Pfizer

Benets

Advantage

Voluntary Benets for Eligible Pzer U.S. Colleagues

www.PfizerAdvantage.com

Benets Advantage Program

• Supplemental Health Insurance Coverage

• Auto & Home Insurance

• Banking & Mortgage Lending

• Child Care

• Fitness

• Identity Protection

• Legal Services

• Pet Health Insurance

Legal Services 12

• MetLife Legal Plans

Pet Health Insurance 13

• Nationwide

Exclusive Discount Programs 15

• Child Care

• Fitness

• Banking & Mortgage Lending

Supplemental Health Insurance

Coverage 5

• MetLife Accident Insurance

• MetLife Critical Illness Insurance

• MetLife Hospital Indemnity Insurance

Auto & Home Insurance 8

• Farmers GroupSelect

SM

• Liberty Mutual

• Travelers

Identity Protection 11

• Allstate Identity Protection

Pzer Benets Advantage provides access to discounted rates for voluntary benets including

supplemental health insurance coverage (Accident, Critical Illness and Hospital Indemnity

Insurance), Auto and Home Insurance, Child Care, Fitness, Identity Protection, Legal Services,

Banking and Mortgage Lending, and Pet Insurance as well as a Vision Savings Program.

*

Signing

up is easy and, for most products, you can enjoy making payments through payroll deduction.

Supplemental Medical—Additional Coverage to Consider for 2022

Pzer has enhanced the supplemental health insurance coverage available, including:

• Lower rates for Accident Insurance

• Improved Critical Illness Insurance coverage and lower rates (with no pre-existing limitation)

• New Hospital Indemnity Insurance coverage

Payments from these benets are non-taxable and can be used at your discretion but are often

used to pay for out-of-pocket medical costs, such as annual deductible and coinsurance or for

other expenses that are generally not covered by health insurance while you are ill, such as

additional caregiving expenses.

* The Legal and supplemental health insurance coverages are subject to annual enrollment terms (see

chart on page 3 of this guide for a quick summary). The Vision Savings and Banking and Mortgage

Lending programs are oered at no cost and provide discounts on products and services.

Welcome to Pzer Benets Advantage

3

www.PfizerAdvantage.com

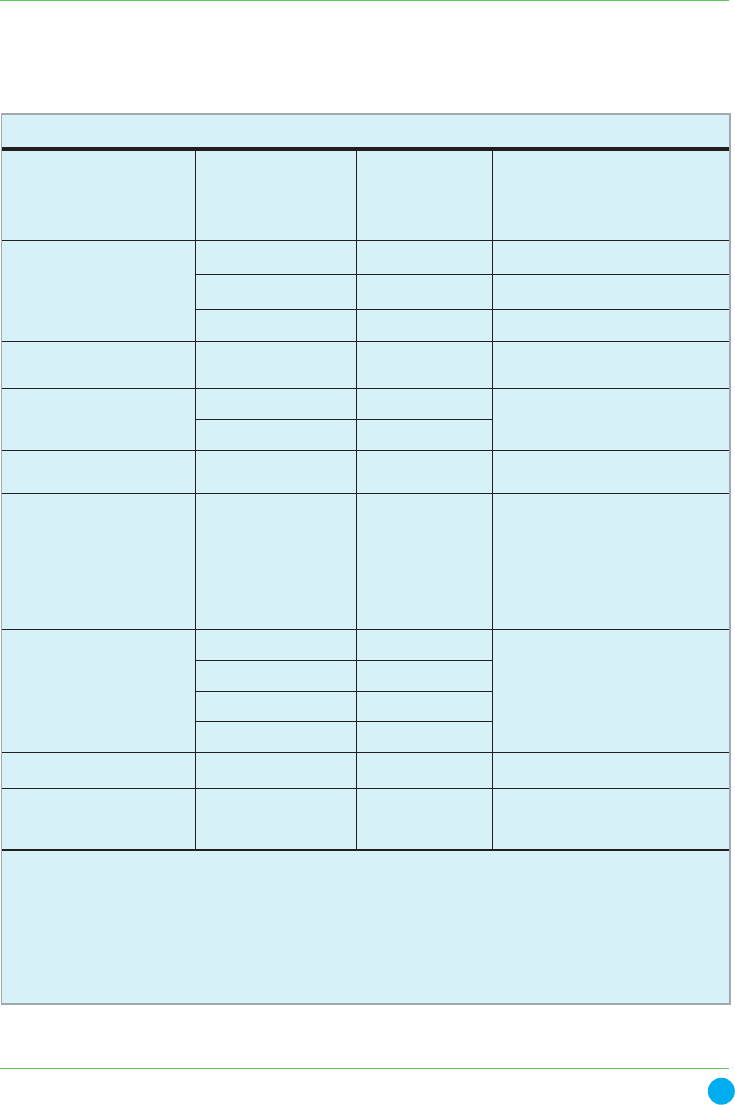

PRODUCT PROVIDER PHONE NUMBER ENROLLMENT TERMS

Supplemental Medical

1,2

– Accident Insurance

– Critical Illness Insurance

– Hospital Indemnity Insurance

MetLife (800) 438-6388

You can enroll during Annual Enroll-

ment, or within 31 days of your date of

hire or becoming eligible for benets,

without having to answer medical ques-

tions. You may cancel at anytime.

