Ashfield

DISTRICT COUNCIL

Statement of Accounts

2020/21

STATEMENT OF ACOUNTS 2020

-

2021

1

CONTENTS

PAGE

NARRATIVE REPORT 3

THE STATEMENT OF RESPONSIBILITIES FOR THE STATEMENT OF ACCOUNTS 22

AUDIT CERTIFICATE AND OPINION 23

STATEMENT OF ACCOUNTING POLICIES 27

THE CORE FINANCIAL STATEMENTS

COMPREHENSIVE INCOME AND EXPENDITURE STATEMENT 41

MOVEMENT IN RESERVES STATEMENT 43

BALANCE SHEET 46

CASH FLOW STATEMENT 48

NOTES TO THE CORE FINANCIAL STATEMENTS

1. ACCOUNTING STANDARDS TO BE ADOPTED 49

2. CRITICAL JUDGEMENT IN APPLYING ACCOUNTING POLICIES 49

3. ASSUMPTIONS MADE ABOUT FUTURE AND SOURCES OF UNCERTAINTY 50

4. MATERIAL ITEMS OF INCOME AND EXPENSE 52

5. EVENTS AFTER THE BALANCE SHEET DATE 52

6. EXPENDITURE AND FUNDING ANALYSIS 52

7. EXPENDITURE AND INCOME ANALYSED BY NATURE 57

8.

ADJUSTMENTS BETWEEN ACCOUNTING BASIS AND FUNDING BASIS UNDER STATUTE 58

9. GRANT INCOME 63

10. INTEREST PAYABLE AND OTHER CHARGES 65

11. TANGIBLE NON

-

CURRENT ASSETS 66

12. HERITAGE ASSETS 69

13. TANGIBLE NON

-

CURRENT ASSETS VALUATIONS 70

14. INVESTMENT PROPERTIES 71

15. INTANGIBLE NON

-

CURRENT ASSETS 73

STATEMENT OF ACOUNTS 2020

-

2021

2

CONTENTS CONTINUED

16. GAINS AND LOSSES FROM THE SALE OF ASSETS 73

17. FINANCIAL INSTRUMENTS 73

18. INVENTORIES 75

19. DEBTORS 75

20. CASH AND CASH EQUIVALENTS 76

21. ASSETS HELD FOR SALE 76

22. CREDITORS 77

23. PROVISIONS 78

24. USABLE RESERVES 80

25. UNUSABLE RESERVES 83

26. CASH FLOW STATEMENT NOTES 88

27. MEMBERS ALLOWANCES 89

28. OFFICERS’ REMUNERATION AND EXIT PACKAGES 90

29. EXTERNAL AUDIT COSTS 94

30. RELATED PARTY TRANSACTIONS 94

31. CAPITAL FINANCING REQUIREMENT 96

32. ASSETS HELD AS LESSEE 96

33. ASSETS HELD AS LESSOR 97

34. REVALUATION LOSS 97

35. RETIREMENT BENEFITS 97

36. CONTINGENT ASSETS AND LIABILITIES 103

37. DEFERRED CREDITS 105

38. JOINT CREMATORIUM COMMITTEE 105

39.

NATURE AND EXTENT OF RISKS ARISING FROM FINANCIAL INSTRUMENTS

106

40. TRUST FUNDS 108

SUPPLEMENTARY FINANCIAL STATEMENTS

HOUSING REVENUE ACCOUNT 109

COLLECTION FUND 115

ANNUAL GOVERNANCE STATEMENT 120

GLOSSARY OF TERMS AND ABBREVIATIONS 160

STATEMENT OF ACOUNTS 2020

-

2021

3

NARRATIVE REPORT

1. BACKGROUND TO

THE NARRATIVE REPORT

The Accounts and Audit (England) Regulations 2015 introduced a requirement for

Local Authorities to publish an annual narrative report to accompany its Statement

of Accounts. The purpose of the narrative report, which replaced the explanatory

forward in the Statement of Accounts, is to comment on the Council’s financial

performance and economy, efficiency and effectiveness in its use of resources over

the financial year. The Narrative Report summarises what Ashfield District Council

spent in 2020/21, how it was spent and what has been achieved in line with the

Corporate Priorities. It provides a narrative context to the accounts by presenting

a clear and simple summary for residents, of Ashfield’s financial position and

performance for the year and its prospects for future years.

STATEMENT OF ACOUNTS 2020

-

2021

4

Despite the Covid-19 pandemic, 2020/21 has proved

to be a very successful year for Ashfield both in

terms of maintaining high quality service delivery

and continued effective financial management.

A robust 2020/21 budget set for the year

supplemented by effective, responsible financial

control by accountable officers and close scrutiny by

elected Members has again enabled the Council to

deliver within budget.

This year I am particularly delighted with the

progression of our capital programme and

specifically the commencement of building our new

Leisure Centre in Kirkby supported by £3m funding

from our partners; Sport England and the Local

Enterprise Partnership (LEP); our future planned

investment in our Leisure Centres at Hucknall and

Lammas and the vast improvements we have been

able to make to our parks and open spaces during

the last year. This has been of immense importance

to assist with the health and well-being of our

residents during the pandemic when access to so

many facilities has been significantly compromised

and for long periods of time.

The Council secured over £6.27m from the Future

High Streets Fund to invest in Sutton-in-Ashfield

and £62.6m Towns Fund for both Sutton and Kirkby.

This investment in our District will offer huge

opportunities to our local residents and businesses

going forward.

In 2020/21 the Council secured over £1m in Green

Homes Grant funding to support investment in both

council and private housing across the District. We

have also submitted a funding bid for more of this

funding which, if successful, will see this investment

double to over £2m. This funding will both improve

energy efficiency ratings and reduce energy costs

for low income households and help reduce the

District’s carbon footprint – something this Council

is very passionate about addressing.

Ashfield is an ambitious and aspirational Council,

but also one that delivers. We put our residents at

the heart of everything we do.

We know Ashfield, like all Councils faces future

financial challenges but with our passion and desire

we are confident that we will continue to invest

in our District and through this deliver increased

chances of an improved quality of life for our

residents.

Cllr Jason Zadrozny

Leader of Ashfield District Council

2. COUNCIL LEADER’S

PREFACE

Cllr Jason Zadrozny

Leader of Ashfield District Council

STATEMENT OF ACOUNTS 2020

-

2021

5

As the Council’s Chief Finance Officer I am pleased

to present Ashfield District Council’s Statement

of Accounts for the year ending 31st March 2021.

The Statement aims to provide information to all

stakeholders (residents, local businesses, Councillors,

partners, members of the public) so that they can:

• Understand the overall financial position of

the Council and the Outturn for 2020/21

• Have confidence that the Council has used and

accounted for public money in an appropriate

manner

• Be assured that the financial position of the

Council is sound and secure

This Statement of Accounts has been prepared and

published in accordance with the Code of Practice

on Local Authority Accounting 2020/21 issued

by the Chartered Institute of Public Finance and

Accountancy (CIPFA) and the Accounts and Audit

(Amendment) Regulations 2021.

The Statement of Accounts should be read in the

context of continuing demand and cost pressures on

the services provided by the Council, and the level

of resources available to fund them. This includes

the additional financial challenges and government

funding made available as a consequence of the

Covid-19 pandemic. There remains significant

uncertainty about the level of future Government

funding pending the outcome, timing and impact of

the delayed Spending Review, Fair Funding Review,

the future level of Business Rates retention and the

Business Rates re-set, the future of New Homes

Bonus funding and the national response to financial

recovery from the pandemic. As a consequence of

the pandemic the Government agreed a one year

financial settlement for 2021/22 and has indicated

a full Spending Round from 2022/23. Whilst the

short term funding decisions are understandable

given these circumstances this does severely hamper

effective longer term financial planning.

The pressures on Council services will continue to

rise and the future financial position of the Council

will be dependent on its ability to manage demand

with reducing resources. The Council is progressing

implementation of its Digital Services Transformation

Strategy at a pace, which along with the review of

current services and service level provision, and the

identification of opportunities for additional income

generation, will be critical to the Council’s ongoing

financial sustainability. Ashfield is not unique in this

regard – all Councils face this funding uncertainty.

We know that further challenges lie ahead and the

Council’s Cabinet working with senior management

are actively progressing options to address these

challenges. The 2020/21 accounts demonstrate

the Council’s success, despite the impact of the

pandemic, in continuing to deliver quality services

within budget and this will put the Council in a good

position in respect of addressing future financial

challenges.

Pete Hudson ACMA, CGMA

Corporate Finance Manager (S151 Officer)

3. INTRODUCTION TO

THE NARRATIVE STATEMENT

BY THE CORPORATE FINANCE MANAGER

(

SECTION 151 OFFICER

)

STATEMENT OF ACOUNTS 2020

-

2021

6

4. INTRODUCTION TO

THE DISTRICT OF ASHFIELD

Ashfield is situated within North Nottinghamshire and serves a population of approximately

127,900 residents (ONS 2019 mid-year estimates) covering an area of 42 square miles across

three towns (Kirkby-in-Ashfield, Sutton-in-Ashfield and Hucknall) and a number of rural

villages. The area boasts a mix of beautiful countryside, complemented by award winning

urban and country parks. Ashfield is one of seven District Councils in Nottinghamshire.

