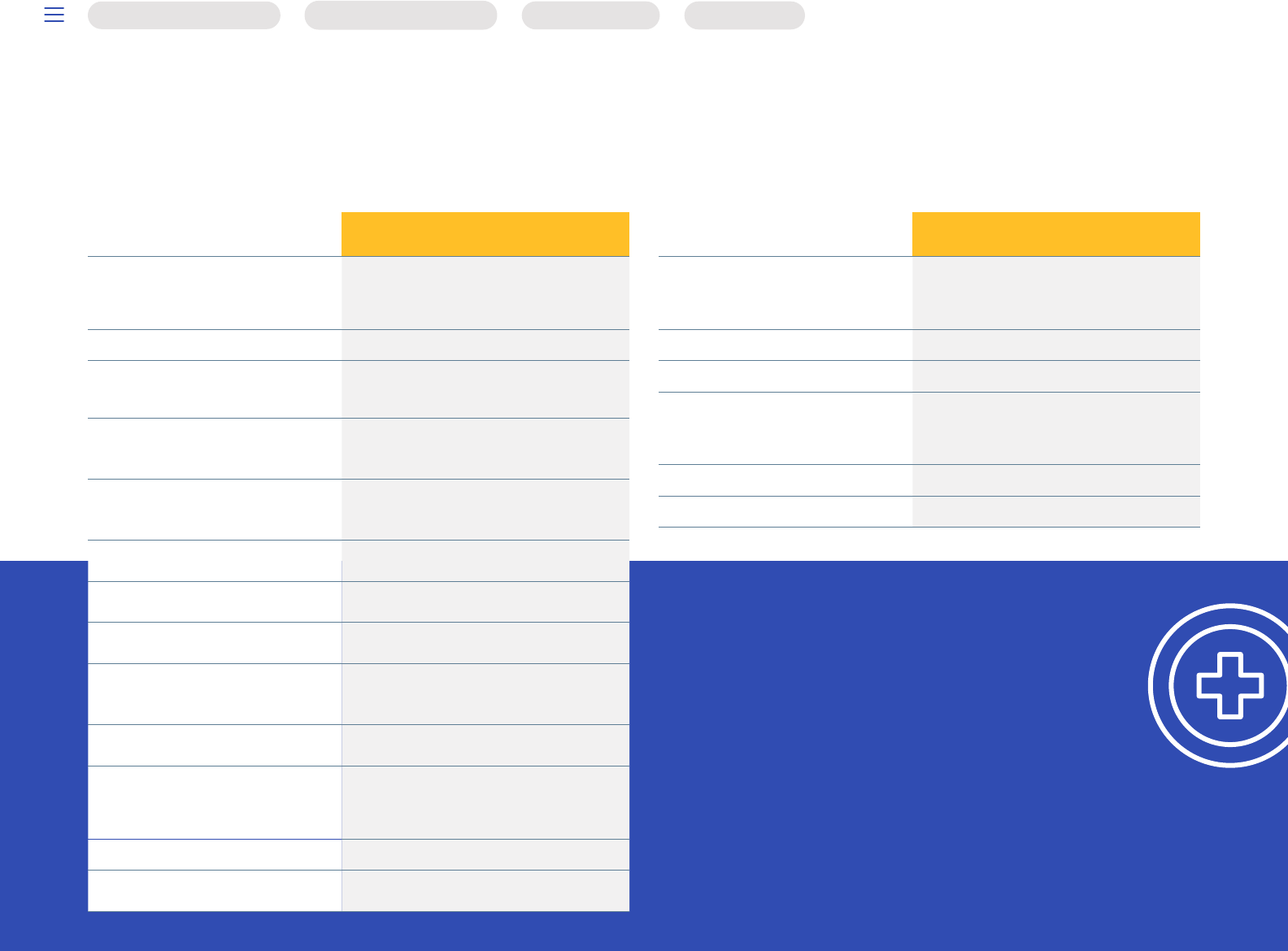

Monthly cost for dental coverage

Optional Basic DeltaCare DHMO

Full-time Part-time Full-time Part-time Full-time Part-time

Employee Only $12.00 $12.00 $3.00 $3.00 $0.00 $0.00

Employee + Spouse/

Committed Partner

$30.00 $34.22 $7.00 $21.62 $0.00 $9.58

Employee + Children $34.00 $38.66 $7.00 $25.34 $0.00 $11.42

Employee + Family $47.00 $56.44 $10.00 $40.20 $0.00 $23.60

ID cards

ID cards are not required for service; however, you

may print a paper Dental ID card by registering on

deltadentalins.com/southwest.

Finding an in-network

provider if you choose

Optional or Basic

Visit deltadentalins.com/southwest or call

(866) 204-5502 to find in-network providers.

Finding an in-network

provider if you choose the

DHMO

You will need to select a primary care dentist

from the DeltaCare® USA Network. Search

dentists at deltadentalins.com/southwest to

see a list of providers. Contact Delta Dental with

your selection. When assigning or changing

dentists, requests must be received by the 21

st

of the month to be eective the first day of the

following month. If you do not select a dentist,

one will be assigned to you.

Health

Contacts

22

BenefitsPlus Program

Regular Plan Program

Other Benefits

22

Vision

Vision coverage is

available through

EyeMed with a network

of providers and vision

care centers. Here’s a

look at how it works.

Vision

What you pay for care

In-network Out-of-network

Exam with dilations

(as necessary; once every calendar year)

$10 copay per person Maximum of $39

Contact lens fit and follow-up

Standard contact lenses

$40 copay

Not applicable

Premium contact lenses

10% o the retail price

Not applicable

Contact lenses

(materials only; once every calendar year)

Conventional

$0 copay; $150 allowance paid by EyeMed;

15% o balance over $150

Any amount over the

$150 allowance

Disposable

$0 copay; $150 allowance paid by EyeMed;

15% o balance over $150

Any amount over the

$150 allowance

Medically necessary

$0 copay; paid in full by EyeMed Any amount over the $210 allowance

Retinal imaging Maximum of $39

Not applicable

Frames

(once every other calendar year)

$0 copay; $130 allowance paid by EyeMed;

20% o balance over $130

Any amount over the

$45 allowance

Standard plastic lenses

(Once every calendar year)

Single vision, bifocal, trifocal, lenticular

$10 copay

Any amount over the

$40, $60,

or

$80 allowance

Standard progressive lens

$75 Any amount over the $60 allowance

Laser vision correction

(LASIK or PRK from U.S. Laser Network)

15% o retail price

5% o promotional price

Not applicable

Health

Contacts

23

BenefitsPlus Program

Regular Plan Program

Other Benefits

23

ID cards

It is not necessary to have an ID card to receive

services; however, EyeMed will provide each new

participant with two ID cards.

Finding an

in-network provider

Visit eyemedvisioncare.com/swa or call

(855) 219-4451 to find in-network providers.