Auto & Home Insurance

1, 2

Pzer Benets Advantage oers a

choice of three providers.

Farmers GroupSelect

SM

(800) 438-6381 You may apply or cancel at anytime.

Liberty Mutual (855) 645-2150 You may apply or cancel at anytime.

Travelers (888) 695-4640 You may apply or cancel at anytime.

Child Care The Learning Care Group Call your local school You may apply or cancel at anytime.

Fitness

Gympass (844) 478-4744

You may enroll or cancel at any time.

Equinox (866) 332-6549

ldentity Protection

1, 2

Allstate Identity

Protection

(800) 789-2720 You may enroll or cancel at anytime.

Legal Services

1, 2

MetLife Legal Plans (800) 821-6400

You can enroll during Annual Enroll-

ment, or within 31 days of your date of

hire or becoming eligible for benets.

Your enrollment will automatically

renew unless you cancel during

Annual Enrollment.

Banking & Mortgage

Lending Program

Bank of America (800) 641-0453

You may apply at any time.

Premia Mortgage (866) 590-2951

Quicken Loans (888) 980-5155

Wells Fargo (800) 553-9988

Pet Health Insurance

1

Nationwide (877) 738-7874 You may enroll or cancel at anytime.

Vision Savings Program MetLife VisionAccess (800) 275-4638

Enrollment is not required. This is

a discount savings program only,

provided at no cost to you.

1 - This product may be continued on a direct-billed basis with the provider should your employment with Pzer end.

NOTE: Portability of Farmers GroupSelect insurance is subject to underwriting guidelines, applicable law, and local availability,

should you relocate out of state concurrent with the end of your employment at Pzer.

2 - Coverage is available for Pzer colleagues and/or eligible family members. (Certain restrictions may apply. See product details

or contact provider for additional information.)

The carriers represented in this material operate independently and are not responsible for each others’ nancial obligations.

For quick reference, a product overview is shown below. For more information about what’s available to you,

visit www.PzerAdvantage.com or contact Pzer Benets Advantage customer care at 1-888-926-2525.

Building Better Benets

5

www.PfizerAdvantage.com

Why Is It So Important?

Accidents can happen when you least expect them

And while you can’t always prevent them, you can

get help to make your recovery less expensive

and stressful.

In the U.S., there are approximately 29.4 million

trips to the emergency room annually due to

injuries

1

. These visits can be expensive — in fact,

ER bills average around $2,032 per visit

2

, and even

seemingly small injuries can come with unexpect-

edly high hospital bills.

You may be thinking — that’s why I have health

insurance. But even the best medical plans

may leave you with unexpected expenses like

deductibles, copays, extra costs for out-of-network

care, and non-covered services. You can’t plan for

accidents, but you can be nancially prepared.

How It Works

Accident insurance provides a nancial support for

life’s unexpected events. You can use it on anything

you want, such as to help pay costs that aren’t

covered by your medical plan. It provides you with

a lump-sum payment for a covered event — one

convenient payment all at once — when you or your

family need it most. The extra cash can help you

focus on getting back on track, without worrying

about nding the money to help cover unexpected

expenses, like the costs of treatment.

And best of all, the payment is made directly to you,

and is made regardless of any other insurance you

may have.

Information provided by MetLife

Accident Insurance from MetLife

®

1. Centers for Disease Control and Prevention: Emergency Department Visits. CDC/National Center for Health Statistics. Accessed July 2020. 2. The Cost of Unwar-

ranted ER Visits: $32 Billion a Year. Kaiser Health News, July 25, 2019. https://khn.org/morning-breakout/the-cost-of-unwarranted-er-visits-32-billion-a-year/ 3. Covered

services/treatments must be the result of an accident or sickness as dened in the group policy/certicate. See your Disclosure Statement or Outline of Coverage/

Disclosure Document for more details. 4. Chip fractures are paid at 25% of Fracture Benet and partial dislocations are paid at 25% of Dislocation Benet. 5. Covered

services/treatments must be the result of a covered accident as dened in the group policy/certicate. See your Disclosure Statement or Outline of Coverage/Disclo-

sure Document for more details.