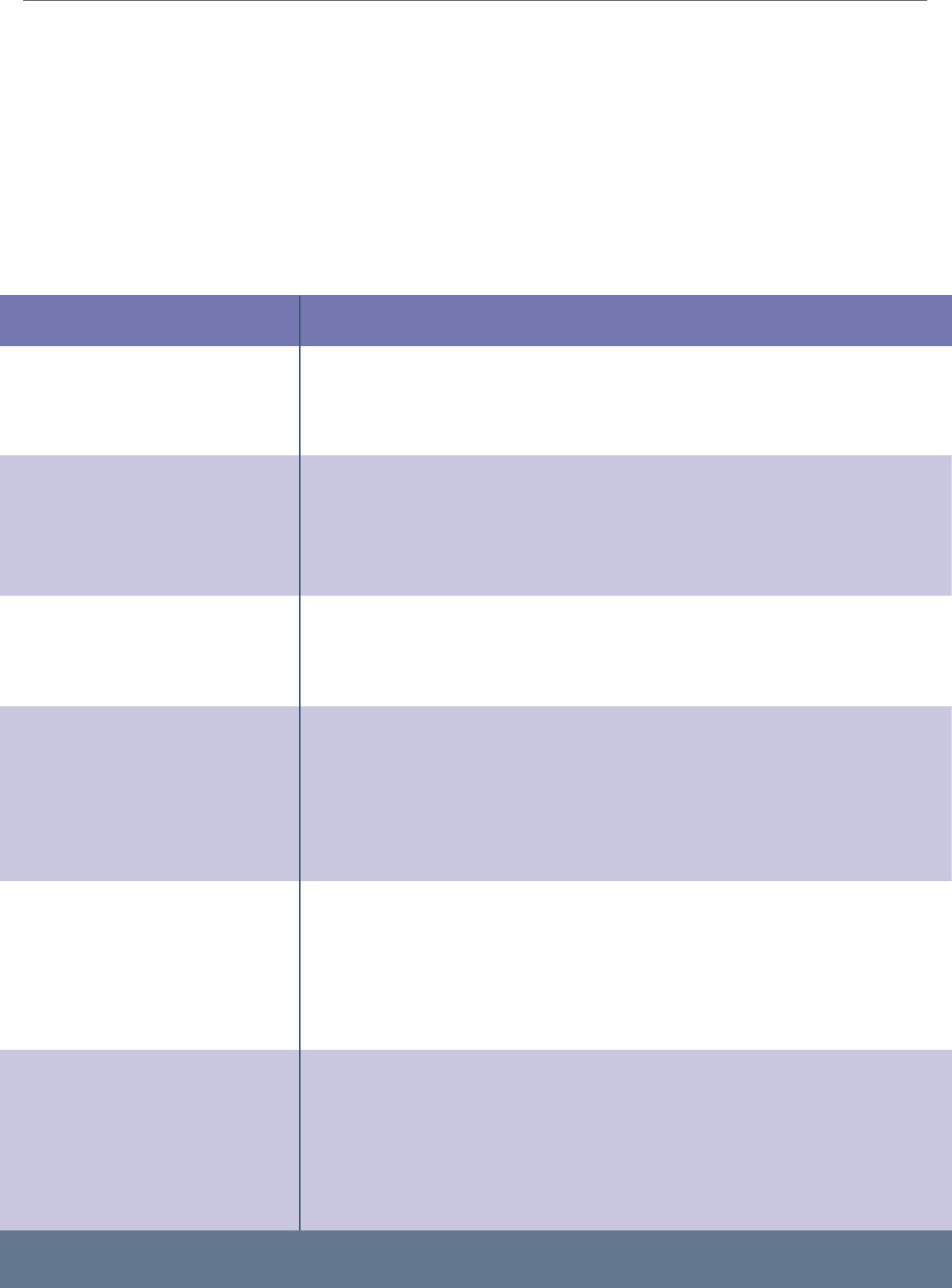

Ashfield has excellent transport

links through the M1 motorway,

bus, rail and tram links which

makes the area an ideal business

location. The District is also within

one hour’s drive of East Midlands

Airport and Doncaster Sheffield

Airport.

Ashfield has traditionally relied

on the manufacturing sector for

local employment but recognises

the need to move to a more

diverse local economy offering

‘high value added’ services as well

as manufacturing. In 2020 the

unemployment rate (16-64) was

4.0% which is lower than the East

Midlands average (4.8%) and the

national average (4.7%), however,

those in employment on average

earn less (£504 per week gross, an

increase of 0.6% on 2019) than the

average weekly pay in Great Britain

(£587, no change since 2019).

The Council is working with its

partners to address the skills gap

and promote the area as a place

to invest, particularly for Creative,

Business, Professional Financial

Services, Advanced Manufacturing

and Knowledge Based Industries;

and to connect local people to

local jobs.

Since October 2016 the Council

has managed its own housing

stock and remains committed to

providing good quality housing

and continues to invest in its

housing stock. In the last 3 years

the Council has also acquired 34

additional properties to grow

its stock and help meet the

social housing needs of Ashfield

residents. During 2020/21 £2.6m

was spent to maintain Council

houses to the Decent Homes

Standard. This is significantly less

than in 2019/20 (£4.3m) largely as

a consequence of the pandemic

delaying planned works. As at the

31st March 2021 the Council has

6,635 Council dwellings.

Although the rate of building

new homes in the District has

declined in the last 18 months, new

properties do continue to be built

and the Council Tax base continues

to grow. The majority of properties

within the District are categorised

at the lowest levels for Council Tax

billing purposes, Band A to Band

C. Band A: 46%, Band B: 22% and

Band C: 18%. Of the £68.834m of

Council Tax raised in 2020/21, the

Council received £6.418m to help

provide residents with the services

on which they rely.

5. GOVERNANCE & RISK

There have been no significant changes in governance arrangements during 2020/21. Details of the

Council’s governance arrangements, its identified potential risks and the planned mitigation of those risks is

set out in the Annual Governance Statement (AGS) which includes the ongoing impacts and response to the

COVID-19 pandemic together with an update regarding recovery to date. The impact of exiting the EU is to

be imminently removed as a key risk from the Corporate Risk Register.

The key corporate risks and planned mitigation are shown in the table below:

Corporate Risk

Future financial sustainability

Failure to adopt a Local Plan

Delivery of Digital Services

Transformation Programme

Monitoring of Investment in

Commercial Properties

Data Matching and National

Fraud Initiative

COVID-19 pandemic – risk

developed as part of recovery

work to cover communities,

business, Council finances and

ways of working.

Risk Mitigation

Robust balanced budget for 2020/21.

Ongoing work programme with Cabinet/CLT to identify savings and income

generating opportunities to address the estimated funding gap: Digital Services

Transformation agenda, service reviews, review of fees and charges, procurement

savings.

A Member Working Group has been meeting regularly. Consultants, where

appropriate have been engaged in order to develop the evidence base. Ongoing

support from Members to engage in a timely way in the process and their support

for the consultation process. Championing from the Chief Executive and Director.

A revised timeframe has been developed and reports are being prepared for a

future Cabinet relating to the Local Development Scheme and public consultation.

Team restructures including recruitment to key posts has taken place. Several

projects are now delivering at a pace with effective project management in place

to deliver future projects, savings and efficiencies. Means of funding the various

projects is in place. Member Champion identified and aligned with Scrutiny

Committee work plan.

Regular updates to CLT, Leadership and Audit Committee to monitor existing

Portfolio. No further acquisition to take place following outcome of Public Works

Loans Board (PWLB) consultation. Consultants remain engaged to provide

specialist knowledge regarding the investment market and also to assist with the

monitoring of the portfolio. Monitoring through Commercial Investment Working

Group (officer group). Member training has been provided. Risks effectively

managed through Covid pandemic to date. Loss of one tenant expediently

replaced by another.

A Data Matching Sub Group of the Anti-Fraud Officer Working Group had been

established to specifically focus on Data Matching. The Sub Group had an action

plan for embedding and improving the Council’s Data Matching processes

and this will be monitored by the main group. Annual reports to CLT and Audit

Committee also planned. Due to the COVID Pandemic and realigning of resources

to meet the demands of administering and awarding COVID Grants, the progress

of this work plan has not taken place although extensive use of NFI and Spotlight

has taken place to assist with assessing business grant eligibility.

Recovery work has commenced which will identify the risk to the Council and

the Communities further. Internal structures have been established to oversee

the local recovery work as well as play a part in the Local Resilience Forum (LRF)

recovery work. An initial Recovery Strategy was reported to Cabinet on 30 June

2020. The Covid Response and Recovery Scrutiny Panel was established to focus

on and monitor the Council’s response and recovery and has been meeting

frequently; the panel will continue to meet during 2021/22 with a revised focus on

recovery.

STATEMENT OF ACOUNTS 2020

-

2021 7

STATEMENT OF ACOUNTS 2020

-

2021

8

6. CORPORATE PLAN

The current Corporate Plan covers the period 2019 to 2023 and was originally

approved by Cabinet in September 2019 with a refresh of the Plan being approved

by Cabinet in July 2020.

OVERALL PERFORMANCE 2020/21

Corporate Plan progress is monitored through both the successful delivery

of key projects and initiatives, and performance achieved against the

corporate scorecard.

Overall, the corporate scorecard outturn for April 2020 to March 2021 and

despite the full year and continuing impact of the Covid-19 pandemic

indicates the following:-

of measures achieved or exceeded target, or were

within a 10% variance of target.

of measures indicated an improved position compared

to the previous year, or were within 5% of previous

year’s performance levels.

75%

67%

VISION

The purpose of the Council as set out in the

current Corporate Plan is to:

a. Serve the Communities and Residents

of Ashfield;

b. Provide good quality, value for money

services; and

c. To act strategically and plan for the

future, working with others to bring about

sustainable improvements in people’s lives.

PRIORITIES

The Council’s Priorities as set out in the current

Corporate Plan are:

a.

Health & Happiness;

b.

Homes & Housing;

c.

Economic Growth & Place;

d.

Cleaner & Greener;

e.

Safer & Stronger; and

f.

Innovate & Improve

Each Directorate has a number of service areas

and each has a Service Plan which supports

effective delivery of the Corporate Plan priorities.

STATEMENT OF ACOUNTS 2020

-

2021

9

7. OPERATIONAL

PERFORMANCE / ACHIEVEMENTS

2020/21

The Council has delivered significant achievements in 2020/21. Some of the key achievements set

out by Corporate Plan Priority are:

Health and Happiness

• Leisure:

• Commenced the build of the new Kirkby Leisure Centre following

the contract award to Kier, including securing £3m from Sport

England and the Local Enterprise Partnership (LEP) towards this

key investment.

• Successfully re-let the Leisure Operating Contract to Everyone

Active for a period of 10 years.