Monthly cost for

vision coverage

Vision

Employee Only $5.74

Employee + Spouse/

Committed Partner

$10.88

Employee + Children $11.46

Employee + Family $16.84

Get Freedom Pass

and save!

Freedom Pass is now included with your vision

coverage from EyeMed! The program includes:

• No cost for any frame, any brand, and any

price point if purchased at Target Optical;

use code 755288 at the time of purchase.

• Use ContactsDirect.com and get $20 o

purchase and free shipping

.

Health

Contacts

24

BenefitsPlus Program

Regular Plan Program

Other Benefits

24

Additional benefits

Supplemental Hospital Plan

This benefit does not replace medical coverage. It provides a cash benefit

if you or a family member have a hospital stay. You can use the cash for any

expense—not just medical bills.

If you buy the plan, you’ll be eligible for up to $1,500 in payments per year

for you and each qualified family member, with an additional benefit of up

to $1,000 if admitted to an intensive care unit. You get $750 as soon as you or

a qualified family member is confined to the hospital. For each additional day

in a regular hospital room during the year, you get $250 (up to three days).

For each day in an intensive care unit room, you get $250 (up to four days).

There is no prerequisite for coverage, but the plan won’t cover certain

hospitalizations. For a list of exclusions, visit

enrollment.visit-aci.com/southwest.

Monthly rates for your coverage level are in the online enrollment tool,

WorkPerks. Rates range from $8.70 to $30.16 per month, depending on your

coverage level. If you have questions, contact CHUBB at (800) 964-7096 or

go to enrollment.visit-aci.com/southwest.

Critical Illness Plan

This plan provides a cash benefit if you experience one (or more) of several

covered illnesses, including a cancer diagnosis, heart attack, or stroke. You can

use the cash for any expense—not just medical bills.

The plan is guaranteed for you and your entire immediate family, and medical

history is not required. Coverage levels you may elect include a benefit of:

• $10,000

• $20,000

• $30,000

Plan rates are based on the coverage amount you elect, your age, and whether

you smoke. Find rates in the online enrollment tool, WorkPerks.

Contact MetLife at (888) 275-0865 for more information.

Health

Contacts

25

BenefitsPlus Program

Regular Plan Program

Other Benefits

25

Short-Term Disability

Noncontract, Meteorology, and Source of Support (SOS) Employees are automatically enrolled in

coverage at no cost. This coverage pays you a portion of your income for a limited time if you can’t work

because of an injury or illness.

Noncontract Employees

Who’s eligible?

• New Hires after 90 days of employment

• Part-time Employees must work an average of at least 10 hours per week in

the six months leading up to the date of disability

• Full-time Employees must work an average of at least 20 hours per week in

the six months leading up to the date of disability

What are the weekly benefit payments?

Payments begin after the waiting period and are:

• Weeks two through seven: 100% of your average daily base pay as of the

date of disability

1

• Week eight to 90

th

day on leave: 80% of your average daily base pay

What is the benefit waiting period?

Seven consecutive calendar days, the first week of leave

Are the benefit payments taxable?

Yes.

Meteorology and Source of

Support (SOS) Workgroups

Who’s eligible?

• New Hires after 90 days of employment

• Part-time Employees must work an average of at least 10 hours per week in

the six months leading up to the date of disability

• Full-time Employees must work an average of at least 20 hours per week in

the six months leading up to the date of disability

What are the weekly benefit payments?

Week two to 90

th

day on leave: 60% of your average daily base pay as of

the date of disability

1

What is the benefit waiting period?

Seven consecutive calendar days, the first week of leave

Are the benefit payments taxable?

Yes.

1

The short-term disability benefit for eligible Employees based in California, New Jersey, New York, Rhode Island, Hawaii,

and Puerto Rico may dier due to certain state-provided disability benefits.

Health

Contacts

26

BenefitsPlus Program

Regular Plan Program

Other Benefits

26

Long-Term Disability (LTD)

LTD pays you a portion of your income for a limited time if you experience a serious, long-term injury or

illness that causes you to miss work for an extended period.

You’re automatically enrolled in basic LTD coverage at no cost to you. You can also elect optional LTD coverage through the

taxable benefit or non-taxable benefit. You can view the rates for each option in the online enrollment tool, WorkPerks.

Basic

Optional

taxable benefit

Optional

non-taxable benefit

Who’s eligible?

All Employees except Pilots

1

Do I pay for coverage? No

Yes,

with after-tax paycheck

deductions

Yes,

with after-tax paycheck

deductions

What is the monthly

benefit?

2

40% of base monthly pay

3

60% of base monthly pay

3

60% of base monthly pay

3

What is the minimum

monthly benefit?

10% of gross benefit or $100,

whichever is greater

10% of gross benefit or $100,

whichever is greater

10% of gross benefit or $100,

whichever is greater

What is the maximum

monthly benefit?

$10,000 $10,000 $10,000

What is the benefit

waiting period?

Noncontract, Meteorology,

and SOS Employees:

90 days

All other Employees:

180 days

90 days 90 days

Are the benefit

payments taxable?

Yes A portion is taxable No

1

Pilots are covered by a separate Loss of License Plan. See Pilot Loss of License Summary Plan Description for details on SWALife >Life & Career >Employee

Services >Health Benefits (WorkPerks) >Access Health Benefits (WorkPerks) >Reference Center >Pilots Loss of License.

2

Benefit is reduced by income from other sources.

3

For definitions of eligibility and base monthly pay, visit the definitions section of the appropriate programs certificate, which can be located on SWALife >Life &

Career >Employee Services >Health Benefits (WorkPerks) >Access Health Benefits (WorkPerks) >Reference Center >Disability Benefits.

Health

Contacts

27

BenefitsPlus Program

Regular Plan Program

Other Benefits

27

Related benefits

You have more benefits in the event

of an accident that involves a seat belt,

airbag, or workplace felonious assault.

Special reimbursements are available to

help pay for childcare centers, child education,

and spouse/committed partner education.

Employees enrolled in AD&D insurance coverage also

have travel assistance at no extra cost through AXA

Assistance USA, Inc. When you travel more than 100

miles away from home, you have access to a full-time

concierge service to help you and your family with

certain travel, financial, and medical services, 24/7.

For more details and to print an ID card, go to

SWALife >Employee Services >Benefits & Perks

>Travel Insurance and Commuter Transit.

Accidental Death and

Dismemberment (AD&D)

AD&D insurance pays a benefit if you or a covered family member dies or suers an

injury in an accident. You can purchase this insurance, before-tax, to help protect you

and your family from financial hardship if the unexpected happens.

Monthly paycheck deductions

Employee only (per $1,000 of coverage)

• $.017 (up to 10 times Employee’s annual salary; maximum of $2,000,000)

Employee + family (per $1,000 of coverage)

• $.029 (up to 10 times Employee’s annual salary; maximum of $2,000,000)

Keep beneficiaries up to date!