METLIFE’S ACCIDENT INSURANCE IS A LIMITED BENEFIT GROUP INSURANCE POLICY. The policy is not intended to be a substitute for medical coverage and certain

states may require the insured to have medical coverage to enroll for the coverage. The policy or its provisions may vary or be unavailable in some states. There is a

preexisting condition limitation for hospital sickness benets, if applicable. MetLife’s Accident Insurance may be subject to benet reductions that begin at age 65. And,

like most group accident and health insurance policies, policies oered by MetLife may contain certain exclusions, limitations and terms for keeping them in force.

For complete details of coverage and availability, please refer to the group policy form GPNP12-AX or contact MetLife. Benets are underwritten by Metropolitan Life

Insurance Company, New York, New York.

Our accident insurance is designed to

cover a wide array of events, medical

services, and treatments.

3

This plan provides a lump-sum payment for over 150

dierent covered events, such as:

•

Fractures

4

• Dislocations

4

• Second and third

degree burns

• Skin grafts

• Torn knee cartilage

• Ruptured disc

•

Concussions

• Cuts/lacerations

• Eye injuries

• Coma

• Broken teeth

You’ll receive a lump-sum payment when you have

these covered medical services or treatments:

5

• Ambulance

• Emergency care

• Inpatient surgery

• Outpatient surgery

• Medical testing bene-

ts (including X-rays,

MRIs, CT scans)

•

Physician follow-up

visits

•

Transportation

• Home modications

• Therapy services (inc:

physical, occupational

and speech therapy)

Visit www.PzerAdvantage.com today to learn

more or to enroll under your group discount. For

additional information, call 1 800 GET-MET 8 (1-800-

438-6388) and identify yourself as a Pzer colleague.

(Program subject to annual enrollment terms.)

Reduced

Rates in

2022

6

www.PfizerAdvantage.com

1. “Medical Bankruptcy: Still Common Despite the Aordable Care Act.” David U. Himmelstein, Robert M. Lawless, Deborah Thorne, Pamela Foohey, and Stee

Woolhandler. American Journal of Public Health, March 1, 2019 (online February 6, 2019). 2. “New Survey: Two of Five Working-Age Adults Do Not Have Stable

Health Coverage; More Than One-Third Have Medical Bill Problems.” David Blumenthal, Sara Collins. The Commonwealth Fund, August 19, 2020. 3. Covered

Family Member means all Covered Persons as dened in the Certicate. 4. Please review the certicate for specic information about cancer benets. In

most states, not all types of cancer are covered. 5. The Heart Attack Covered Condition pays a benet for the occurrence of a myocardial infarction, subject

to the terms of the certicate. A myocardial infarction does not include sudden cardiac arrest. 6. In certain states, the Covered Condition is Severe Stroke. 7.

In most states, we will not pay a Major Organ Transplant benet if a covered person is placed on the organ transplant list prior to coverage taking eect and

subsequently undergoes a transplant procedure for the same organ while coverage is in eect. Refer to the Certicate for which organs are covered. In some

states, the condition is Major Organ Failure. 8. In certain states, the Covered Condition is Coronary Artery Disease.

METLIFE CRITICAL ILLNESS INSURANCE (CII) IS A LIMITED BENEFIT GROUP INSURANCE POLICY. Like most group accident and health insurance policies, MetLife’s CII

policies contain certain exclusions, limitations and terms for keeping them in force. Product features and availability vary by state. There may be a Benet Reduction

Due to Age provision. There may be a Benet Suspension Period between recurrences of the same Covered Condition or occurrences of dierent Covered Conditions.

MetLife oers CII on both an Attained Age basis, where rates will increase when a Covered Person reaches a new age band, and an Issue Age basis, where rates will not

increase due to age. Rates are subject to change. MetLife reserves the right to raise premium rates for Issue Age CII on a class-wide basis. A more detailed description

of the benets, limitations, and exclusions applicable to MetLife’s CII product can be found in the applicable Disclosure Statement or Outline of Coverage/Disclosure

Document available at time of enrollment. For complete details of coverage and availability, please refer to the group policy form GPNP07-CI, GPNP09-CI, GPNP10-CI,

GPNP14-CI, GPNP19-CI or contact MetLife for more information. Please contact MetLife for more information. Benets are underwritten by Metropolitan Life Insurance

Company, New York, New York.

MetLife’s Critical Illness Insurance is not intended to be a substitute for Medical Coverage providing benets for medical treatment, including hospital, surgical and

medical expenses. MetLife’s Critical Illness Insurance does not provide reimbursement for such expenses.

Critical illness insurance helps you

manage expenses so you can focus on

getting well.