• Secured £280k through the National Leisure Recovery Fund to

support the successful transitional reopening of leisure facilities.

• Through the Ashfield Community Fund distribution of over £40,000 to

the Community and Voluntary sector in Ashfield, to help them support

residents negatively impacted by Covid. In addition, the Council

co-ordinated over £120k of Covid Winter Grants (food vouchers) to

vulnerable residents.

• Ashfield Health and Wellbeing Partnership has launched a new strategy

for 2021 – 2025, which is focussed on delivering outcomes to enable

residents to have the best start in life, make healthy choices, age well,

be physically active and live and work in environments that foster positive

mental wellbeing.

• The Council has worked tirelessly with Public health England to provide

safety advice to businesses in relation to Covid interpreting legislation,

providing advice and guidance.

Homes and Housing

• Throughout the year of the pandemic we successfully eliminated

homelessness by implementing the ‘everyone in’ homeless initiative.

• Ashfield has been the lead authority in securing £1m Rough Sleeper

Initiative to improve opportunities and support for rough sleepers and

those threatened with rough sleeping across the County.

• Work has commenced on 2 new affordable Council housing

STATEMENT OF ACOUNTS 2020

-

2021

1 0

developments. The new homes will be thermally efficient and will

minimise carbon usage.

• Successful bid for £1m funding to improve thermal efficiency ratings

of domestic properties, both Council owned and private sector.

• Statutory Gas Safety Checks – Despite the pandemic, achieved

a compliancy rate of 99.67% with only 22 properties could not provide

access due to issues such as self-isolating or shielding.

• For 2020/21, 99.37% of emergencies repairs were attended to in

Government timeframes (5,356 repairs out of 5,390).

Economic Growth and Place

• Kirkby and Sutton Towns Funding – the Town Investment Plan for Kirkby

and Sutton was submitted to MHCLG in February 2021 with a request for

over £62m and potential investment of £99m. An announcement on the

Town Deal offer is due in early June.

• The Future High Streets bid for Sutton was successful and over

£6.27m has been secured to deliver projects to revitalise the town centre.

• Town centre masterplans for Kirkby and Sutton were adopted and

underpinned the Towns Fund bids and Station Masterplans bids.

• Planning applications continue to be processed well above

nationally prescribed standard targets, with 95% of major applications

being processed within 13 weeks and 91% of minor applications within

8 weeks.

• An Economic Recovery Plan post Covid has been developed and is being

implemented.

• The Council was successful in achieving the Restoring Your Railways bid

Cleaner and Greener

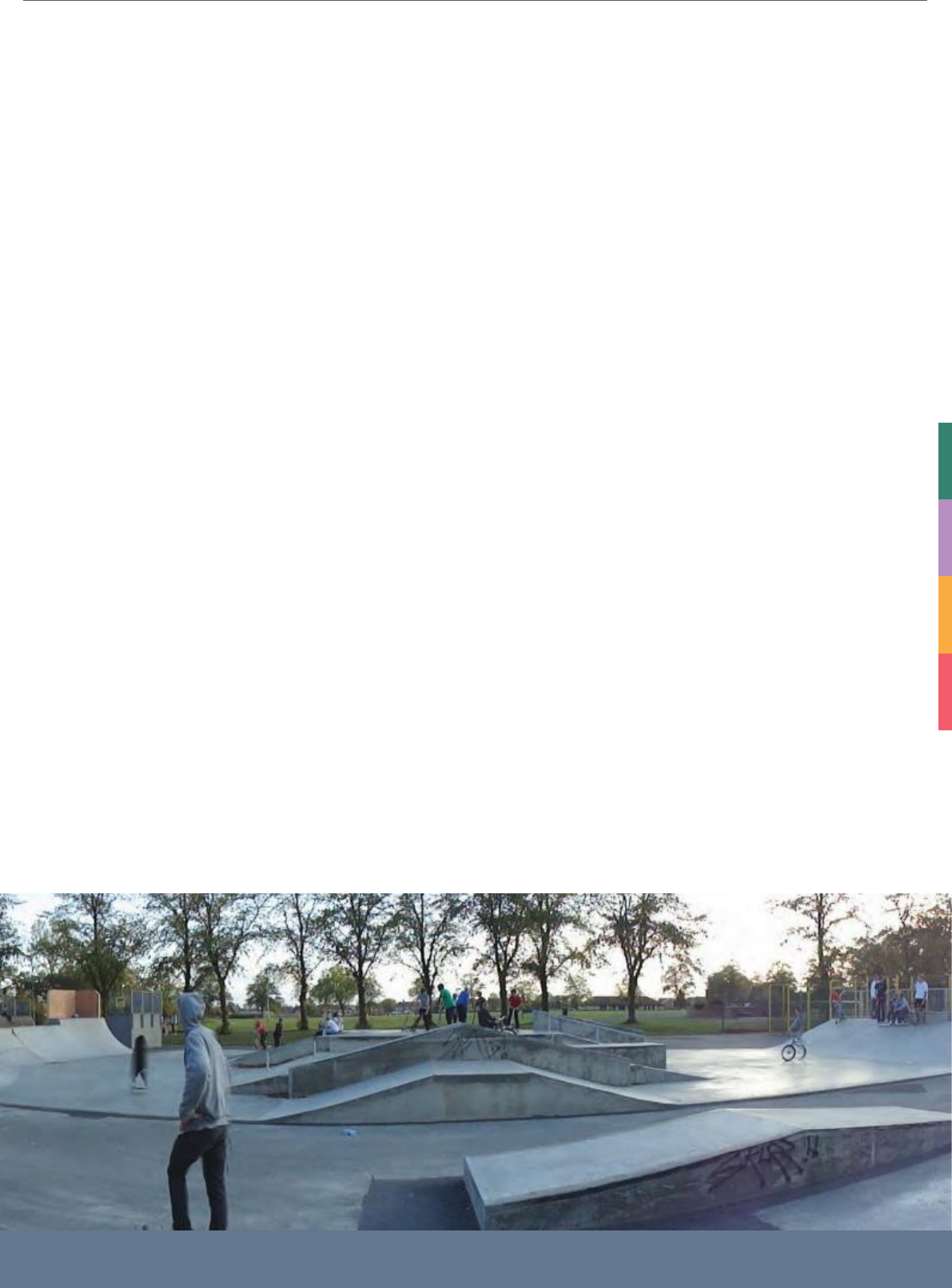

• A review of the standard of all of our parks, open spaces, play areas

and sports facilities has been completed. Investment of £1.8m in parks

and green spaces has continued with improvements completed at 19

sites. This has resulted in a significant increase in the numbers of people

using them – critical during the pandemic when alternative facilities have

been closed or access significantly restricted.

• The Council has developed a set of carbon emissions baseline

for its activities, which can be used to track progress in the reduction of

such emissions in future and is working with Nottingham City Council to

develop a carbon reduction strategy and action plan.

STATEMENT OF ACOUNTS 2020

-

2021

1 1

Safer and Stronger

• The Council has responded to 2,574 reports of anti-social and nuisance

behaviour between April-September 2020, a 34% increase compared to

the previous year.

• CCTV is supporting the continued identification of ASB and crime and

disorder across the District with the use of cameras deployed in hotspot

locations to tackle both ASB and environmental crime.

• Domestic abuse remains a high priority, the Council has appointed a new

Domestic Abuse and Vulnerability Officer in October 2020. The officer

acts as the Council lead for MARAC (a multi-agency risk assessment

conference) and provides key support for survivors across the District.

Innovate and Improve

• Over 60,000 payments made online throughout the year, a significant

increase of 14% compared to last year and 25% higher over the last 2

years since we implemented our new ‘e-store’, exceeding channel shift

predictions.

• During 2020/21 over 7,300 business grant payments were processed to

Ashfield business, with a total value of around £30m.

• Online Benefit and Test & Trace applications implemented during the

year allowed the Council to process over 2,600 online benefits related

applications and receive and process almost 1,300 test and trace claims,

enabling £191,000 to be paid in test and trace grants.

• At the end of September, 2020, we launched a brand new, modern, user

friendly website, which was accredited by the Shaw Trust as fully meeting

accessibility standards. Over the last six months, since launch, website

usage statistics are indicating significant improvements, particularly

regarding the customer journey and easier access to information.

• Staff sickness absence out-turn has seen an 11% reduction compared to

the previous year.

• Procurement activities conducted by Nottingham City Procurement

on behalf of Ashfield have delivered savings of over £2.7m in spend

avoidance.

COVID 19 STATEMENT

Due to the Covid-19 pandemic the Council has put in place a number of measures throughout the year to

ensure that additional support and reporting mechanisms were in place (and continue to operate) to meet

both additional internal and external requirements. The Council’s response to the key issues presented by

the Pandemic are set out in the table below:

Area of Impact

Council’s Workforce

Service Delivery

Supply Chains & Third Parties

Issue / Response of the Council

From the outset of the pandemic the Council put in place a daily absence

monitoring system to identify emerging pressures on key services where

absence was being reported. This daily reporting has continued throughout

2020/21 and to date (June 2021). No staff have been furloughed and sickness

absence for the year 2020/21 is 11% lower than in 2019/20. Wherever possible

staff have been able to work from home and have been provided with the

relevant ICT to facilitate agile working.

The Council engaged and deployed additional agency staff as Covid Marshals

throughout the year to assist with providing advice and guidance to local

businesses and citizens on implementing covid secure measures and to also

enforce compliance where this has been necessary.

The Council has continued to deliver all of its key in-house services throughout

the year including an increase to its waste collection services to respond to the

additional demands presented by the pandemic, using additional agency staff

when necessary. At times during the year there were staff shortages within the

cemeteries team but these absences were covered through staff redeployment

and agency cover to ensure effective service continuity.

Most of the in-person appointments were replaced with on-line or telephone

service provision to maximise the protection of both the public and Council

staff. Where in-person appointments have been essential these have taken

place following strict Covid-safe guidance.