It’s important to keep your beneficiaries up to date for AD&D insurance.

You can only add, remove, or change your beneficiaries online at

metlife.com/myBenefits.

Health

Contacts

28

BenefitsPlus Program

Regular Plan Program

Other Benefits

28

Life insurance

coverage

Life insurance, administered by MetLife, pays a benefit if you or a covered

family member dies. Basic life insurance is paid for by Southwest. You can

purchase additional coverage for yourself, your spouse/committed partner,

and your children.

Basic Life

Optional Life

(paid for by you)

Employee $50,000 One to 10 times your

annual base pay, up to

$2.95 million

See next page for your cost

for coverage.

Spouse/Committed

Partner

No coverage $10,000, $20,000, $30,000,

$50,000, $100,000,

$150,000, or $250,000

See next page for your cost

for coverage.

Children

1

No coverage $10,000 per child for a

monthly premium of $.53

$20,000 per child for a

monthly premium of $1.06

1

Eligible children include any children from at least 20 weeks gestation to age 26 who is a/an disabled child, foster child,

adopted child, or child living in your home as your grandchild, your stepchild, or the child of your spouse/committed

partner. Additional provisions with stillborn apply. Please see the Insurance Certificate on SWALife >Life & Career

>Employee Services >Health Benefits (WorkPerks) >Access Health Benefits (WorkPerks) >Reference Center >Life

Insurance and Accidental Death and Dismemberment.

Keep beneficiaries

up to date!

It’s important to keep your beneficiaries up

to date for life insurance. You can only add,

remove, or change your beneficiaries online

at metlife.com/myBenefits.

Important note

Do not pay for benefits that you will not be

able to use! Paycheck deductions for child life

insurance do not stop automatically when your

child turns 26. However, the coverage does stop

even if deductions continue to be taken from your

paycheck. Review your insurance coverage and be sure

to drop coverage if your child(ren) are older than 26. A

third party provides child life insurance coverage, and

refunds will not be issued.

If you elect certain levels of life insurance, you may be required to complete a statement of

health (SOH) form after your election. If you increase life insurance coverage at a later date for

yourself or your spouse/committed partner, you will be required to complete a new SOH form

at that time.

Health

Contacts

29

BenefitsPlus Program

Regular Plan Program

Other Benefits

29

Example

Age

45

Employee optional life

paycheck deduction

(per $1,000)

$.057

Salary

$50,000

Optional life

insurance election

10 times salary

Optional life insurance

coverage amount

$500,000

($50,000 times 10)

Employee optional life

paycheck deduction

(per month)

$28.50

($500,000 divided

by $1,000=500;

500 times $.057)

Monthly cost for

life insurance coverage

Here’s what you’ll pay for optional and spouse/committed

partner life insurance.

Age band

Employee coverage

(per $1,000 of coverage)

Spouse/committed

partner coverage

(per $1,000 of coverage)

<25 $.025 $.042

25–29 $.025 $.042

30–44 $.032 $.053

45–49 $.057 $.095

50–54 $.089 $.147

55–59 $.165 $.273

60–64 $.287 $.473

65–69 $.555 $.914

70+ $.892 $1.47

Calculating your cost

Here’s how to calculate the monthly cost for optional life

insurance based on the deductions per $1,000 of coverage

to the left.

Health

Contacts

30

BenefitsPlus Program

Regular Plan Program

Other Benefits

30

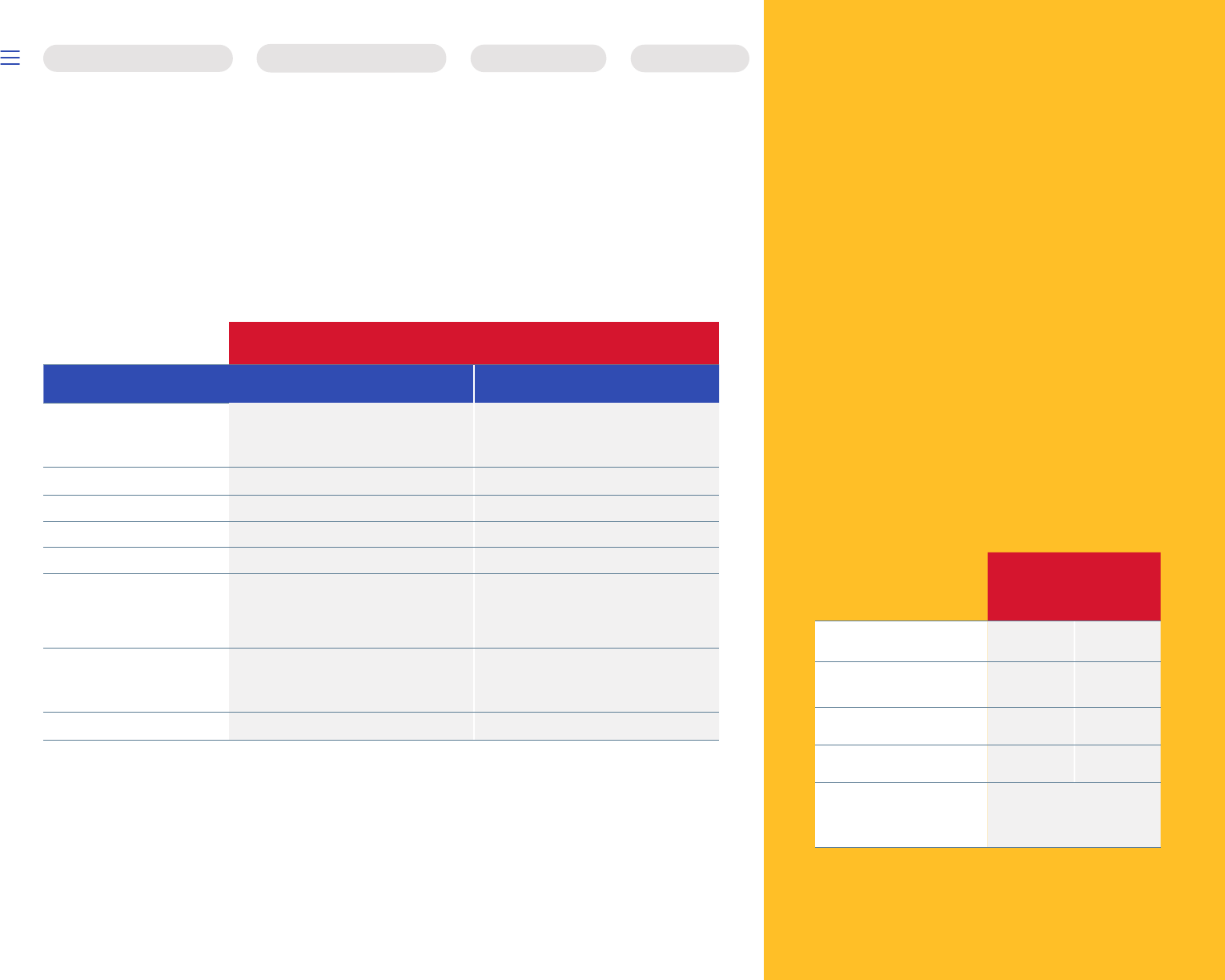

Medical

If you choose the Regular Plan Program, you get automatic medical coverage.