As long as you or your loved one meets the policy

and certicate requirements, the following medical

conditions are covered:

3

• Cancer

4

• Heart attack

5

• Coma

•

Stroke

6

• Major organ transplant

7

• Coronary artery

bypass graft

8

• Severe burns

•

Kidney failure

• Benign brain tumor

•

4 childhood diseases

• 9 infectious diseases

• 11 progressive

diseases

Visit www.PzerAdvantage.com today to learn

more or to enroll under your group discount. For

additional information, call 1 800 GET-MET 8 (1-800-

438-6388) and identify yourself as a Pzer colleague.

(Program subject to annual enrollment terms.)

Why Is It So Important?

Medical bills have contributed to 58% of bankruptcies.

1

In 2020, one in four working-age adults with

insurance coverage reported medical bill problems

or debt in the past year.

2

The nancial consequences of surviving a critical

illness are something few people are prepared for.

Expenses that may not be covered by medical plans,

such as co-pays, deductibles, childcare, mortgage,

groceries and experimental treatments, could cut

into your savings.

When critical illness aects your family, you’ll have the

support you need when it matters most with MetLife

Critical Illness Insurance.

How It Works

Critical illness insurance is coverage that can help

safeguard your nances by providing you with a

lump-sum payment — one convenient payment all at

once — when you or your loved ones need it most.

The extra cash can help you focus on getting back on

track without worrying about nding the money to

cover the costs of treatment.

And best of all, the payment is made directly to you,

and is in addition to any other insurance you may

have. It’s yours to spend however you like, including

for everyday living expenses.

While recovering, critical illness insurance is there to

make life a little easier.

Critical Illness Insurance from MetLife

®

Information provided by MetLife

New

Carrier,

Enhanced

Benets &

Reduced

Rates in

2022

7

www.PfizerAdvantage.com

1. “Hospital does not include certain facilities such as nursing homes, convalescent care or extended care facilities. See your Disclosure Statement or Outline of Cover-

age/Disclosure Document for full details. 2. Why health insurance Is Important: Protection from high medical costs. www.healthcare.gov/why-coverage-is-important/

protection-from-high-medical-costs/. Accessed June 2020. 3. There is a pre-existing exclusion for covered sicknesses. 4. Hospital Connement requires the assignment

to a bed as a resident inpatient in a Hospital (including an Intensive Care Unit of a Hospital) on the advice of a Physician or connement in an observation area within

a Hospital for a period of no less than 20 continuous hours on the advice of a Physician. Please consult your certicate for details.

METLIFE’S HOSPITAL INDEMNITY INSURANCE IS A LIMITED BENEFIT GROUP INSURANCE POLICY. The policy is not intended to be a substitute for medical coverage

and certain states may require the insured to have medical coverage to enroll for the coverage. The policy or its provisions may vary or be unavailable in some states.

There may be a preexisting condition limitation for hospital sickness benets. MetLife’s Hospital Indemnity Insurance may be subject to benet reductions that begin

at age 65. Like most group accident and health insurance policies, policies oered by MetLife may contain certain exclusions, limitations and terms for keeping them

in force. For complete details of coverage and availability, please refer to the group policy form GPNP12-AX, GPNP13-HI, GPNP16-HI or GPNP12-AX-PASG, or contact

MetLife. Benets are underwritten by Metropolitan Life Insurance Company, New York, New York. In certain states, availability of MetLife’s Group Hospital Indemnity

Insurance is pending regulatory approval. Hospital Connement requires the assignment to a bed as a resident inpatient in a Hospital (including an Intensive Care

Unit of a Hospital) on the advice of a Physician or connement in an observation area within a Hospital for a period of no less than 20 continuous hours on the advice

of a Physician. Please consult your certicate for details.

Why Is It So Important?

Hospital

1

stays can be pricey and are often unex-

pected. Since most healthcare plans don’t cover

all expenses, taking steps to help protect yourself

can make a big dierence. Studies show that the

average cost of a three-day hospital stay in the U.S.

is $30,000.

2

This is why having hospital indemnity

insurance makes good nancial sense.

While in the hospital, it’s likely you’ll need various

treatments, tests and therapies to get up and about

again. These services can result in out-of-pocket

costs beyond what your medical plan may cover —

in addition to deductibles, copays and expenses as

well as possible additional costs for out-of-network

care.

How It Works

Hospital indemnity insurance is coverage that can

help safeguard your nances by providing you with

a lump-sum payment — one payment all at once

— when you or your loved ones need it most. The

extra cash can help you focus on getting back on

track without worrying about nding the money to

cover the costs of treatment. A at amount is usually

paid for a hospital admission and a per-day amount

for each day of your hospital stay.