The Council’s staff have, on behalf of the Government, processed significant

volumes of business grants and business rates reliefs throughout the year to

ensure local businesses are supported. Where the Council has had discretion

over grant payments these are reflected in the Comprehensive Income

and Expenditure Statement (CIES) but where it has acted as Agent for the

Government (a conduit to pay businesses the grants to which they are entitled

as directed by Government) these are not reflected in the CIES.

Provision of leisure services by our partner ‘Everyone Active’ has followed

the strict Government guidelines throughout the year. During the limited

times when the Leisure Centres have been able to operate capacity has been

significantly restricted and this placed significant financial pressure on our

Leisure Partner. The Council has utilised some of its Covid-19 grant funding

to support the organisation and has also worked with them to successfully

secure further funding from the National Leisure Recovery Fund (NLRF – Sport

England) to aid its transitional recovery.

We complied with the Central Government Policy Note PPN 02/20 and 04/20

to support key suppliers to ensure business and service continuity. To comply

STATEMENT OF ACOUNTS 2020

-

2021 1 2

Area of Impact Issue / Response of the Council

Reserves / Financial

Performance / Cashflow

Reporting

Other Major Risks and

Recover Action

we identified key suppliers at risk and offered support. However, due to

changes in lockdown restrictions and other financial support they could access

themselves, no additional support was needed, we continued to pay suppliers

promptly.

Other than at the very start of the pandemic when there was a national

shortage, the Council has been able to access and provide relevant Personal

Protective Equipment (PPE) to its workforce.

The Council has delivered its service well within budget for the year both

for its General Fund and HRA Outturns. The unspent balance of our Covid

19 grant has been transferred to reserves and will be used to cushion any

further financial implications of the pandemic going forward.

The Council’s reserves have further increased in 2020/21 compared with

2019/20 which has further increased the Council’s financial resilience and

will assist with sustainability for the future – the Council remains a ‘going

concern’.

During the financial year the Council had no adverse impact on its

cashflow at any time, principally due to most grants being received from

Government in advance of the requirement to pay them to businesses.

The Council has been reporting on both the financial and performance

impacts of the pandemic throughout the year. This includes regular

reports to the Corporate Leadership Team (Standing Weekly Agenda item),

Cabinet, the Covid Scrutiny Panel (specifically established to monitor

pandemic impacts/recovery) and the Council.

The Council has also been submitting the various weekly, monthly,

quarterly and ad-hoc financial reports in respect of grant processing and

payment assurance to Government Departments.

Where appropriate Officer Decision Records (ODR’s) and Executive

Decision Records (EDR’s) have been prepared to record pandemic related

decisions.

The pandemic is not yet over and the furlough scheme is still currently in

place until the end of September 2021 at which time more will be known

about the impact on businesses and jobs. However, the Council’s recent

success in securing £62.6m Towns Fund funding and £6.27m Future High

Streets Fund funding along with other sources of match funding and the

significant ongoing investment in our leisure provision will bring new jobs

and businesses to the District and through the nature of these various

projects, will boost the visitor numbers to the local economy in the coming

years.

STATEMENT OF ACOUNTS 2020

-

2021 1 3

STATEMENT OF ACOUNTS 2020

-

2021

1 4

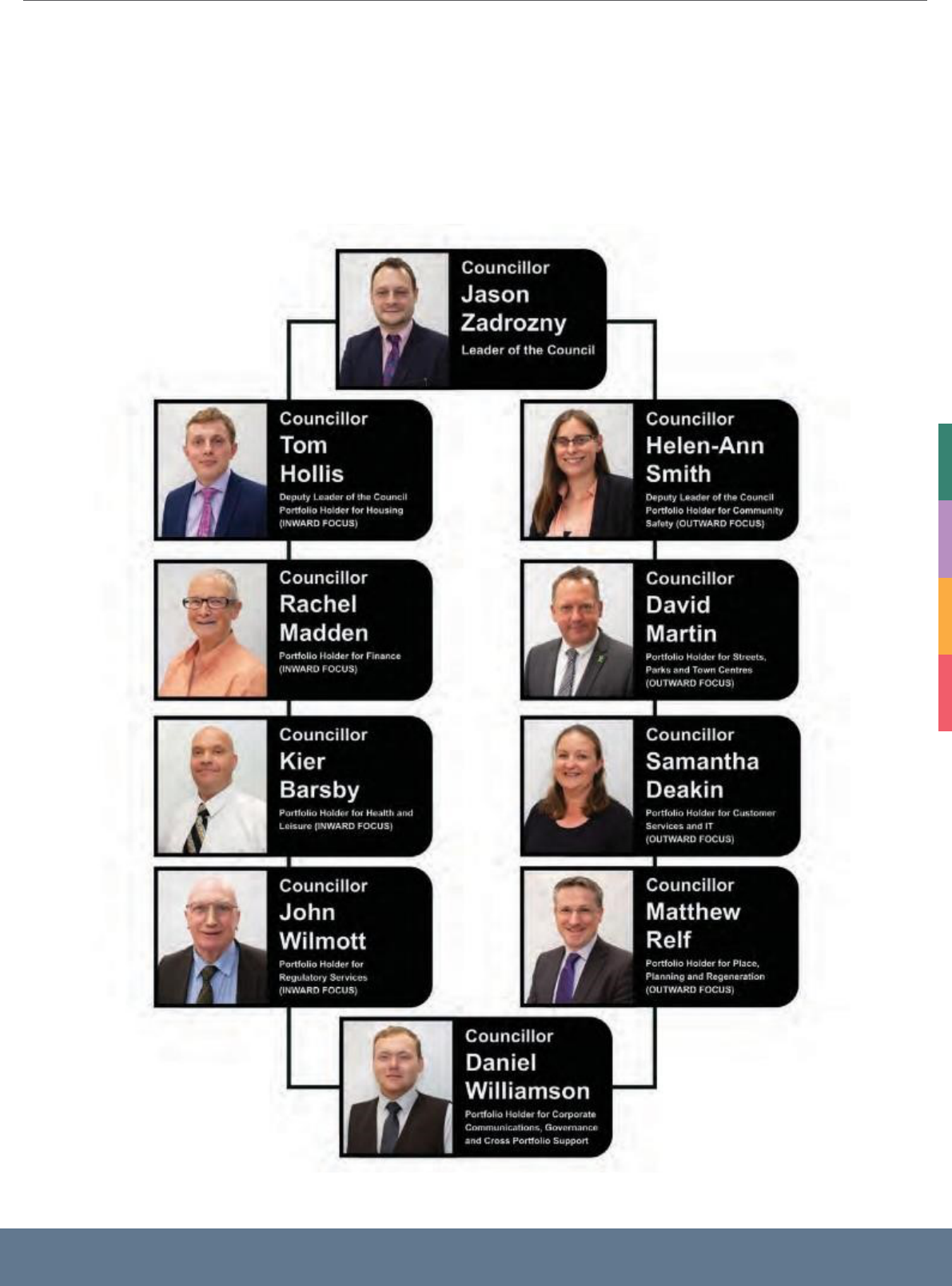

8. ORGANISATIONAL DELIVERY

The Council consists of 35 Councillors, controlled by the Ashfield Independents (28) with 3

Conservative, 2 non-aligned and 2 Labour Councillors. The Council’s Cabinet comprises of ten

Councillors:

STATEMENT OF ACOUNTS 2020

-

2021

1 5

Within Ashfield there are two parishes, Selston Parish Council and

Annesley & Felley Parish Council who provide additional services to

residents within their respective boundaries. The JUS-t Neighbourhood

Plan was made for a substantial part of the Parish of Selston following a

referendum in October 2017. Currently no neighbourhood plan has been

adopted by Annesley & Felley Parish Council.

The Teversal, Stanton Hill and Skegby Neighbourhood Forum brought

forward a Neighbourhood Plan for Teversal, Stanton Hill and Skegby,

which was also made in October 2017. The Forum was re-designated for

a further five years following a decision of the Cabinet on 27th January

2020.

MANAGEMENT STRUCTURE AND WORKFORCE

The Council’s management structure – the Corporate Leadership Team

(CLT) is documented in the Council’s Constitution and is comprised of

the Chief Executive, four Directors and the Corporate Finance Manager

(& Section 151 Officer). The CLT is responsible for implementing the

Council’s strategic goals as determined by elected Members, and for the

effective operational delivery and management of Council services.

As at 31st March 2021 the Council’s workforce comprised 592 employees

in post (540.19 full time equivalent posts) on the approved staffing

establishment.

KEY PARTNERING ARRANGEMENTS

Ashfield District Council has key working relationships with the following

organisations:

• Mansfield District Council and Newark & Sherwood District Council for

owning and operating the Mansfield Crematorium.

• Mansfield District Council for delivering shared services across both

authorities (Human Resources & Payroll and Legal Services).

• Ashfield District Council is the Lead Partner for the Rough Sleeper

Initiative funding/service.

• Mansfield District Council – Home Options Partnership

• Mansfield District Council and Newark & Sherwood District Council –

Private Sector Landlord Forum

• Broxtowe Borough Council sharing an Estates Manager, whilst Ashfield

provides Business Rates processing support to Broxtowe.

• J. Tomlinson Ltd, our delivery partner for completing capital

improvements to the Council’s housing stock.

• Nottingham City Homes for the Lifeline Service.

•

Sport & Leisure Management Ltd for operating the Council’s leisure centres.

• Nottingham City Council for provision of Procurement services.

• Central Midlands Audit Partnership (CMAP) for the provision of our

Internal Audit function.

• Erewash Borough Council for the provision of our Building Control

function.

STATEMENT OF ACOUNTS 2020

-

2021

1 6

9.

FINANCIAL PERFORMANCE

2020/21

GENERAL FUND REVENUE OUTTURN

The General Fund supports the day to day running of the Council’s services, excluding Council Housing provision.