There is a provider network in the Regular Plan, but it works dierently in some ways than the provider

network in BenefitsPlus. For example, your benefits coverage is 80% in the Regular Plan whether you see

a network provider or an out-of-network provider. But, like BenefitsPlus, if you see an out-of-network

provider, you are financially responsible for any amounts the provider may charge in excess of the amount

paid by the Regular Plan. This is called “balance billing,” but it can be avoided by using network doctors,

hospitals, and facilities. Use your medical plan administrator’s website to determine if your physician,

hospital, or other provider is in-network, or call your administrator.

Here’s a look at what you pay when you need care.

Regular Plan

Annual deductible

1

Individual

$200

Family

$300

Coinsurance 20%

Preventive care Not covered

Newborn care Not covered

Infertility treatment Not covered

Mental, emotional, behavioral, and

chemical abuse/dependency benefits

Preauthorization is required for many services,

treatments, and hospital stays.

2

20%

(both inpatient and outpatient)

Annual out-of-pocket maximum

3

$2,500

Lifetime maximum No limit

1

Eligible charges incurred in October, November, and December that count against the deductible will also be applied

to the deductible for the following year.

2

Refer to the Summary Plan Description on SWALife >Life & Career >Employee Services >Health Benefits (WorkPerks)

>Access Health Benefits (WorkPerks) >Reference Center >Legal Documents for preauthorization rules.

3

In the Regular Plan, you may be required to pay any amount that exceeds the eligible charge, as determined by the

claims administrator, even after you reach your annual out-of-pocket maximum.

Words

to know

Annual deductible

The amount you pay before

Southwest starts sharing costs with you.

Coinsurance

The percentage you pay after meeting your

deductible; preauthorization is required for many

services, treatments, and stays.

2

Annual out-of-pocket maximum

The most you’ll pay for eligible expenses in

a plan year.

Lifetime maximum

The most you’ll pay for medical services in

a lifetime.

Health

Contacts

32

BenefitsPlus Program

Regular Plan Program

Other Benefits

32

Prescription drugs

The Regular Plan includes prescription drug coverage administered by CVS Caremark.

Here’s what you’ll pay for prescription drugs.

Regular Plan

Annual deductible

Individual

$200

Family

$300

Coinsurance or copay

Generic

0%

after deductible

Preferred brand

20%

after deductible

Non-preferred brand

20%

after deductible

Specialty drug (30-day only)

20%

after deductible

Diabetic testing supplies

20%

after deductible

Infertility

Not covered

What you need to know

• There is no prescription drug coverage if you fill at an

excluded pharmacy, like Walgreens. To find a pharmacy,

visit caremark.com and use the Pharmacy Locator tool.

• If you take a maintenance medication, you may purchase a

90-day supply at a CVS retail pharmacy or through CVS

mail order. Or, if you wish to use another of the 58,000+

pharmacies in the network, you can fill a 30-day supply.

If you choose to refill every month, it will probably cost a

little more for the smaller volume prescription. Go to

caremark.com or call (800) 378-0755 for more details.

• Get the app! Download the CVS Caremark app to find

pharmacies, refill or request new prescriptions, track your

orders, view your prescription history, and more.