And best of all, the payment is made directly to you,

and is in addition to any other insurance you may

have. It’s yours to spend however you like, including

for everyday living expenses.

If you or a loved one is admitted to the

hospital, this insurance helps cover the

costs of care.

This plan provides benets for hospitalization due to

accidents and sicknesses,

3

like:

•

Admission

4

to a

hospital

•

Hospital stays

• A d m i s s i o n t o a n

intensive care unit

•

Intensive care unit

stays

•

Inpatient rehab unit

stays

Visit www.PzerAdvantage.com today to learn

more or to enroll under your group discount. For

additional information, call 1 800 GET-MET 8 (1-800-

438-6388) and identify yourself as a Pzer colleague.

(Program subject to annual enrollment terms.)

Hospital Indemnity Insurance from MetLife

®

Information provided by MetLife

New

for

2022

8

www.PfizerAdvantage.com

Auto and Home Insurance

from Farmers GroupSelect

SM

Advertisement produced on behalf of the following specic insurers and seeking to obtain business for insurance underwritten by Farmers Property and Casualty

Insurance Company (a MN licensee) and certain of its aliates: Economy Fire & Casualty Company, Economy Premier Assurance Company, Economy Preferred

Insurance Company, Farmers Casualty Insurance Company (a MN licensee), Farmers Direct Property and Casualty Insurance Company, Farmers Group Property

and Casualty Insurance Company, or Farmers Lloyds Insurance Company of Texas, all with administrative home oces in Warwick, RI. Company names approved

in domiciliary states; approval pending non-domiciliary states. Coverage, rates, discounts, and policy features vary by state and product and are available in most

states to those who qualify. 3722194.1v2 © 2021 Farmers Insurance.

Farmers GroupSelect Provides Auto

and Home* Insurance Coverage for

Your Personal Insurance Needs

Policies available include: auto, home, landlord’s

rental dwelling, condo, mobile home, renters, recre-

ational vehicle, boat, and personal excess liability.

Benets

Farmers GroupSelect oers special benets and

money-saving discounts including:

•

Customized insurance that meets your needs

• Special group discounts

• Automated payment savings

• Good driver rewards

• Multi-policy discounts

• Multi-vehicle discounts

• 24/7 customer service

• and more!

Convenient Payment Options

You can choose to have your premiums automatically

deducted from your paychecks or bank account.

Information provided by Farmers GroupSelect

With these options, insurance premiums are

spread throughout the policy term with no down

payments**, interest charges, or service fees. Other

payment options are available.

Free Premium Quotes and

Application Processing

Since everyone’s insurance policies renew at dier-

ent times during the year, you may apply for group

auto and home insurance at any time.

Visit www.PzerAdvantage.com today to learn

more, or to try the Auto Insurance Quote

Comparison Tool. For quotes on auto, home, and

renters insurance with multi-policy discounts, call

1-800-438-6381, and identify yourself as a Pzer

colleague.

*Home Insurance is not part of Farmers GroupSelect’s benet oering in MA

& FL.

**Required in limited instances.

9

www.PfizerAdvantage.com

Auto and Home Insurance from Liberty Mutual

Savings validated by countrywide survey of participating new customers from

3/1/2018 to 3/1/2019 who switched to Liberty Mutual. Savings may vary. Com-

parison does not apply in MA. Coverage provided and underwritten by Liberty

Mutual Insurance Company or its subsidiaries or aliates, 175 Berkeley Street,

Boston, MA 02116 USA. In Texas, coverage provided and underwritten by one

or more of the following companies: Liberty Insurance Corporation, Liberty

Lloyds of Texas Insurance Company, Liberty Mutual Fire Insurance Company,

and Liberty County Mutual Insurance Company.

The materials herein are for informational purposes only. All statements made

are subject to provisions, exclusions, conditions, and limitations of the applica-

ble insurance policy. Coverages and features not available in all states. Eligibility

is subject to meeting applicable underwriting criteria. Learn more about our

privacy policy at libertymutual.com/privacy.

We’ll Help You Worry Less, Whether

You’re on the Road or Relaxing

at Home

With Liberty Mutual Insurance, you’ll receive

customized coverage, unique features, benets,

and discounts that will help you worry less and

save more.

Pzer colleagues could save $586 on auto insur-

ance by customizing their coverage with Liberty

Mutual Insurance.

Auto Protection You Can

Depend On

Liberty Mutual’s coverage provides a range of

options—from collision to liability—and features

such as Accident Forgiveness and Better Car

Replacement.™ If your car breaks down, we won’t

leave you stranded. From a jump-start to a tow,

our optional 24-Hour Roadside Assistance will get

you moving again.