Directorate

Revised

Budget £’000

Outturn

£’000

Variance

£’000

Chief Executive

540

536

(4)

Resources & Business Transformation

958

(1,730)

(2,688)

Legal & Governance

1,809

1,654

(155)

Place & Communities

10,338

8,392

(1,946)

Housing & Assets

2,277

2,129

(148)

Net Cost of Services

15,922

10,981

(4,941)

Key Variance Explanations:

Unallocated Covid funding (service related)

(1,198)

Unallocated Covid funding (support for individuals)

(1,146)

Unused budgeted transfers from earmarked reserves

(427)

New Burdens funding not utilised in 2020/21

(550)

Towns Fund and Future High Streets Capacity Funding to be used in 2022/23

(313)

Unbudgeted Investment Property Income

(250)

Housing Benefit Losses

250

Increased Planning income

(325)

Salaries and wages savings

(564)

Transport related savings

(269)

Unspent Homelessness Support and Syrian Vulnerable Persons Grant

(141)

Other net Costs/Savings

(8)

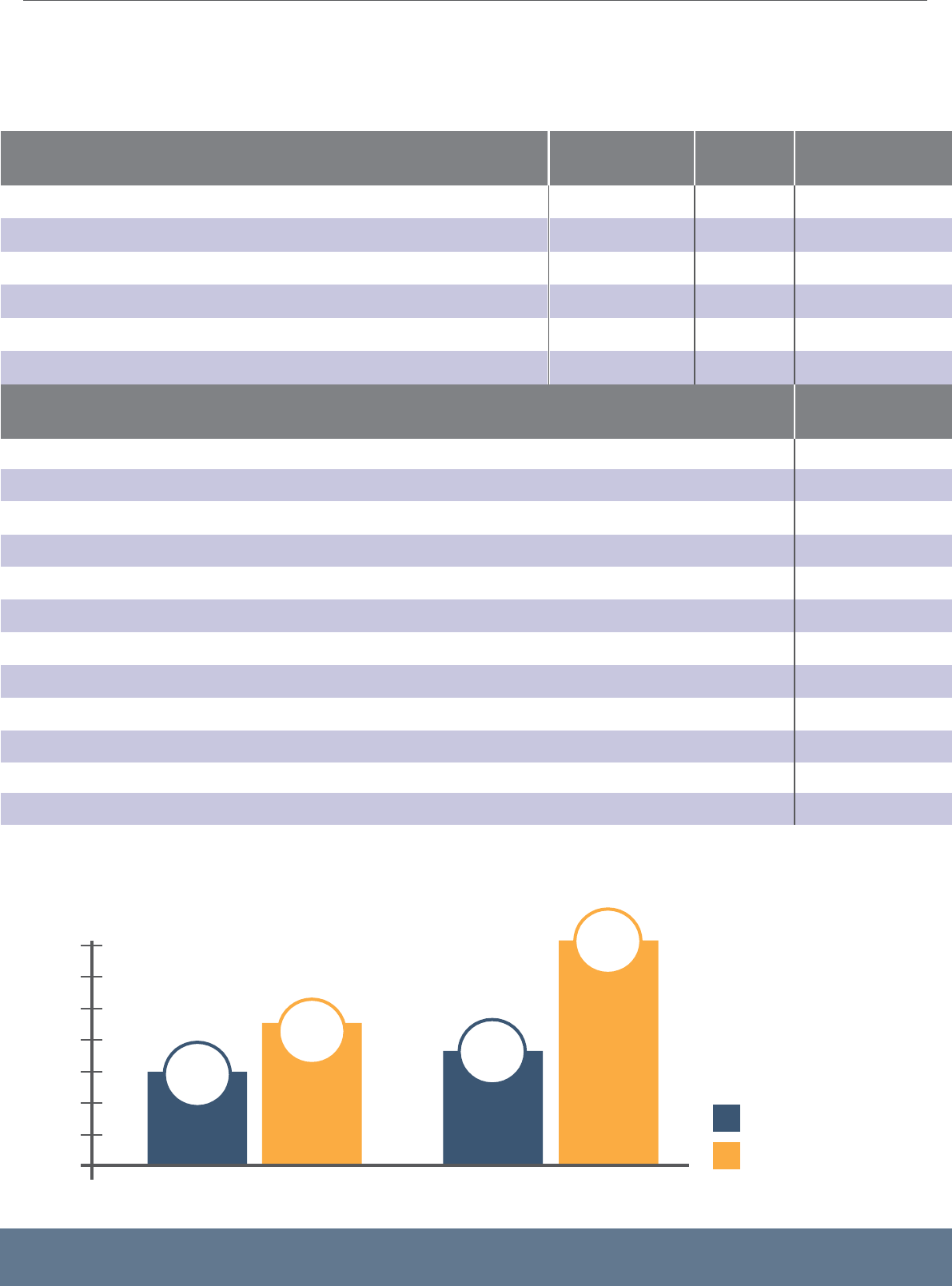

GENERAL FUND RESERVES

–

CHANGE 2019/20 TO 2020/21

GENERAL FUND RESERVES

(

£M

)

14

12

10

14,250

(4,941)

8

6 6,713

4

2

9,670

7,901

General Reserve

Earmarked

O

2019/20 2020/21

Reserves

STATEMENT OF ACOUNTS 2020

-

2021

1 7

HOUSING REVENUE ACCOUNT

(

HRA

)

The HRA is a ring-fenced landlord’s account for the management and maintenance of the Council’s housing

stock. This account funds both day to day revenue costs as well as funding borrowing costs for capital work

to maintain and improve council properties.

HRA OUTTURN 2020/2021

Compared to the 2020/21 revised budget the HRA achieved savings of £1.777m, these are shown in the

Table below:

£’000

Reduced income from closure of Community Centres and home

improvement/garden maintenance due to the Covid restrictions.

Reduced Interest rates in the banking sector reduced the average annual

interest rate on the HRA balances.

Reduced repairs and maintenance and staffing expenditure attributable to a

reduction in repairs due to the Covid restrictions.

Reduced contribution to bad debt provision

Reduced capital expenditure largely due to the delay in new vehicle delivery.

Other various minor variances (net)

50

141

(1,220)

(119)

(656)

27

(1,777)

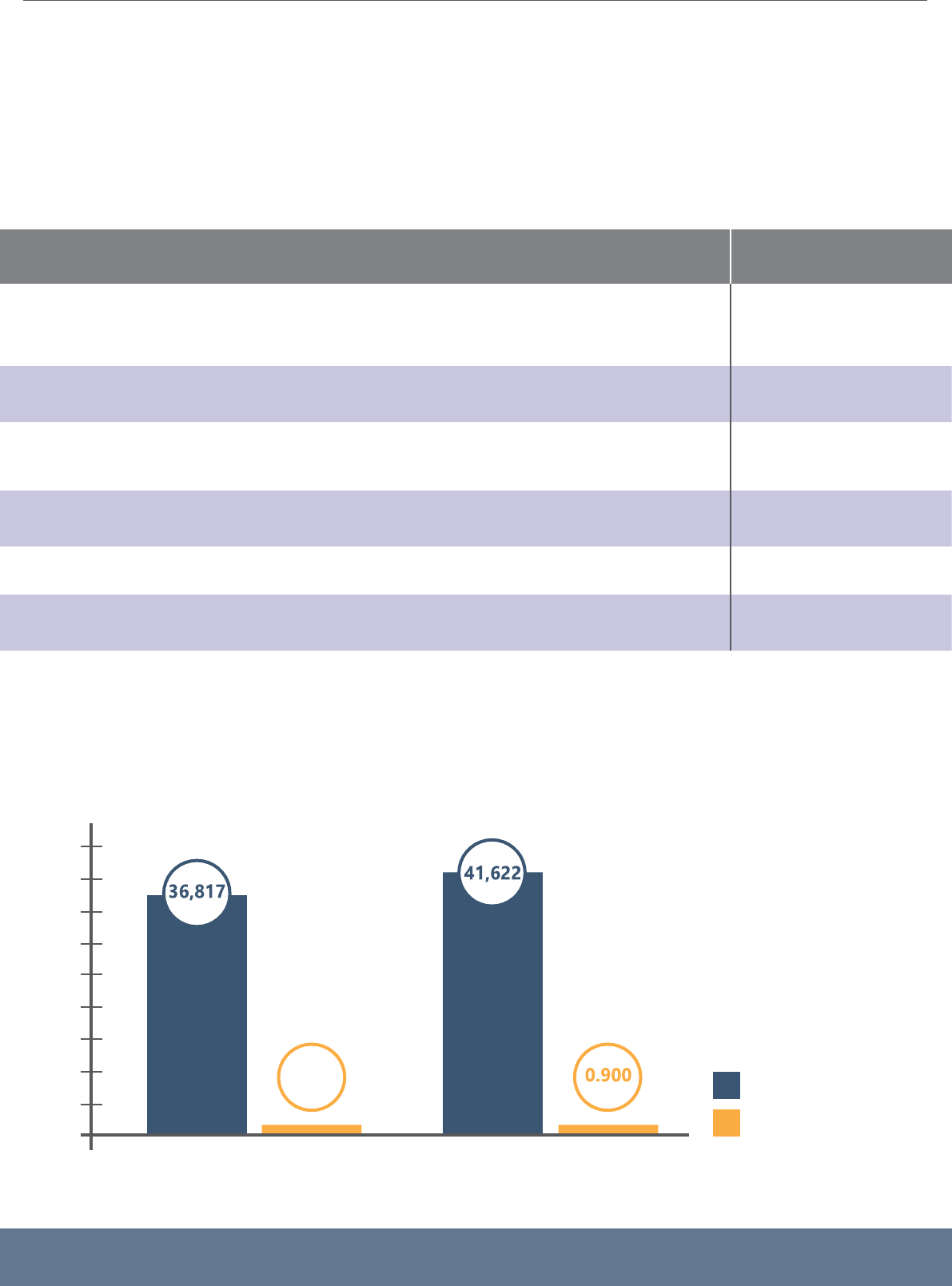

HRA RESERVES

–

CHANGE 2019/20 TO 2020/21

HRA RESERVES

(

£M

)

45

40

35

30

25

20

15

10

5

O

General Reserve

Earmarked

Reserves

Further information relating to the Housing Revenue Account can be found within the Supplementary

Financial Statements.