Health

Contacts

33

BenefitsPlus Program

Regular Plan Program

Other Benefits

33

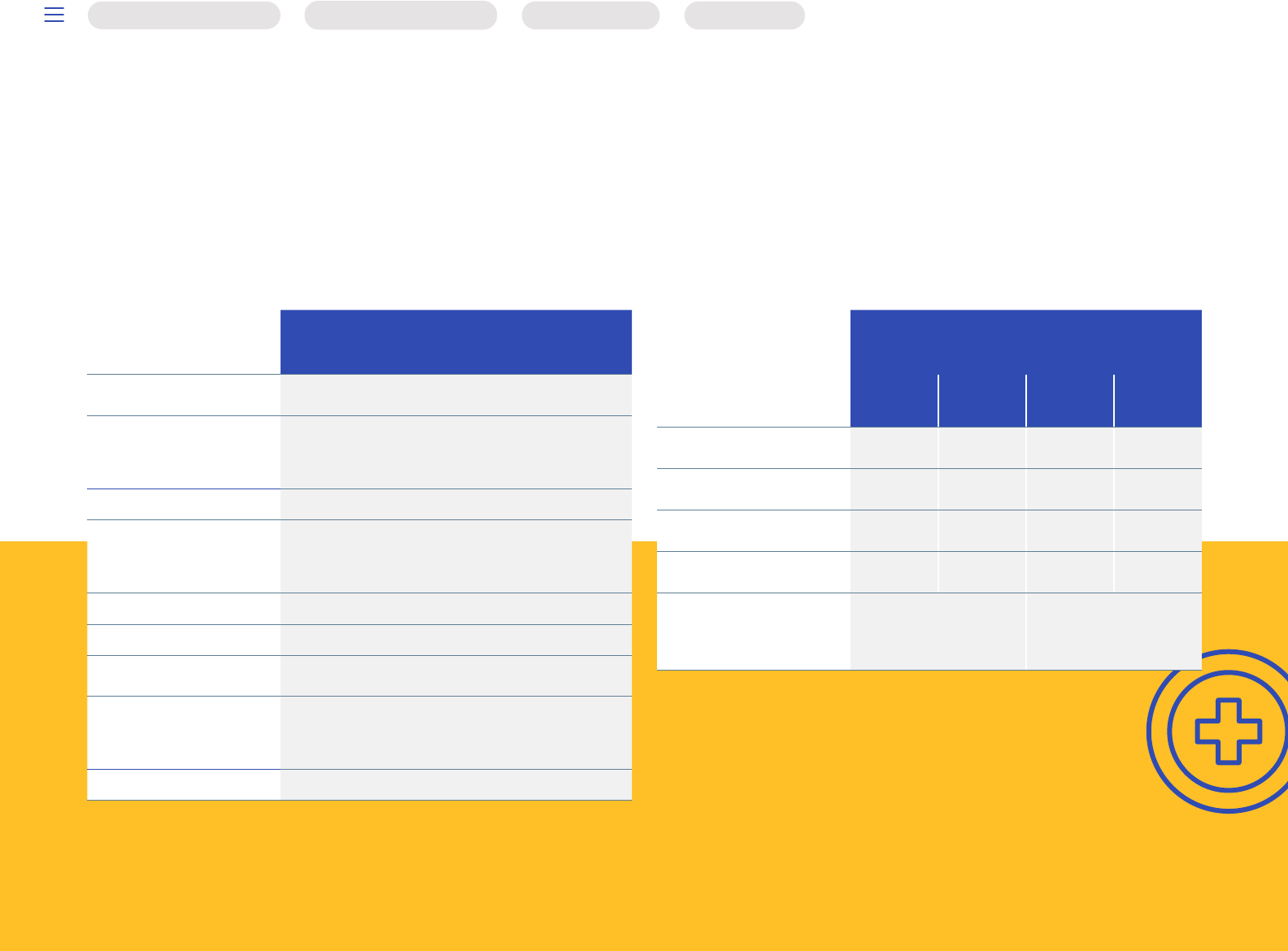

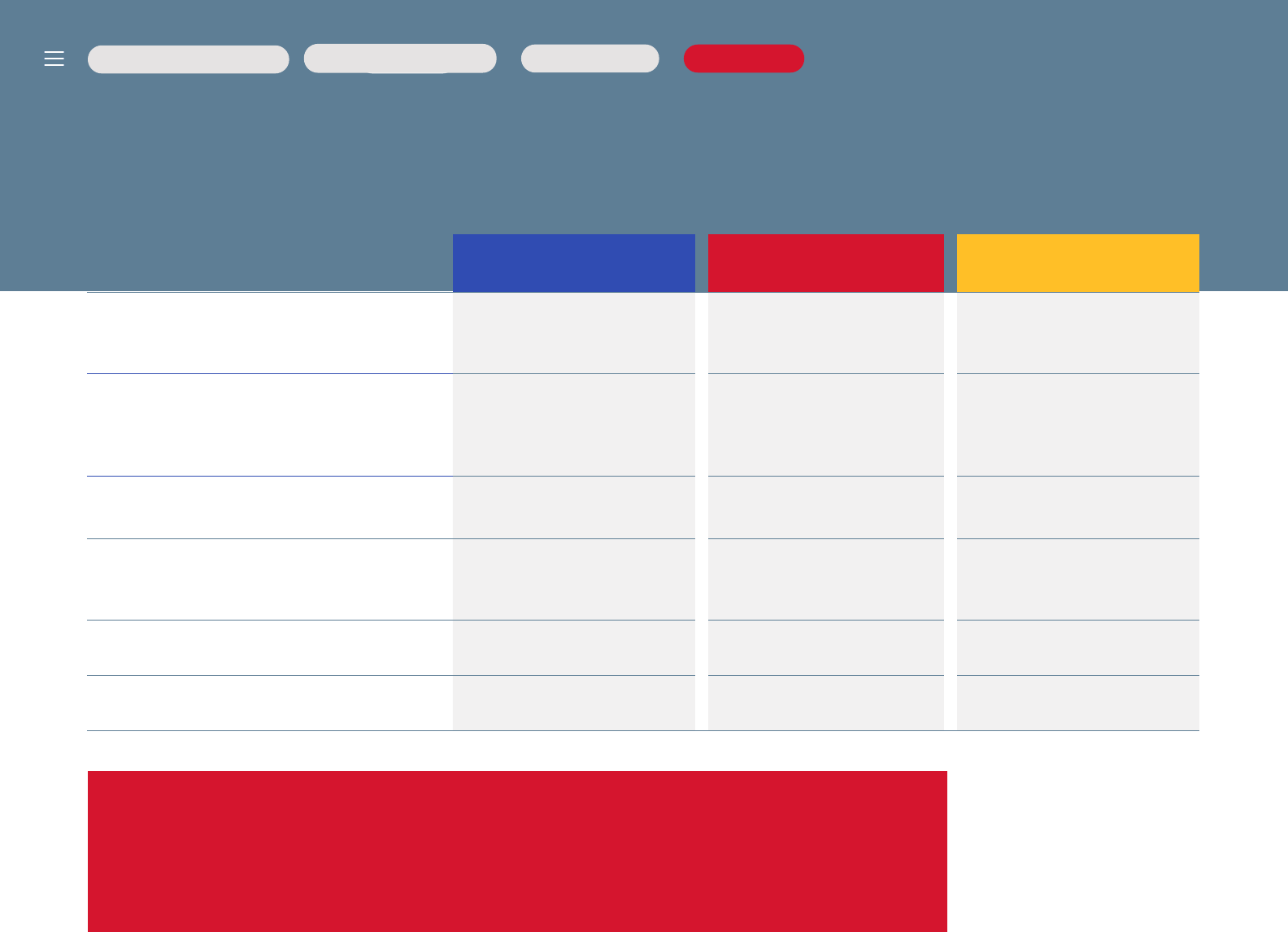

Monthly cost

for medical coverage

Your cost for medical coverage under the Regular Plan is deducted from your

paycheck on a before-tax basis. This lowers your taxable income, saving you money.

Finding an in-network provider

If Cigna is your administrator, you can find in-network providers here.

If Aetna is your administrator, you can find in-network providers here.

ID cards

Keep an eye out for medical ID cards that will be sent to your permanent

residence (as it’s listed on SWALife >Life & Career >Employee Services

>About Me).

Regular Plan

Full-time Part-time

Employee Only $0.00 $0.00

Employee + Spouse $0.00 $708.55

Employee + Children $0.00 $495.99

Employee + Family $0.00 $1,204.53

Health

Contacts

34

BenefitsPlus Program

Regular Plan Program

Other Benefits

34

Livongo

Livongo is available at no cost to Employees and

their covered dependents that meet the program’s

criteria and are enrolled in the BenefitsPlus

Program (Choice Plus Plan, Choice Plan C, and

Health Savings Plan) or Regular Plan Program. All

other medical plans are not eligible to participate.

Livongo provides you with tools, insights, and

expert support to help you reach your health

goals. There are two main areas where Livongo

can support:

• Healthy living and diabetes prevention

• Diabetes management

With Livongo all participants will have

access to:

• Technology: Track and manage health on the go by

automatically logging data in a private dashboard and

easy-to-use app.

• Personalized insights: Get real-time tips and

personalized feedback to help learn and improve.

• Expert coaching: Talk to a Livongo health coach for

advice on nutrition, weight loss, and more, whenever

extra support is needed.

Depending on the selected program,

you will also have access to the following

additional benefits at no cost:

Healthy living and diabetes prevention includes:

• smart scale,

• unlimited coaching, and

• guidance on healthy habits

Diabetes management includes:

• unlimited test strips,

• a connected blood glucose meter, and

• personalized insights

Programs include trends and support on

participant’s secure Livongo account and mobile

app but do not include a tablet or phone.

Get started

Contact Livongo at (800) 945-4355 or visit

go.livongo.com/SWA/now, registration code

is SWA.

Talk to a nurse

Evie Newton, our Dedicated Nurse, is

available Monday-Friday from 8 a.m.

to 5 p.m. CT at (214) 792-7986 or

evie.newton@wnco.com. Evie’s goal

is to provide preventive and general

health education to you and your family

members. She provides consultation to

assess and refer you to the appropriate

resources as needed. Additional

information about Evie and other physical

health resources may be found on

SWALife >Employee Services.