Home Protection That Helps You Sleep

Better at Night

Liberty Mutual’s home coverage provides protection

for your home, your possessions, and your liability.

And you can benet from features such as Loss

Forgiveness, Computer and Smart Phone coverage,

and Multi-Policy discount. And should your property

be damaged or stolen, Liberty Mutual will be there

with our Guaranteed Repair Network and Personal

Property Replacement Cost Coverage.

Discounts That Keep Pace With

Your Life

Wherever you are in life, Liberty Mutual will make sure

you’re fully protected and aware of all the additional

money-saving discounts you’re eligible for.

Sales and Service Your Way

You can purchase your policy through one of our

local licensed Liberty Mutual Sales Representatives,

online, or through our licensed call centers. And

we oer multiple payment options such as payroll

deduction, direct billing, online payment, and auto-

matic deductions from your bank account. Payroll

Deduction is convenient, supports the environment,

and saves you money with no installment billing fees

and a discount on your insurance.

Additional Coverages Make Sure You’re

Fully Protected

Liberty Mutual also oers motorcycle, condo,

renters, watercraft, personal liability (umbrella) and

identity fraud expense coverage.

Visit www.PzerAdvantage.com today to

learn more or to try the Auto Insurance Quote

Comparison Tool. For quotes on auto, home and

renters insurance with multi-policy discounts,

call 1-855-645-2150 and identify yourself as a

Pzer colleague.

Information provided by Liberty Mutual

10

www.PfizerAdvantage.com

Travelers Auto and Home

Insurance Program

You could get the coverage that ts your needs for

your auto, home and personal possessions with a

savings advantage from Travelers. With over 160

years of experience and highly rated in the industry,

you can trust Travelers for peace-of-mind protection.

Benets-At-A-Glance

• Special program savings

• Money-saving discounts

• Additional coverage options

• Convenient payment methods and plans,

including payroll deduction

• Apply year round

• 24/7 claim reporting

• Portable policies

Licensed insurance representatives at Travelers

can help you nd the coverage you need and can

help you determine your savings. You can request

a quote or switch at any time, even if your current

policy isn’t expiring soon.

Insurance is underwritten by The Travelers Indemnity Company or one of its

property and casualty aliates, One Tower Square, Hartford, CT 06183. In

CA: Insurance is underwritten by Travelers Commercial Insurance Company,

One Tower Square, Hartford, CT 06183, Certicate of Authority # 6519, or

Travelers Property Casualty Insurance Company, One Tower Square, Hartford,

CT 06183, Certicate of Authority # 6521, State of Domicile: Connecticut. In

FL: Homeowners insurance is not currently oered for new business. In TX:

Auto insurance is oered by Travelers Texas MGA, Inc. and underwritten by

Consumers County Mutual Insurance Company (CCM). CCM is not a Travelers

company. Coverages, discounts, special program rates or savings, billing

options, and other features are subject to availability and individual eligi-

bility. Not all features available in all areas. © 2020 The Travelers Indemnity

Company. All rights reserved. Travelers and the Travelers Umbrella logo are

registered trademarks of The Travelers Indemnity Company in the U.S. and

other countries.

Visit www.PzerAdvantage.com today to

learn more or to try the Auto Insurance Quote

Comparison Tool. For quotes on auto, home and

renters insurance with multi-policy discounts,

call 1-888-695-4640 and identify yourself as a

Pzer colleague.

Auto and Home Insurance from Travelers

Information provided by Travelers

11

www.PfizerAdvantage.com

Your Identity Belongs to You,

Protect It Today

With Allstate Identity Protection’s comprehensive

identity protection plan Pro Plus,

®

you can enjoy

peace of mind, nancial reassurance and time-

saving expertise.

Identity and Credit Monitoring

Enjoy peace of mind with proactive monitoring for

the most damaging types of fraud.* Uncover and

resolve issues early to help minimize damages. Your

credit is monitored through TransUnion, Equifax

and Experian.

Credit Scores and Reports

Stay informed and protect your nancial assets by

detecting credit misuse quickly. You will have access

to unlimited TransUnion credit reports and scores,

and an annual tri-bureau credit report and score.

Social Media Reputation Monitoring

Actionable alerts help defend you and your family

from reputational damage or cyberbullying. We

monitor Facebook, LinkedIn, Twitter, and

Instagram proles.

Wallet Protection and Dark Web Monitoring

Minimize stress and potential damages. Allstate

Identity Protection can easily replace the contents of

a lost or stolen wallet through an online, secure vault

that conveniently stores important documents. Any

items entered here will also be monitored on the dark

web for misuse or exposure.

Financial Activity Monitoring

Receive alerts from sources such as bank accounts,

thresholds, credit and debit cards, 401(k)s, and other

investment accounts.