0.944

2019/20

2020/21

STATEMENT OF ACOUNTS 2020

-

2021

1 8

Capital Spending 2020/21

i

r

Capital monies are spent on

building or enhancing the

Council’s asset base. There are

rules and regulations regarding

what can be classed as capital

expenditure and this expenditure

must be financed separately from

the day to day running costs of

the Council. During 2020/21 the

Council spent £11.8m on capital

works. Key projects were:

NEW KIRKBY LEISURE CENTRE

Almost £1m was spent on the

new Leisure Centre at Kirkby, the

building of which commenced in

late 2020/21.

PARKS AND OPEN SPACES

Over £1m capital funding has

been spent on Parks and Open

Spaces infrastructure across the

whole District during 2020/21.

DISABLED FACILITIES GRANTS

The Council spent £691k to meet

the statutory duty to provide

Mandatory Disabled Facilities

Grants to qualifying applicants

under the Housing Grants

Construction and Regeneration

Act 1996. These grants provide

the funds for adaptations to

modify environments to restore

or enable independent living,

privacy, confidence and dignity

for individuals and their families

in non-Council dwellings.

INVESTMENT PROPERTY

ACQUISITION

£3.3m was spent on the

acquisition of an investment

property in April 2020. The

Council has since taken a decision

not to acquire any further

nvestment properties (unless for

egeneration purposes within the

District) following the outcome

of the consultation undertaken

in 2020 which would now restrict

access to Public Works Loan

Board funding as a borrowing

source should this acquisition

strategy continue.

HOUSING PROJECTS

£5.1m was spent in 2020/21

on improvements to Council

dwellings throughout the District

ensuring that the Decent Homes

Standard is maintained and on

the other projects including the

acquisition of houses to add to

the Council’s stock to help meet

the social housing demands of

our residents and undertaking

disabled adaptations to Council

properties.

Balance Sheet

PROPERTY, PLANT &

EQUIPMENT

(

PPE

)

The value of PPE increased by

£6.239m to £303.612m as at

31st March 2021. This increase is

due to increases in revaluations

(mainly to the leisure centres)

and new additions exceeding

depreciation, disposals and

impairment in the year.

Council dwellings are valued

utilising the East Midland

Adjustment Factor, as required

by Government. This Adjustment

Factor reduces the value of

social housing from the market

level to a level which reflects the

Government’s assessment of

valuation, taking account of ‘right

to buy’ and other factors.

INVESTMENT PROPERTIES &

ASSETS HELD FOR SALE

The overall value of Investment

Properties decreased in year by

£2.4m. This decrease was due to

valuation reductions of £5.8m

across the portfolio which were

partially offset by the £3.3m

purchase of one investment

property in April 2021. The Asset

Held for Sale value decreased

by £0.7m in the year; this was

largely due to the transfer out of

this category of the Brook Street,

Sutton in Ashfield.

LONG TERM PROVISIONS

The value of Long Term provisions

increased by £150k to £2.485m at

the end of March 2021. The main

provision within this is £2.154m in

respect of Business Rates appeals.

PENSION LIABILITY

The Council is a member of the

Nottinghamshire County Council

Pension Fund. The Pension

Liability increased by £31.193m

to £124.085m at 31st March

2021 largely due to changes

to the financial assumptions of

a lower discount rate and an

increased inflation rate in line

with economic information, as

advised by Barnett Waddingham,

the Council’s Pensions Actuary,

both of which increase the

pension liability. The increase in

liability due to the changes in the

financial assumptions is partly

offset by investment returns

by the Fund and the pension

payments made during 2020/21.

STATEMENT OF ACOUNTS 2020

-

2021

1 9

10. OUTLOOK

BUDGETS AND FUNDING

There is significant uncertainty

about the level of funding the

Council will receive beyond

2021/22 pending the outcome

and impact of the following:

• The impact of and recovery from

the Covid-19 pandemic;

• The next Spending Review;

• Fair Funding Review;

• Business Rates – future levels of

retention and clarification of what

will happen around the baseline

re-set; and

• Future of New Homes Bonus

funding and distribution

methodology

It is anticipated that a key

outcome of the above will be

a redistribution of resources

to address the national social

care pressure in both Adults’

and Children’s services and as

District Councils do not provide

these services, District Councils’

resources will reduce.

Ashfield District Council, like

most Councils, receives support

from Local Government Futures

(LG Futures) and has used their

resource forecasting model

and the Council’s own forecast

expenditure requirements to

estimate the anticipated funding

gap for the next four financial

years. Notwithstanding the

uncertainty brought about by

the aforementioned factors, the

estimated cumulative funding

gap from 2022/23 to 2025/26 is

£3m with the largest proportion

of this (£2.46m) front-loaded into

2022/23.

As set out in the Council’s

2021/22 Budget Setting Report

robust plans are in place to

identify options and implement

actions to address the future

estimated financial challenge. This

includes a line by line review of

all of the Council’s budgets and

Medium Term Financial Strategy

(MTFS) assumptions; a review

of fees and charges and income

generating opportunities; a review

of procurement and contracting

arrangements; a review of services

and future service delivery

options; and delivery of financial

efficiencies from the investment

in technology via the Council’s

Digital Transformation Strategy.

It also includes progressing at

a pace the development and

delivery of our Local Plan clearly

setting out our aspirations for the

District in terms of where we want

to see both business and homes

growth, and attract developers

to help deliver that vision. The

Corporate Leadership Team

and the Council’s Cabinet meet

frequently to progress this work.

The Council has a strong track

record of setting a balanced

and deliverable budget and this

robust approach will continue

with the future development of

the MTFS to ensure the Council’s

ongoing financial sustainability.

The Medium Term Financial

Strategy will be updated and

re-presented to Cabinet in

Autumn 2021 to reflect the

2020/21 Outturn and progress on

identifying savings to help close

the estimated funding gap.

CAPITAL INVESTMENT

Recent announcements made by

Government to invest £62.6m in

Kirkby and Sutton from the Towns

Fund and over £6.27m from

the Future High Streets Fund,

coupled with our own significant

investment plans for our leisure

provision which are currently

being delivered at a pace, will

bring about new opportunities for

the whole District. The investment

will deliver jobs and further

education opportunities, long-

term economic and productivity

growth, new homes, improved

transport infrastructure, reduced

carbon and new cultural and

visitor facilities.

STATEMENT OF ACOUNTS 2020

-

2021

20

11. EXPLANATION

OF THE FINANCIAL STATEMENTS

The Statement of Accounts is for the financial year 31st March 2021 and as required

by the Code, comprises of Core and Supplementary Statements, together with

Disclosure Notes. The style and format of the Accounts complies with the local

authority accounting standards.

The Core Financial Statements

COMPREHENSIVE INCOME AND EXPENDITURE

STATEMENT

(

CIES

)

This Statement records all of the Council’s income

and expenditure for the year. It includes both the

amounts spent on local taxpayer services and

also local rent payer services. The top half of the

statement provides analysis of spend by Directorate

on services that the Council is required to undertake

by law (statutory duties such as street cleansing,

planning and registration) and discretionary

services focussed on local priorities and need. The

bottom half of the statement deals with corporate

transactions and funding.

MOVEMENT IN RESERVES STATEMENT

(

MIRS

)

This statement summarises the movement in year

on the Council’s different reserves. These reserves

are analysed into ‘useable reserves’ (i.e. those that

can be used to fund expenditure or reduce local

taxation) and ‘unusable reserves’ which must be set

THE COLLECTION FUND

aside for specific purposes (as they relate to gains

and losses on statutory adjustment accounts).

BALANCE SHEET

The Balance Sheet is a ‘snapshot’ of the Council’s

financial position at the end of March 2021. It shows

the Council’s assets, liabilities, cash balances and

reserves at 31st March 2021.

CASH FLOW STATEMENT

The Cash Flow Statement shows the reasons for

changes in the Council’s cash balances during the

year, and whether the change is due to operating

activities (day to day costs), new investments, or

financing activities (such as repayment of borrowing

and other long term liabilities).

The Supplementary Financial Statements

HOUSING REVENUE ACCOUNT

(

HRA

)

This Account separately identifies expenditure

incurred in the provision, management and

maintenance of the Council’s housing stock and

demonstrates how this has been funded from rents,

service charges and other income. In accordance

with the Local Government and Housing Act 1989

this is maintained as a separate account and must

operate with a positive working balance.

The Collection Fund details all monies due from

Council Tax and Non Domestic Rate payers and

redistribution of some of these payments to other

organisations on whose behalf the Council collects

these taxes including the County Council and the

Nottinghamshire Police and Crime Commissioner

and Fire & Rescue Authorities.

Annual Governance Statement (AGS)

This Statement sets out the Council’s governance

structures and its key internal controls.

Other Key Sections in the Statement

of Accounts

STATEMENT OF RESPONSIBILITIES

This Statement sets out the respective

responsibilities of the Council and the Chief

Finance Officer.

ACCOUNTING POLICIES

These Policies explain the treatment and basis

of the figures in the accounts in accordance with

proper accounting practices.

NOTES TO THE FINANCIAL STATEMENTS

These provide additional information on important

points included in the Core Financial Statements.

EXPENDITURE AND FUNDING ANALYSIS

(

EFA

)

This Statement shows how annual expenditure

is used and funded from Council resources in

comparison with how those resources are consumed

or earned by the Council. It also shows how this

expenditure is allocated for decision making

purposes across the Council’s Directorates.

GLOSSARY OF TERMS AND ABBREVIATIONS

Key terms used throughout this Statement of

Accounts are more fully explained.

FURTHER INFORMATION

If you require further information concerning

the Council’s 2020/21 Accounts please contact:

The Corporate Finance Manager

Ashfield District Council

Urban Road,

Kirkby in Ashfield,

Nottinghamshire

NG17 8DA

Telephone: 01623 457362 or

Email:

Pete.Hudson@ashfield.gov.uk

STATEMENT OF ACOUNTS 2020

-

2021 2 1

STATEMENT OF ACOUNTS 2020

-

2021

2 2

THE STATEMENT OF

RESPONSIBILITIES FOR

THE STATEMENT OF ACCOUNTS

RESPONSIBILITIES OF THE COUNCIL

The Council is required to:

• Make arrangements for the proper administration of its financial affairs and to ensure that one of its

officers has the responsibility for the administration of those affairs. In this Council, that officer is the

Corporate Finance Manager;

• Manage its affairs to secure economic, efficient and effective use of resources and safeguard its assets;

• Approve the Statement of Accounts.