Support for your health

Health

Contacts

35

BenefitsPlus Program

Regular Plan Program

Other Benefits

35

Dental

When you enroll in the Regular Plan, you and your family members are automatically

enrolled in basic dental coverage through Delta Dental. You can get care from any

dentist you choose, but you’ll save money if you stay in-network. Here’s a look at how

the plan works.

Dental

Annual deductible

$50 per person

What the plan pays

Annual maximum benefit

$1,000 per person

Preventive treatment

(e.g., cleanings, oral exams, X-rays two times a year)

No deductible, and costs do not apply to your deductible or annual

maximum benefit

100%

Dental sealants

No deductible

Not covered

Basic treatment

(e.g., tooth extractions, root canals)

After deductible

75%

Major treatment

(e.g., crowns, bridges, dentures)

After deductible

60%

Orthodontia

Braces for all ages

60% up to a lifetime maximum benefit

of $1,000 per person

Special services

(e.g., impacted wisdom teeth)

No deductible and does not apply to your annual maximum benefit

80%

Note: Amount only includes covered charges. Refer to Dental Program (Section 7) of the Summary

Plan Description for a list of covered charges.

Health

Contacts

36

BenefitsPlus Program

Regular Plan Program

Other Benefits

36

Monthly cost for

dental coverage

Finding an

in-network provider

Visit deltadentalins.com/southwest or call

(866) 204-5502 to find in-network providers.

ID cards

ID cards are not required for service; however, you

may print a paper Dental ID card by registering on

deltadentalins.com/southwest.

Dental

Full-time Part-time

Employee Only $0.00 $0.00

Employee + Spouse $0.00 $33.42

Employee + Children $0.00 $38.90

Employee + Family $0.00 $64.81

Health

Contacts

37

BenefitsPlus Program

Regular Plan Program

Other Benefits

37

Vision

You can elect vision

coverage through

EyeMed with a network

of providers and

vision care centers if

you’re in one of the

following work groups:

Aircraft Appearance

Technicians, Customer

Service Agents,

Dispatchers, Flight

Simulator Technicians,

Mechanics,

Pilots, Customer

Representatives,

Material Specialists,

and SOS.

Vision

What the plan pays

In-network Out-of-network

Exam with dilations

(as necessary; once every calendar year)

$10 copay per person Maximum of $39

Contact lens fit and follow-up

Standard contact lenses

$40 copay Not applicable

Premium contact lenses

10% o the retail price Not applicable

Contact lenses

(materials only; once every calendar year)

Conventional

$0 copay; $105 allowance paid by EyeMed;

15% o balance over $105

Any amount over the $105 allowance

Disposable

$0 copay; $105 allowance paid by EyeMed;

You pay any balance over $105

Any amount over the $105 allowance

Medically necessary

$0 copay; paid in full by EyeMed Any amount over the $210 allowance

Retinal imaging

Maximum of $39 Not applicable

Frames

(once every other calendar year)

$0 copay; $130 allowance paid by EyeMed;

20% o balance over $130

Any amount over the $45 allowance

Standard plastic lenses

(Once every calendar year)

Single vision, bifocal, trifocal, lenticular

$10 copay Any amount over the $40, $60,

or $80 allowance

Standard progressive lens

$75 Any amount over the $60 allowance

Laser vision correction

(LASIK or PRK from U.S. Laser Network)

15% o retail price

5% o promotional price

Not applicable

Health

Contacts

38

BenefitsPlus Program

Regular Plan Program

Other Benefits

38

Vision

Employee Only $4.46

Employee + Spouse $8.48

Employee + Children $8.94

Employee + Family $13.12

Finding an

in-network provider

Visit eyemedvisioncare.com/swa or call

(855) 219-4451 to find in-network providers.

Monthly cost for

vision coverage

Get Freedom Pass

and save!

Freedom Pass is now included with your vision

coverage from EyeMed! The program includes:

• No cost for any frame, any brand, and any

price point if purchased at Target Optical;

use code 755288 at the time of purchase.

• Use ContactsDirect.com and get $20 o

purchase and free shipping.

ID cards

It is not necessary to have an ID card to receive

services; however, EyeMed will provide each new

participant with two ID cards.

Health

Contacts

39

BenefitsPlus Program

Regular Plan Program

Other Benefits

39

Short-Term Disability

Noncontract, Meteorology, and Source of Support (SOS) Employees are automatically enrolled in

coverage at no cost. This coverage pays you a portion of your income for a limited time if you can’t work

because of an injury or illness.

Noncontract Employees

Who’s eligible?

• New Hires after 90 days of employment

• Part-time Employees must work an average of at least 10 hours per week in

the six months leading up to the date of disability.

• Full-time Employees must work an average of at least 20 hours per week in

the six months leading up to the date of disability.

What are the weekly benefit payments?

Payments begin after the waiting period and are:

• Weeks two though seven: 100% of your average daily base pay as of the

date of disability

1

• Week eight to 90

th

day on leave: 80% of your average daily base pay

What is the benefit waiting period?

Seven consecutive calendar days, the first week of leave

Are the benefit payments taxable?

Yes.

Meteorology and Source of

Support (SOS) Workgroups

Who’s eligible?

• New Hires after 90 days of employment

• Part-time Employees must work an average of at least 10 hours per week in

the six months leading up to the date of disability.

• Full-time Employees must work an average of at least 20 hours per week in

the six months leading up to the date of disability.

What are the weekly benefit payments?

Week two to 90

th

day on leave: 60% of your average daily base pay as

of the date of disability

1

What is the benefit waiting period?

Seven consecutive calendar days, the first week of leave

Are the benefit payments taxable?

Yes.

1

The short-term disability benefit for eligible Employees based in California, New Jersey, New York, Rhode Island, Hawaii,

and Puerto Rico may dier due to certain state-provided disability benefits.

Health

Contacts

40

BenefitsPlus Program

Regular Plan Program

Other Benefits

40

Long-Term Disability (LTD)

LTD is designed to provide salary replacement if you experience a serious, long-term injury

or illness that causes you to miss work for an extended period.

All Employees except Pilots have the option to purchase LTD insurance. Unlike the BenefitsPlus Program,

you are NOT automatically provided LTD in the Regular Plan Program.

Coverage level

What is the monthly benefit?

1

Customer Service, Ramp Operations, Freight, Provisioning, Customer Representatives

(includes Agents and Supervisors), Flight Attendants, Skycaps

50% of base monthly pay

3

All other eligible Employees

2

60% of base monthly pay

3

What is the minimum monthly benefit?

All other eligible Employees

2

$50 per month

What is the maximum monthly benefit?