Allstate Digital Footprint

A digital footprint is a collection of all the accounts

a person has opened, and information they’ve

left behind that might expose them. The Digital

Footprint oers a simple way for people to see and

secure their information.

Privacy Advocate

®

Remediation

Should you become a victim, you will have a dedi-

cated specialist who will work to resolve the fraud

and restore your good name.

$1,000,000 Identity Theft Insurance Policy

If you are a victim of fraud, we will reimburse your out

of pocket costs to reinforce your nancial security.

†

Solicitation Reduction

Reduce unwanted calls, mail and preapproved

credit oers and receive guidance on how to limit

exposure to fraud.

Aordable plans for you and your family!

‡

Visit www.PzerAdvantage.com today to learn

more or to enroll under your group discount. For

additional information, call 1-800-789-2720 and

identify yourself as a Pzer colleague.

Information provided by Allstate Identity Protection

Identity Protection from Allstate Identity Protection

*Network provides comprehensive coverage, although no solution can detect all suspicious activity. Nonetheless, our Privacy Advocates will work tirelessly to restore

your identity regardless of when or how the damage was done.

†

Identity theft insurance underwritten by insurance company subsidiaries or aliates of AIG. The

description herein is a summary and intended for informational purposes only and does not include all terms, conditions and exclusions of the policies describe.

Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions.

‡

Family coverage is available for

individuals that are supported by you nancially or live under your roof. ©2020 Allstate Identity Protection, Inc. All rights reserved.

According to the 2020 Javelin Identity Theft

Study, in 2019 total identity fraud reached $16.9

billion (USD) a 15% increase from 2018.

Did You Know?

12

www.PfizerAdvantage.com

Legal Services from MetLife Legal Plans

fee schedule.¹ Best of all, you have unlimited access to

our attorneys for all the legal matters covered under

your plan — with no copays, deductibles or claim

forms — giving you peace of mind knowing you’ll have

an expert on your side for as long as you need them.

Visit www.PzerAdvantage.com today to learn

more or to enroll under your group discount.

For additional information, call 1-800-821-6400,

Monday through Friday, 8:00 a.m. to 8:00 p.m. EST

and identify yourself as a Pzer colleague. (Program

subject to annual enrollment terms.)

Live Worry Free With Access

to Expert Legal Help

Quality legal assistance can be pricey. And it can

be hard to know where to turn to nd an attorney

you can trust. But, for one low monthly cost, you

can have a team of experienced attorneys ready to

help you take care of life’s planned and unplanned

legal events.

With MetLife Legal Plans, you get these experts to

assist you on a broad range of personal legal issues

you might face throughout your life, like when you’re

getting married, buying or selling a home, starting a

family, or caring for aging parents. See more exam-

ples in the chart below.

Getting Help Is Easy. Online,

by Phone, or in Person

With MetLife Legal Plans, service is tailored to your

needs. You can choose an attorney near you from

our network of over 18,000 attorneys and work with

them by phone, email or in-person. And for certain

legal matters, your attorney can represent you in

court without you having to make an appearance.

You can also use an out-of-network attorney and get

reimbursed for covered services according to a set

Information provided by MetLife Legal Plans

Getting married

• Prenuptial agreement

• Name change

• Updating or creating estate planning documents

Buying, renting, or selling a home

• Previewing contracts and purchase agreements

• Preparing deeds

• Attending the closing

Starting a family

• Creating wills and estate planning documents

• School and administrative hearings

• Adoption

Sending students o to college

• Security deposit assistance

• Reviewing leases

• Student loan debt assistance

Caring for aging parents

• Review of Medicare/Medicaid documents

• Nursing home agreement

• Reviewing estate planning documents

MetLife Legal Plans covers some of the most frequently

needed personal legal matters

1. You will be responsible to pay the dierence, if any, between the plan’s payment and the out-of-network attorney’s charge for services. Group legal plans provided

by MetLife Legal Plans, Inc., Cleveland, Ohio. In certain states, group legal plans are provided through insurance coverage underwritten by Farmers Property and

Casualty Insurance Company Warwick, RI (Company name approved in domiciliary state; approval pending in non-domiciliary states. Business reinsured by MetLife

Legal Plans, Inc.). Some services not available in all states. No service, including consultations, will be provided for: 1) employment-related matters, including com-

pany or statutory benets; 2) matters involving the employer, MetLife and aliates and plan attorneys; 3) matters in which there is a conict of interest between the

employee and spouse or dependents in which case services are excluded for the spouse and dependents; 4) appeals and class actions; 5) farm and business mat-

ters, including rental issues when the participant is the landlord; 6) patent, trademark and copyright matters; 7) costs and nes; 8) frivolous or unethical matters; 9)

matters for which an attorney client relationship exists prior to the participant becoming eligible for plan benets. For all other personal legal matters, an advice and

consultation benet is provided. Additional representation is also included for certain matters. Please see your plan description for details. MetLife® is a registered

trademark of MetLife Services and Solutions, LLC, New York, NY.