I confirm that the Financial Statements were approved by the Audit Committee meeting held on 18th

October 2021.

Signed on behalf of Ashfield District Council:

Councillor D. Walters

Chairman of the Audit Committee

RESPONSIBILITIES OF THE CORPORATE FINANCE MANAGER

The Corporate Finance Manager is responsible for the preparation of the Council’s statement of accounts

in accordance with proper practices as set out in the CIPFA/LASAAC Code of Practice on Local Authority

Accounting in the United Kingdom 2020/21 (“the Code of Practice”).

In preparing this Statement of Accounts, the Corporate Finance Manager has:

• Selected suitable accounting policies and then applied them consistently;

• Made judgements and estimates that were reasonable and prudent;

• Complied with the Code of Practice.

The Corporate Finance Manager has also

• Kept proper, up to date accounting records;

• Taken reasonable steps for the prevention and detection of fraud and other irregularities.

I confirm that the Statement of Accounts presents a true and fair view of the financial position of the

Council at the accounting date and its income and expenditure for the year ended 31st March 2021

P. Hudson, ACMA, CGMA

Corporate Finance Manager & Section 151 Officer

17th December 2021

STATEMENT OF ACOUNTS 2020

-

2021

23

AUDIT CERTIFICATE

AND OPINION

INDEPENDENT AUDITOR’S REPORT TO THE MEMBERS OF ASHFIELD DISTRICT COUNCIL

Report on the audit of the financial statements

Opinion on the financial statements

We have audited the financial statements of Ashfield District Council (“the Council) for the year ended 31 March 2021, which

comprise the Comprehensive Income and Expenditure Statement, the Movement in Reserves Statement, the Balance Sheet, the

Cash Flow Statement, the Housing Revenue Account – Income and Expenditure Statement, the Collection Fund and notes to the

financial statements, including a summary of significant accounting policies. The financial reporting framework that has been applied

in their preparation is applicable law and the CIPFA/LASAAC Code of Practice on Local Authority Accounting in the United Kingdom

2020/21.

In our opinion, the financial statements:

• give a true and fair view of the financial position of the Council as at 31

st

March 2021 and of its expenditure and income

for the year then ended; and

• have been properly prepared in accordance with the CIPFA/LASAAC Code of Practice on Local Authority Accounting in

the United Kingdom 2020/21.

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our

responsibilities under those standards are further described in the Auditor’s responsibilities section of our report. We are

independent of the Council in accordance with the ethical requirements that are relevant to our audit of the financial statements in

the UK, including the FRC’s Ethical Standard, and we have fulfilled our other ethical responsibilities in accordance with these

requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Emphasis of Matter – Effect of the Covid-19 pandemic on the valuation of Investment property assets

We draw attention to Note 2 of the financial statements, which describes the effects of the Covid-19 pandemic on the valuation of

the Council’s investment property assets. As disclosed in Note 2 of the financial statements, the Council’s valuers included a

‘material valuation uncertainty’ declaration within their report as a result of the Covid-19 pandemic. Our opinion is not modified in

respect of this matter.

Conclusions relating to going concern

In auditing the financial statements, we have concluded that the Corporate Finance Manager’s (& S151 Officer) of the going concern

basis of accounting in the preparation of the financial statements is appropriate.

Based on the work we have performed, we have not identified any material uncertainties relating to events or conditions that,

individually or collectively, may cast significant doubt on the Council's ability to continue as a going concern for a period of at least

twelve months from when the financial statements are authorised for issue.

Our responsibilities and the responsibilities of the Corporate Finance Manager’s (& S151 Officer) with respect to going concern are

described in the relevant sections of this report.

STATEMENT OF ACOUNTS 2020

-

2021

24

Other information

The Corporate Finance Manager’s (& S151 Officer) is responsible for the other information. The other information comprises the

information included in the Statement of Accounts, other than the financial statements and our auditor’s report thereon. Our opinion

on the financial statements does not cover the other information and, except to the extent otherwise explicitly stated in our report,

we do not express any form of assurance conclusion thereon.

In connection with our audit of the financial statements, our responsibility is to read the other information and, in doing so, consider

whether the other information is materially inconsistent with the financial statements or our knowledge obtained in the audit or

otherwise appears to be materially misstated. If we identify such material inconsistencies or apparent material misstatements, we

are required to determine whether there is a material misstatement in the financial statements or a material misstatement of the

other information. If, based on the work we have performed, we conclude that there is a material misstatement of this other

information, we are required to report that fact.

We have nothing to report in this regard.

Responsibilities of the Corporate Finance Manager (& S151 Officer) for the financial statements

As explained more fully in the Statement of the Corporate Finance Manager’s (& S151 Officer) Responsibilities, the Corporate

Finance Manager (& S151 Officer) is responsible for the preparation of the Statement of Accounts, which includes the financial

statements, in accordance with proper practices as set out in the CIPFA/LASAAC Code of Practice on Local Authority Accounting

in the United Kingdom 2020/21, and for being satisfied that they give a true and fair view. The Corporate Finance Manager (& S151

Officer) is also responsible for such internal control as the Corporate Finance Manager (& S151 Officer) determines is necessary

to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

The Corporate Finance Manager (& S151 Officer) is required to comply with the CIPFA/LASAAC Code of Practice on Local Authority

Accounting in the United Kingdom 2020/21 and prepare the financial statements on a going concern basis on the assumption that

the functions of the Council will continue in operational existence for the foreseeable future. The Corporate Finance Manager (&

S151 Officer) is responsible for assessing each year whether or not it is appropriate for the Council to prepare its accounts on the

going concern basis and disclosing, as applicable, matters related to going concern.

Auditor’s responsibilities for the audit of the financial statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material

misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a

high level of assurance but is not a guarantee that an audit conducted in accordance with ISAs (UK) will always detect a material

misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the

aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial

statements.

Irregularities, including fraud, are instances of non-compliance with laws and regulations. We design procedures in line with our

responsibilities, outlined above, to detect material misstatements in respect of irregularities, including fraud. Based on our

understanding of the Council, we identified that the principal risks of non-compliance with laws and regulations related to the Local

Government Act 2003 (and associated regulations made under section 21), the Local Government Finance Acts of 1988, 1992 and

2012, the Local Government and Housing Act 1989 and the Accounts and Audit Regulations 2015, and we considered the extent

to which non-compliance might have a material effect on the financial statements.

We evaluated the Corporate Finance Manager’s (& S151 Officer) incentives and opportunities for fraudulent manipulation of the

financial statements (including the risk of override of controls) and determined that the principal risks were related to posting manual

journal entries to manipulate financial performance, management bias through judgements and assumptions in significant

accounting estimates and significant one-off or unusual transactions.

Our audit procedures were designed to respond to those identified risks, including non-compliance with laws and regulations

(irregularities) and fraud that are material to the financial statements. Our audit procedures included but were not limited to:

• discussing with management and the Audit Committee the policies and procedures regarding compliance with laws and

regulations;

• communicating identified laws and regulations throughout our engagement team and remaining alert to any indications of

non-compliance throughout our audit; and

• considering the risk of acts by the Council which were contrary to applicable laws and regulations, including fraud.

STATEMENT OF ACOUNTS 2020

-

2021

25

Our audit procedures in relation to fraud included but were not limited to:

• making enquiries of management and the Audit Committee on whether they had knowledge of any actual, suspected or

alleged fraud;

• gaining an understanding of the internal controls established to mitigate risks related to fraud;

• discussing amongst the engagement team the risks of fraud; and

• addressing the risks of fraud through management override of controls by performing journal entry testing.

There are inherent limitations in the audit procedures described above and the primary responsibility for the prevention and

detection of irregularities including fraud rests with management and the Audit Committee. As with any audit, there remained a risk

of non-detection of irregularities, as these may involve collusion, forgery, intentional omissions, misrepresentations or the override

of internal controls.

We are also required to conclude on whether the Corporate Finance Manager’s (& S151 Officer) use of the going concern basis of

accounting in the preparation of the financial statements is appropriate. We performed our work in accordance with Practice Note

10: Audit of financial statement and regularity of public sector bodies in the United Kingdom, and Supplementary Guidance Note

01, issued by the National Audit Office in April 2021.

A further description of our responsibilities for the audit of the financial statements is located on the Financial Reporting Council’s

website at www.frc.org.uk/auditorsresponsibilities. This description forms part of our auditor’s report.

Report on the Council’s arrangements for securing economy, efficiency and effectiveness in its

use of resources

Matter on which we are required to report by exception

We are required to report to you if, in our opinion, we are not satisfied that the Council has made proper arrangements for securing

economy, efficiency and effectiveness in its use of resources for the year ended 31 March 2021.

We have not completed our work on the Council’s arrangements. On the basis of our work to date, having regard to the guidance

issued by the Comptroller and Auditor General in April 2021, we have not identified any significant weaknesses in arrangements

for the year ended 31 March 2021.

We will report the outcome of our work on the Council’s arrangements in our commentary on those arrangements within the Auditor’s

Annual Report. Our audit completion certificate will set out any matters which we are required to report by exception.

Responsibilities of the Council

The Council is responsible for putting in place proper arrangements to secure economy, efficiency and effectiveness in its use of

resources, to ensure proper stewardship and governance, and to review regularly the adequacy and effectiveness of these

arrangements.

Auditor’s responsibilities for the review of arrangements for securing economy, efficiency and effectiveness in the use of

resources

We are required under section 20(1)(c) of the Local Audit and Accountability Act 2014 to satisfy ourselves that the Council has

made proper arrangements for securing economy, efficiency and effectiveness in its use of resources. We are not required to

consider, nor have we considered, whether all aspects of the Council’s arrangements for securing economy, efficiency and

effectiveness in its use of resources are operating effectively.