Customer Service, Ramp Operations, Freight, Provisioning, Customer Representatives

(includes Agents and Supervisors), Flight Attendants, Skycaps

$3,000 per month

Flight Attendants

$5,000 per month

All other eligible Employees

2

$10,000 per month

What is the benefit waiting period?

Flight Attendants

180 days

All other eligible Employees

2

90 days

Are the benefit payments taxable? No

1

Benefit is reduced by income from other sources.

2

Pilots are covered by a separate Loss of License Plan. See Pilot Loss of License Summary Plan Description for details on SWALife >Life & Career >Employee

Services >Health Benefits (WorkPerks) >Access Health Benefits (WorkPerks) >Reference Center >Pilots Loss of License.

3

For definitions of eligibility and base monthly pay, visit the appropriate programs certificate, which can be located on SWALife >Life & Career >Employee Services

>Health Benefits (WorkPerks) >Access Health Benefits (WorkPerks) >Reference Center >Disability Benefits.

Your cost

for coverage

Rates for LTD coverage

are based on your base

monthly pay and your

job classification as of the

day before your disability.

You can find rates in the

online enrollment tool,

WorkPerks.

Health

Contacts

41

BenefitsPlus Program

Regular Plan Program

Other Benefits

41

Life insurance

Life insurance, administered by MetLife, pays a benefit if you or a covered family member dies.

Basic life insurance is paid for by Southwest. You can purchase additional coverage for yourself, your

spouse, and your children.

Basic Life Amount of coverage

Employee annual

base salary

Less than $10,000

$10,000

$10,000 but less than $15,000

$15,000

$15,000 but less than $20,000

$20,000

$20,000 but less than $30,000

$30,000

$30,000 and over

$50,000

Optional Life Amount of coverage

Employee

Pilots and Corporate Ocers

$50,000, $100,000, or $150,000

See next page for your costs

for coverage.

All other Employees

The same amount as your basic coverage

See next page for your costs for coverage.

Spouse $10,000

for a monthly paycheck deduction of $1.88

Children $5,000

per child for a monthly paycheck deduction of $0.30

If you enroll in this optional life insurance, you’ll automatically receive

Accidental Death and Dismemberment (AD&D) for yourself in the same

amount. The Employee + Family AD&D option is not available in this Program.

You may review your applicable monthly rates for AD&D insurance in the

online enrollment tool, WorkPerks.

Health

Contacts

42

BenefitsPlus Program

Regular Plan Program

Other Benefits

42

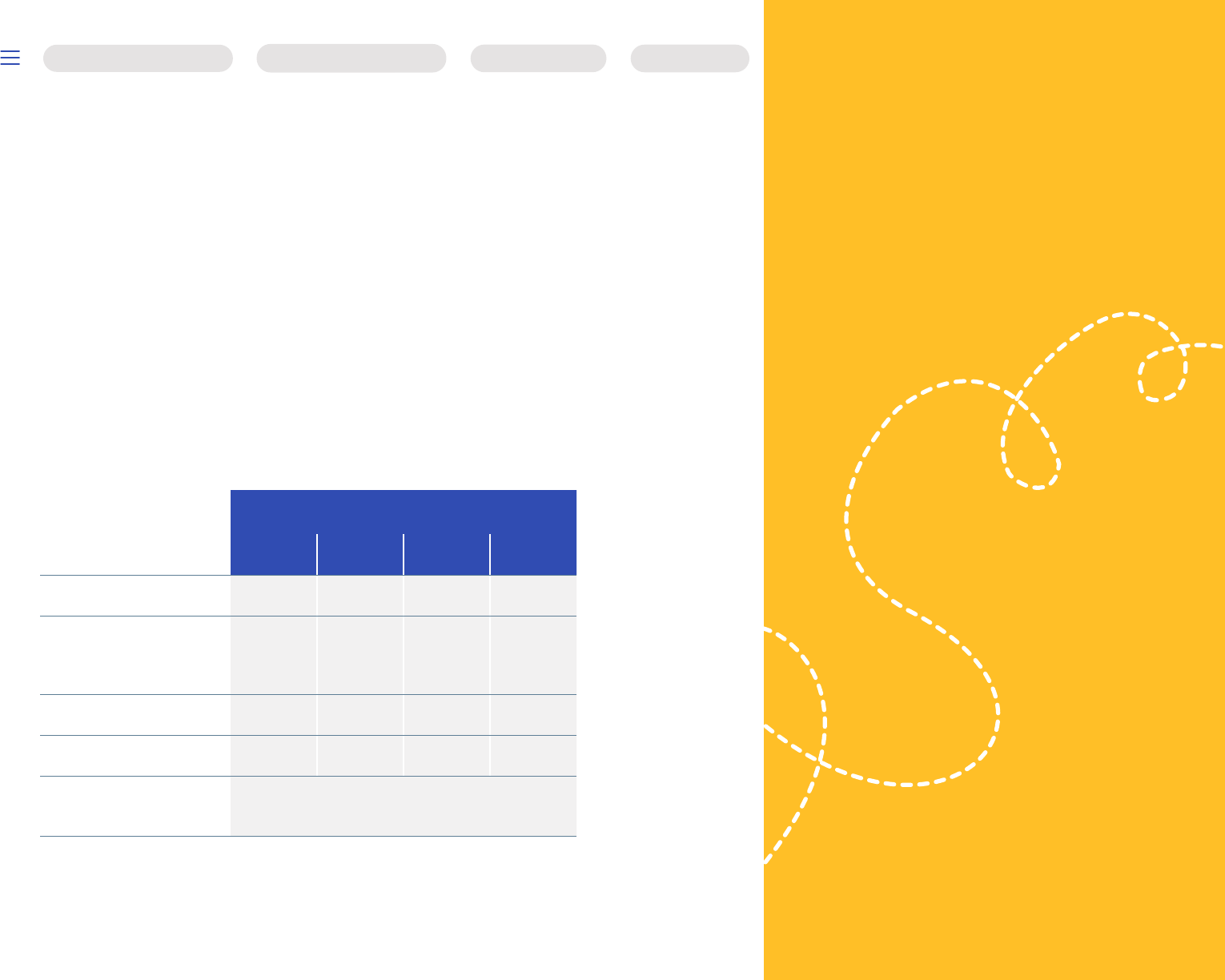

Monthly cost for life

insurance coverage

Here’s what you’ll pay for optional life insurance for yourself.

Age Band

Employee

(per $1,000 of coverage)

<25

$.052

25–29

$.052

30–44

$.059

45–49

$.094

50–54

$.136

55–59

$.238

60–64

$.400

65–69

$.757

70+

$1.207

Keep beneficiaries up

to date!

It’s important to keep your beneficiaries up

to date for life insurance. You can only add,

remove, or change your beneficiaries online

at metlife.com/myBenefits.