13

www.PfizerAdvantage.com

Pet Health Insurance from Nationwide

®

Products underwritten by Veterinary Pet Insurance Company (CA), Columbus, OH; National Casualty Company (all other states), Columbus, OH. Agency of Record: DVM

Insurance Agency. All are subsidiaries of Nationwide Mutual Insurance Company. Subject to underwriting guidelines, review and approval. Products and discounts

not available to all persons in all states. Insurance terms, denitions and explanations are intended for informational purposes only and do not in any way replace or

modify the denitions and information contained in individual insurance contracts, policies or declaration pages, which are controlling. Nationwide, the Nationwide N

and Eagle, and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. ©2021 Nationwide.

Information provided by Nationwide

Nationwide brings you the best health insurance for

your pets. They understand you work hard to provide

your family with everything they need. So whether

your family includes kids with two feet or kids with

four paws, you know what responsibility looks like.

My Pet Protection

®

from Nationwide® helps you

provide your pets with the best care possible by

reimbursing you for eligible vet bills. You can get cash

back for accidents, illnesses, hereditary conditions

and more. We’re also the rst and only provider in the

U.S. to cover birds and exotic pets. Choose 50% or

70% reimbursement for the level of coverage that ts

your needs.*

You’re free to use any vet and your coverage includes

benets for emergency boarding, lost pet advertising

and more. Plus, our 24/7 vethelpline® is included as a

service to all pet insurance members ($110 value).

For over 30 years, Nationwide has been the nation’s

leading provider of pet health insurance. Don’t let

another vet bill come your way before you decide

to take action. Experience the protection and

peace of mind that pet insurance from Nationwide

can provide.

Visit www.PzerAdvantage.com

today to learn more

or to enroll under your group preferred pricing. For

additional information, call 1-877-738-7874 and

identify yourself as a Pzer colleague.

Pet insurance from Nationwide

®

can help you balance the cost of many annual

or one-time expenses, as well as help you cover the cost of unexpected treatments.

*Some exclusions may apply. Certain coverages may be excluded due

to pre-existing conditions. See policy documents for a complete list of

exclusions.

15

www.PfizerAdvantage.com

Nationally known companies are providing exclusive oers for Pzer colleagues looking to save on everyday

living expenses. Visit www.PzerAdvantage.com and click on each of the program providers to learn more

about their unique oers, as well as how to access the benets.

The only exclusive discount program available with Pzer payroll deduction is the Gympass tness program.

The Corporate Mortgage Benet Program from Wells Fargo Home Mortgage

oers special mortgage benets, including online educational tools and

resources.

Working with the Quicken Loans Mortgage Insiders program, you’ll receive special

benets including complimentary mortgage review to compare options, cash back

and a closing credit. See Quicken Loans website for details.

Equinox member benets include award-winning program design, state-

of-the-art equipment, world-class group tness classes and trainers, and

full-service spas.

Fitness

Wells Fargo Home Mortgage is a division of Wells Fargo Bank, N.A. ©

2017 Wells Fargo Bank, N.A. All rights reserved. NMLSR ID 399801

Exclusive Discount Programs

Featuring Child Care, Fitness, Banking & Mortgage Lending

Visit www.PzerAdvantage.com to learn more or call 1-888-926-2525.

With seven unique school brands, Learning Care Group oers nurturing care and

creative learning in a safe environment. Pzer colleagues receive 10% o child

care and free registration.

Child Care

With Gympass, Pzer colleagues can access a global network of more than 11,000

gyms and studios in the U.S. oering hundreds of activities, all through one

membership.

Colleagues with a Pzer payroll direct deposit into an existing or new personal

Bank of America

®

checking or savings account will get a special bundle of fee

waivers on that account. Additionally, colleagues may be eligible for certain

discounts on a new mortgage.

Banking & Mortgage Lending Program

The Premia mortgage experience features a customized nancial consultation

and an exclusive lender credit at closing. This oer can be extended to family, too.

v.9/2021

Pzer Benets Advantage

5404 Cypress Center Dr., Suite 130

Tampa, FL 33609

Have questions?

Call Pzer Benets Advantage anytime at 1-888-926-2525.

www.PfizerAdvantage.com

Supplemental Health Insurance Coverage • Auto & Home Insurance •

Banking & Mortgage Lending

Child Care •

Fitness •

Identity Protection •

Legal Services •

Pet Health Insurance