We have undertaken our work in accordance with the Code of Audit Practice, having regard to the guidance issued by the

Comptroller and Auditor General in April 2021.

Matters on which we are required to report by exception under the Code of Audit Practice

We are required by the Code of Audit Practice to report to you if:

• we issue a report in the public interest under section 24 of the Local Audit and Accountability Act 2014;

• we make a recommendation under section 24 of the Local Audit and Accountability Act 2014; or

• we exercise any other special powers of the auditor under sections 28, 29 or 31 of the Local Audit and Accountability Act

2014.

STATEMENT OF ACOUNTS 2020

-

2021

26

We have nothing to report in these respects.

Use of the audit report

This report is made solely to the members of Ashfield District Council, as a body, in accordance with part 5 of the Local Audit and

Accountability Act 2014 and as set out in paragraph 44 of the Statement of Responsibilities of Auditors and Audited Bodies

published by Public Sector Audit Appointments Limited. Our audit work has been undertaken so that we might state to the members

of the Council those matters we are required to state to them in an auditor’s report and for no other purpose. To the fullest extent

permitted by law, we do not accept or assume responsibility to anyone other than the members of the Council, as a body, for our

audit work, for this report, or for the opinions we have formed.

Delay in certification of completion of the audit

We cannot formally conclude the audit and issue an audit certificate until we have completed:

• the work necessary to issue our assurance statement in respect of the Council’s Whole of Government Accounts

consolidation pack; and

• the work necessary to satisfy ourselves that the Council has made proper arrangements for securing economy, efficiency

and effectiveness in its use of resources.

David Hoose, Key Audit Partner

For and on behalf of Mazars LLP

Park View House

58 The Ropewalk

Nottingham

NG1 5DW

20 December 2021

STATEMENT OF ACOUNTS 2020

-

2021

2 7

STATEMENT OF

ACCOUNTING POLICIES

1. GENERAL PRINCIPLES

The Statement of Accounts summarises the Council’s transactions for the financial year 2020/21 and its

position at the year-end 31st March 2021. The Council is required to prepare an annual Statement of

Accounts by the Accounts and Audit Regulations 2015. These Regulations require the accounts to be

prepared in accordance with proper accounting practices. These practices under Section 21 of the 2003 Act

primarily comprise of the Code of Practice on Local Authority Accounting in the United Kingdom 2020/21

and International Financial Reporting Standards (IFRS).

The accounting convention adopted in the Statement of Accounts is principally historical cost, modified by

the revaluation of certain categories of non-current assets and financial instruments.

2. ACCRUALS OF INCOME AND EXPENDITURE

Activity is accounted for in the year that it takes place, not simply when cash payments are made or

received. In particular:

• Revenue from contracts with service recipients, whether for services or the provision of goods, is

recognised when (or as) the goods or services are transferred to the service recipient in accordance with

the performance obligations in the contract.

• Supplies are recorded as expenditure when they are consumed; where there is a gap between the date

supplies are received and their consumption, they are carried as inventories on the Balance Sheet;

• Expenses in relation to services received (including services provided by employees) are recorded as

expenditure when the services are received rather than when payments are made;

• Interest receivable on investments and payable on borrowings is accounted for respectively as income and

expenditure on the basis of the effective interest rate for the relevant financial instrument rather than the

cash flows fixed or determined by the contract.

• Where revenue and expenditure have been recognised but cash has not been received or paid, a debtor

or creditor for the relevant amount is recorded in the Balance Sheet. Where debts may not be settled,

the balance of debtors is written down and a charge made to revenue for the income that might not be

collected.

3. CASH AND CASH EQUIVALENTS

Cash is represented by cash in hand and deposits with financial institutions repayable without penalty on

notice of not more than one working day.

Cash Equivalents are highly liquid investments that mature in 3 months or less from the date of acquisition

and that are readily convertible to known amounts of cash with insignificant risk of change in value.

In the cash flow statement, cash and cash equivalents are shown net of any bank overdrafts that are

repayable on demand and form an integral part of the Council’s cash management.

STATEMENT OF ACOUNTS 2020

-

2021

28

4. EXCEPTIONAL ITEMS

When items of income and expenditure are material, their nature and amount is disclosed separately, either

on the face of the Comprehensive Income and Expenditure Statement or in the notes to the accounts,

depending on how significant the items are to an understanding of the Council’s financial performance.

5. PRIOR PERIOD ADJUSTMENTS, CHANGES IN ACCOUNTING POLICIES AND ESTIMATES AND

ERRORS

Prior period adjustments may arise as a result of a change in accounting policies or to correct a material

error. Changes in accounting estimates are accounted for prospectively, i.e. in the current and future years

affected by the change and do not give rise to a prior period adjustment.

Changes in accounting policies are only made when required by proper accounting practices or the change

provides more reliable or relevant information about the effect of transactions, other events and conditions

on the Council’s financial position or financial performance. Where a change is made, it is applied

retrospectively (unless stated otherwise) by adjusting opening balances and comparative amounts for the

prior period as if the new policy had always been applied.

Material errors discovered in prior period figures are corrected retrospectively by amending opening

balances and comparative amounts for the prior period.

6. CHARGES TO REVENUE FOR NON

-

CURRENT ASSETS

Service revenue accounts, support services and trading accounts are charged with the following amounts to

record the real cost of holding non-current assets during the year:

• Depreciation attributable to the assets used by the relevant service.

• Revaluation and impairment losses on assets used by the service where there are no accumulated gains in

the Revaluation Reserves against which the losses can be written off.

• Amortisation of intangible assets attributable to the service.

The Council is not required to raise Council Tax to cover depreciation, revaluation and impairment losses

or amortisations. However, it is required to make an annual provision from revenue to contribute towards

the reduction in its overall borrowing requirement equal to an amount calculated on a prudent basis

determined by the Council in accordance with statutory guidance. Depreciation, revaluation, impairment

losses and amortisation are therefore replaced by the contribution in the General Fund Balance by way of

an adjusting transaction with the Capital Adjustment Account in the Movement in Reserves Statement for

the difference between the two.

7. EMPLOYEE BENEFITS

A. BENEFITS PAYABLE DURING EMPLOYMENT

Short-term employee benefits are those due to be settled within 12 months of the year-end. They include

such benefits as wages and salaries, paid annual leave and paid sick leave, bonuses and accumulated flexi

time for current employees and are recognised as an expense for the services in the year in which the

employees render service to the Council. An accrual is made for the cost of holiday entitlements etc. earned

by employees but not taken before the year-end, which employees can carry forward into the next financial

year. The accrual is made at the wage and salary rates applicable the following accounting year, being

the period in which the employee takes the benefit. The accrual is charged to Surplus and Deficit on the

Provision of Services, but then reversed out through the Movement in Reserves Statement so that holiday

benefits are charged to revenue in the financial year in which the holiday absence occurs.

B. TERMINATION BENEFITS

Termination benefits are amounts payable as a result of a decision by the Council to terminate an officer’s

employment before the normal retirement date or an officer’s decision to accept voluntary redundancy in

exchange for those benefits. These are charged on an accruals basis to the Non Distributed Costs line in the

Comprehensive Income and Expenditure Statement when the Council can no longer withdraw the offer of

those benefits or when the Council recognises costs for a restructuring.

Where termination benefits involve the enhancement of pensions, statutory provisions require the General

Fund Balance to be charged with the amount payable by the Council to the pension fund or pensioner in

the year, not the amount calculated according to the relevant accounting standards. In the Movement in

Reserves Statement, appropriations are required to and from the Pensions Reserve to remove the notional

debits and credits for pension enhancement termination benefits and replace them with debits for the cash

paid to the pension fund and pensioners and any such amounts payable but unpaid at the year-end.

C. POST EMPLOYMENT BENEFITS

Most employees of the Council contribute to the Nottinghamshire Pension Fund, the Local Government

Pension Scheme administered by Nottinghamshire County Council. The scheme provides defined benefits

(retirement lump sums and pensions) earned as employees work for the Council.

The Nottinghamshire Pension Fund is accounted for as a defined benefit scheme:

• The liabilities of Nottinghamshire Pension Fund attributable to the Council are included in the Balance

Sheet on an actuarial basis using the projected unit method, i.e. an assessment of the future payments

that will be made in relation to retirement benefits earned to date by employees, based on assumptions

including mortality rates, employee turnover rates and projections of projected earnings for current

employees.

• Liabilities are discounted to their value at current prices using a discount rate based on an appropriate

rate of return on high quality corporate bonds.

• The assets of the Fund attributable to the Council are included in the Balance Sheet at their fair value.

a) Quoted securities – current bid price

b) Unquoted securities – professional estimate

c) Unitised securities – current bid price

d) Property – market value

STATEMENT OF ACOUNTS 2020

-

2021 2 9

STATEMENT OF ACOUNTS 2020

-

2021

30

The change in the net pension liability is analysed into the following components:

• Service Cost comprising

a) Current Service Cost - the increase in liabilities as result of years of service earned this year - allocated in

the Comprehensive Income and Expenditure Account to the services for which the employees worked

b) Past Service cost - the increase in liabilities as a result of a scheme amendment or curtailment whose

effect relates to years of service earned in earlier years - debited to the Surplus or Deficit on Provision of

Services in the Comprehensive Income and Expenditure Account as part of Non-Distributed Costs

c) Net interest on the net defined liability (asset), i.e. the net interest expense for the Council – the change

during the period in the net defined benefit liability (asset) that arises from the passage of time charged to

the Financing and Investment Income and Expenditure line of the Comprehensive Income and Expenditure

Statement – this is calculated by applying the discount rate used to measure the defined benefit obligation

at the beginning of the period to the net defined benefit liability (asset) at the beginning of the period –

taking into account any changes in the net defined benefit liability (asset) during the period as a result of

contribution and benefit payments

d) Re-measurement comprising:

• the return on plan assets – excluding amounts included in net interest on the defined benefit liability