Important note

Do not pay for benefits that you

will not be able to use! Paycheck

deductions for child life insurance

do not stop automatically when your

child turns 26. However, the coverage does

stop even if deductions continue to be taken from

your paycheck. Review your insurance coverage and be

sure to drop coverage if your child(ren) are older than 26.

A third party provides child life insurance coverage, and

refunds will not be issued.

If you elect certain levels of life insurance, you may be required to complete

a statement of health (SOH) form after your election. If you increase life

insurance coverage at a later date for yourself or your spouse, you will be

required to complete a new SOH form at that time.

Health

Contacts

43

BenefitsPlus Program

Regular Plan Program

Other Benefits

43

Accidental

Death and

Dismemberment

(AD&D)

AD&D insurance pays a benefit if you die or suer an injury

in an accident. If you enroll in optional life insurance, you

automatically receive optional AD&D insurance for yourself

in the same amount. You can’t enroll in AD&D coverage for

your spouse or children.

Keep beneficiaries up to date!

It’s important to keep your beneficiaries up to date for AD&D insurance.

You can only add, remove, or change your beneficiaries online at

metlife.com/myBenefits.

Eective the day you turn 70 years of age, the coverage amount for the

applicable accidental death and dismemberment will be automatically

reduced by 50%, and your deductions adjusted accordingly.

Basic AD&D Amount of coverage

Employee annual

base salary

Less than $10,000

$10,000

$10,000 but less than $15,000

$15,000

$15,000 but less than $20,000

$20,000

$20,000 but less than $30,000

$30,000

$30,000 and over

$50,000

Optional AD&D Amount of coverage

Employee

The same amount as your optional life

insurance coverage

Your cost for coverage

Rates for optional AD&D insurance can be found

on the online enrollment tool, WorkPerks.

Health

Contacts

44

BenefitsPlus Program

Regular Plan Program

Other Benefits

44

RETIREMENT BENEFITS

401(k)

No matter where you are in life, it’s

never too early to start preparing for

your future.

To help, Southwest oers a 401(k) plan.

Employees are eligible to participate in the

Southwest Airlines Co. 401(k) Plan any time

on or after the first of the month following 30

consecutive days of service. New Hires and

rehires are automatically enrolled in the 401(k)

plan at a 3% contribution rate. Unless you

make an active election for another investment

option, the contributions are invested in the

Target Retirement Trust that is closest to your

assumed age 65 retirement date.

Contributions

You may contribute 1% to 50% of your eligible earnings to the 401(k) plan on a before-tax or

Roth after-tax basis. The IRS sets limits on the amount you may contribute each year. For 2022,

1

the limits are:

• $20,500 for total pre-tax and Roth after-tax contributions, if you are under age 50.

• An additional $6,500 for catch-up contributions, if you are at least age 50 or older during the 2022 plan year.

Before-tax and Roth contributions

Before-tax contributions are withheld from your eligible earnings before federal income tax

and state taxes (if applicable) are deducted from your paycheck. You pay taxes on before-tax

contributions when you take a distribution.

Roth

2

contributions are withheld from your eligible earnings after federal income taxes and

state taxes (if applicable) are deducted from your paycheck. If you meet certain age and holding

period requirements, distributions of Roth contributions are tax-free.

Company Match

The 401(k) plan oers a generous dollar-for-dollar match up to 9.3% of your eligible earnings.

Both Roth after-tax contributions and before-tax contributions are eligible for the 401(k)

Company Match. Southwest makes all Company contributions on a before-tax basis. You can

find more information about your 401(k) on SWALife >Employee Services >Benefits & Perks

>401(k) Plan or at freedomtoretire.com.

If you are a Pilot

You are covered under a separate retirement savings

plan administered by SWAPA. If you have questions

about your plan, contact SWAPA at (800) 969-7972

or reach out to Schwab Participant Services at

(800) 724-7526, 7 a.m. to 11 p.m. CT, Monday-Friday.

1

Limits are set by the IRS and are subject to change annually. If you work in Puerto

Rico, your contributions limits may be dierent.

2

Roth contributions are not available if you work at SJU.

See more.

Health

Contacts

46

BenefitsPlus Program

Regular Plan Program

Other Benefits

46

RETIREMENT BENEFITS

401(k) (continued)

Investments

The plan oers you the flexibility to choose from a diverse selection of core

investment options as well as Target Retirement Trusts and a self-directed

brokerage window.

Rollovers

If you have qualified retirement accounts from a previous employer, you may be

able to rollover those funds to your Southwest Airlines Co. 401(k) account. For

more information about initiating a rollover, contact Empower Retirement at

(866) 588-2728.

Vesting

Vesting is a term that describes ownership of your account. You are always

100% vested in your 401(k) contributions (before-tax and Roth after-tax) as well

as the earnings on your contributions. The 401(k) Company match vests at a rate

of 20% per year for five years. To meet each year’s vesting requirement, you

must be credited with at least 1,000 hours during the year. You are credited

with 190 hours of service for each month in which you complete at least one

hour of service (or one trip, in the case of Flight Attendants). Therefore, six

months of service are typically required to receive vesting credit for each year

(190 x 6 = 1,140).

Get personalized

retirement planning

guidance

Shar-Né Warren is a Retirement Plan Counselor with

Empower Retirement. Shar-Né’s goal is to help you feel

more empowered to make informed financial decisions

by understanding the short-term and long-term eects.

She can help you strategize steps to achieve your financial

goals. If you have questions or would like to set up

a one-on-one meeting, you can email her at

SharNe.Warren@empower.com. Shar-Né is

available Monday-Friday, from

9 a.m. to 5 p.m. CT.

Personal interactions with Shar-Né

are completely confidential.

Health

Contacts

47

BenefitsPlus Program

Regular Plan Program

Other Benefits

47

RETIREMENT BENEFITS

ProfitSharing

Plan

We want to share success with our Employees. That’s why

we oer the ProfitSharing Plan, which rewards you for

your contributions to Southwest’s profitability.

Contribution eligibility

To receive a contribution, you must be credited with 1,000 vesting hours

during the plan year. You are credited with 190 hours of service for each

month in which you complete at least one hour of service (or one trip, in the

case of Flight Attendants and Pilots). Therefore, you must work at least one

day in six dierent months to receive the 1,000-hour credit needed to be

eligible for a contribution.

Investments

The investment options in the ProfitSharing plan mirror those in the Southwest

Airlines 401(k) plan. Additionally, the ProfitSharing plan includes the Southwest

Airlines Company Stock Fund as an investment option.

Vesting

Vesting is a term that describes ownership of your account. You become vested

in the Employer contributions to the ProfitSharing plan at a rate of 20% per plan

year in which you accumulate 1,000 vesting hours.

You can find more information about ProfitSharing on SWALife >Employee

Services >Benefits & Perks >ProfitSharing or at freedomtoretire.com.

Eligibility

You are eligible to participate in the ProfitSharing plan on your hire date.

Health

Contacts

48

BenefitsPlus Program

Regular Plan Program